[ad_1]

The cryptocurrency market not too long ago skilled occasions that have been beforehand anticipated to current a extreme destructive value impression, and but, Bitcoin (BTC) trades close to $37,000 on Nov. 22, which is basically flat from three days prior.

Such efficiency was completely sudden given the relevance of Binance’s plea deal on Nov. 21 with the USA Authorities for violating legal guidelines involving cash laundering and terror financing.

Bearish information has had restricted impression on Bitcoin value

One would possibly argue that entities have been manipulating Bitcoin’s value to keep away from contagion, probably involving the issuing of unbacked stablecoins–particularly these with direct ties to the exchanges affected by the regulatory stress. Thus, to determine whether or not traders turned extremely risk-averse one ought to analyze Bitcoin derivatives as an alternative of focusing solely on the present value ranges.

The U.S. authorities filed indictments towards Binance and Changpeng “CZ” Zhao in Washington state on Nov. 14, however the paperwork have been unsealed on Nov. 21. After admitting the offenses, CZ stepped away from Binance administration as a part of the deal. Penalties totaled over $4 billion, together with fines imposed on CZ personally. The information triggered a mere $50 million in BTC leverage lengthy futures contracts after Bitcoin’s value momentarily traded right down to $35,600.

It’s value noting that on Nov. 20 the USA Securities and Change Fee (SEC) sued Kraken exchange, alleging it commingled buyer funds and didn’t register with the regulator as a securities dealer, supplier and clearing company. Moreover, the grievance claimed Kraken paid for operational bills instantly from accounts containing buyer belongings. Nevertheless, Kraken stated the SEC’s commingling accusations have been beforehand earned charges, so basically their proprietary belongings.

One other probably disastrous tidbit of reports got here from Mt. Gox, a now-defunct Bitcoin alternate that misplaced 850,000 BTC to a hack in 2014. Nobuaki Kobayashi, the Mt. Gox trustee introduced on Nov. 21 the redemption of $47 million in belief belongings and reportedly deliberate to start out the primary cash repayments to creditors in 2023. Though there was no data relating to the sale of Bitcoin belongings, traders speculated that this ultimate milestone is nearer than ever.

One will discover posts on social networks from skilled merchants and analysts that anticipated a crypto market crash in case Binance have been to be indicted by the DoJ. Some examples are listed beneath, and it’s secure to say such a concept was virtually a consensus amongst traders.

ETF denied, gradual bleed is almost certainly, with a swap to laborious crash if DOJ prices are unsealed quickly towards Binance.

— Parrot Capital (@ParrotCapital) August 26, 2023

I don’t imagine in coincidences. The Universe is never so lazy.

Anticipating ETFs to be rejected and DoJ to drop the hammer on Binance crushing bulls goals for 2023.

— McKenna (@Crypto_McKenna) July 31, 2023

Discover how McKeena predicted that Binance could be indicted by the DoJ and additional added that the continued Bitcoin spot exchange-traded (ETF) fund purposes will probably be denied by the SEC. However, as counterintuitive as it’d sound, Binance going totally compliant will increase the percentages of the spot ETF approval. It is because it enormously weakens the SEC’s predominant argument for earlier denials, particularly the extreme quantity market share on unregulated exchanges.

Nothing concrete got here out from the spot Bitcoin ETF with reference to latest regulatory actions, however the amends to a number of proposals is a touch of a wholesome dialogue with the SEC.

Bitcoin derivatives show resilience

To substantiate if the Bitcoin value resilience aligns with skilled traders’ threat evaluation, one ought to analyze BTC futures and choices metrics. As an example, merchants may have rushed to hedge their positions, which does not stress the spot markets, however vastly impacts BTC futures premium and choices pricing.

