[ad_1]

A federal court docket has launched the indictments towards Binance and CEO Changpeng “CZ” Zhao filed underneath seal on Nov. 14, by which the USA authorities stated it anticipated the cryptocurrency trade and CZ to enter responsible pleas.

In Nov. 14 filings in U.S. District Courtroom for the Western District of Washington at Seattle, the U.S. authorities stated it requested to file the indictments towards Binance and CZ underneath seal as any potential plea offers with the trade and CEO in addition to regulatory settlements have been “more likely to have a serious impact on the corporate, its clients, and world cryptocurrency markets.” Authorities charged CZ with one felony depend for failure to take care of an efficient anti-money laundering program at Binance, violating the Financial institution Secrecy Act.

“On the day of the plea hearings, the Authorities anticipates that the prison resolutions with Defendant Zhao and Defendant Binance will probably be introduced concurrently with vital civil resolutions by the U.S. Division of the Treasury Workplace of International Property Management [OFAC], the U.S. Division of the Treasury Monetary Crimes Enforcement Community [FinCEN], and the Commodity Futures Buying and selling Fee [CFTC],” stated the Nov. 14 submitting, including:

“Whereas Binance just isn’t a publicly traded firm, Binance is the biggest cryptocurrency trade on this planet and information associated to Zhao and Binance’s prison and civil legal responsibility is more likely to have a big impact on buying and selling of varied cryptocurrencies.”

“Cryptocurrency markets are unstable, topic to vital swings primarily based on exterior occasions,” stated the submitting. “Right here, given the standing that Binance and Zhao have amongst contributors within the cryptocurrency and associated markets, even the straightforward docketing of a federal prison case towards both would by itself have a big market influence.”

The federal government in contrast potential volatility in the price of Binance Coin (BNB) to that of the FTX Token (FTT) when the crypto trade collapsed in November 2022, and former CEO Sam “SBF” Bankman-Fried was indicted on federal fraud prices. SBF was subsequently found guilty on seven charges and awaits sentencing in March 2024.

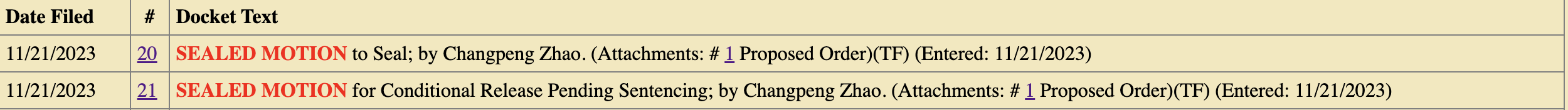

In response to court docket data, legal professionals representing Binance and CZ appeared in court docket for separate hearings scheduled on the morning of Nov. 21 to debate pleas and potential detention. Attorneys for CZ filed sealed motions in regards to the Binance CEO’s conditional launch pending sentencing within the case, however the contents weren’t obtainable on the time of publication.

Associated: Binance $3.9B USDT move gains community attention amid DOJ settlement claims

A settlement for lots of the prison and civil circumstances towards Binance and CZ in the USA is predicted to be introduced at 8:00 pm UTC on Nov. 21 as a part of a joint assertion by the Justice Division, CFTC, and Division of the Treasury. In response to many experiences, CZ has agreed to plead guilty, and Binance can pay greater than $4 billion as a part of the settlement.

It’s unclear on the time of publication if any a part of the announcement will concern Binance’s pending civil case with the U.S. Securities and Change Fee (SEC). In June, the regulator filed 13 charges towards the crypto trade, Binance.US, and CZ for securities legislation violations.

[ad_2]

Source link