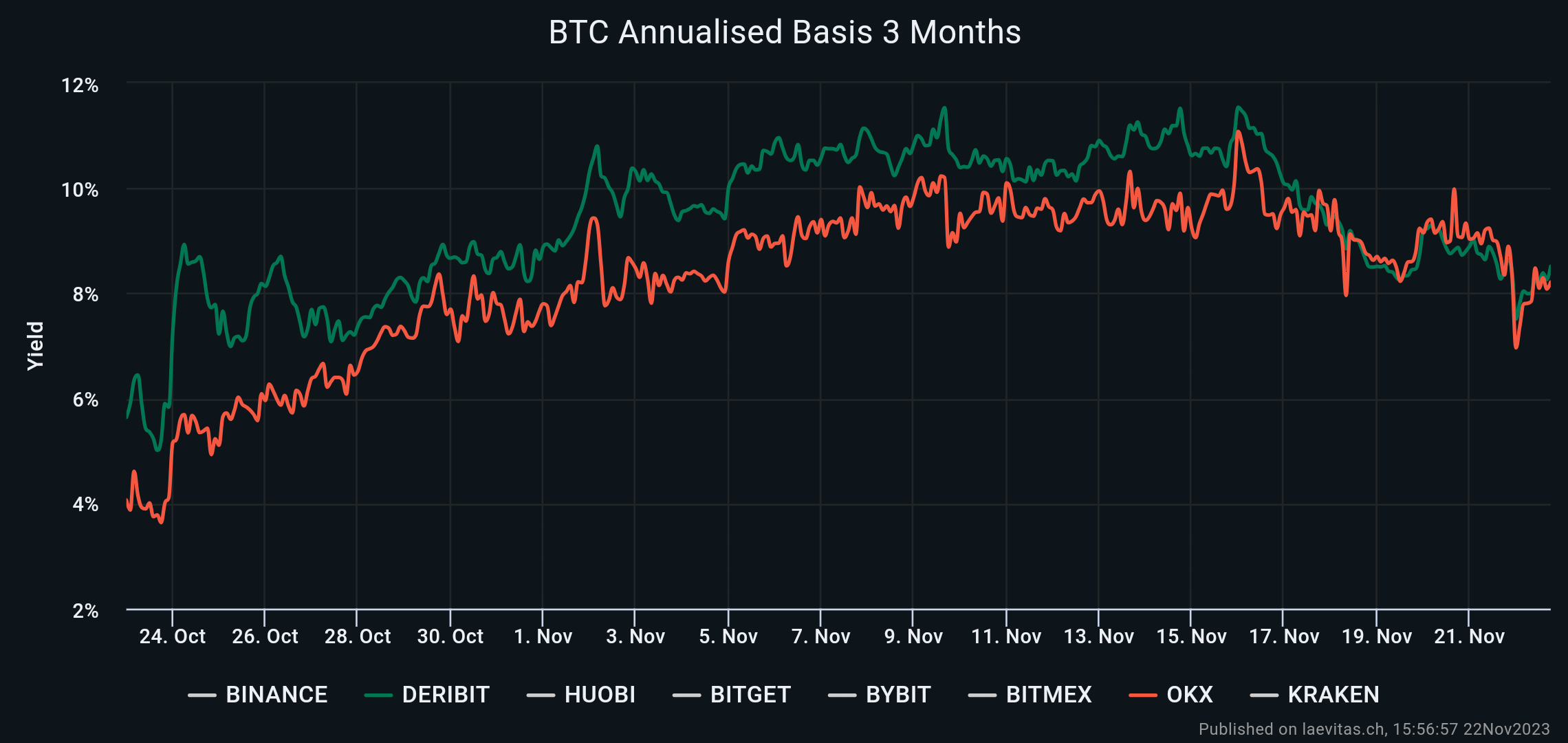

The value of Bitcoin month-to-month futures contracts are inclined to differ from common spot exchanges since members demand more cash to delay the settlement. That’s not unique to cryptocurrencies, and in a impartial promote it ought to stand close to an annualized 5% charge.

Discover how Bitcoin futures at present holds an 8% premium, which is a sign of extreme demand for leverage longs, however removed from extreme. This degree is decrease than the 11.5% seen in mid November, however is sort of optimistic given the latest regulatory newsflow.

Associated: BlackRock met with SEC officials to discuss spot Bitcoin ETF

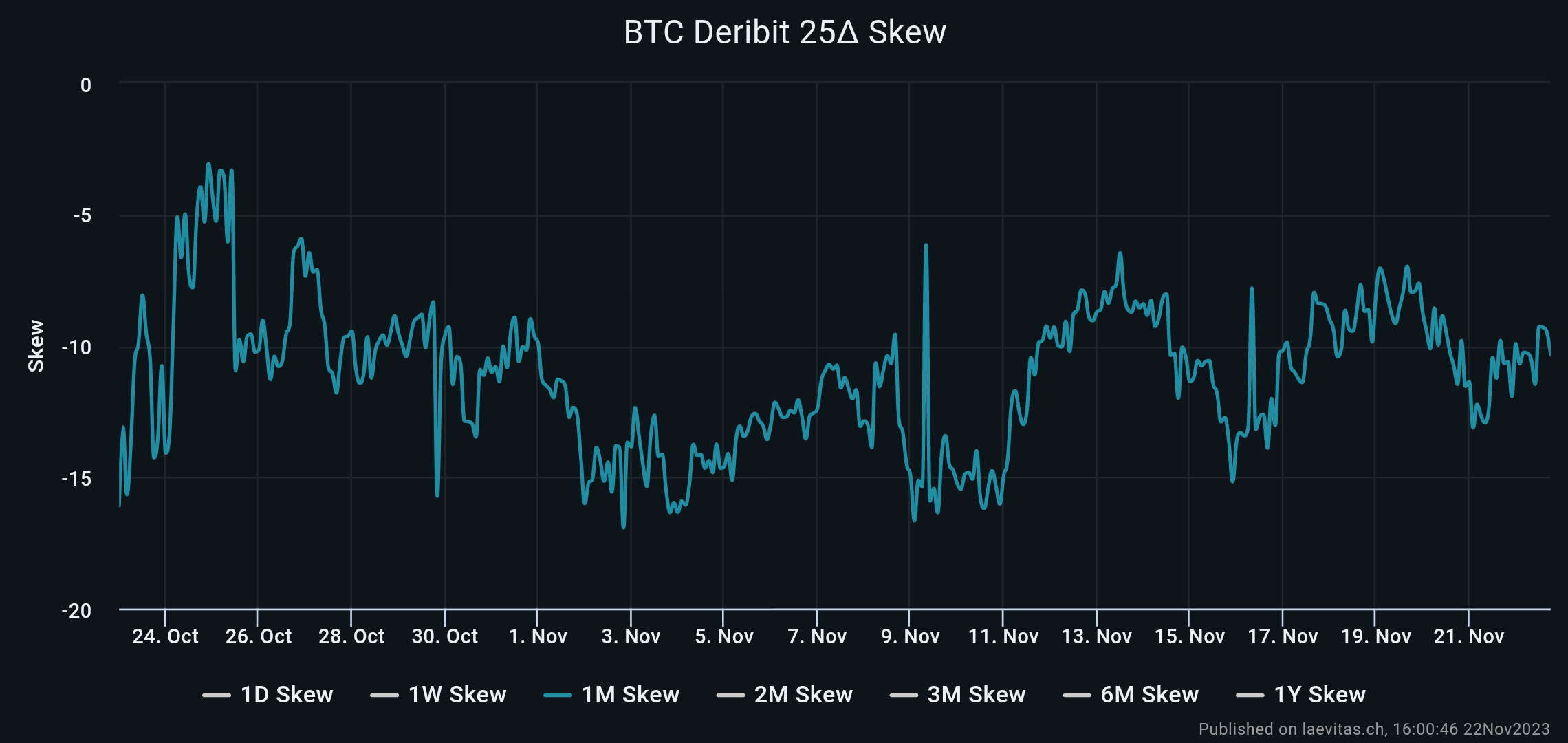

To substantiate if Bitcoin derivatives didn’t expertise an enormous influx of hedge operations, one wants to investigate BTC possibility markets as effectively. The 25% delta skew is a telling signal when arbitrage desks and market makers overcharge for upside or draw back safety.

When merchants anticipate a drop in Bitcoin’s value, the delta 25% skew tends to rise above 7%, whereas intervals of pleasure sometimes see it dip beneath destructive 7%.

As displayed above, the choices 25% delta skew signifies optimism for the previous 4 weeks because the put (promote) choices have been buying and selling at a reduction in comparison with comparable name (purchase) choices. Extra importantly, the latest information movement didn’t change skilled merchants’ urge for food for hedging methods.

General, there is not any doubt that the impression of regulatory actions and the potential promote stress from Mt Gox caught the market in an ideal temper given the derivatives indicators.

Moreover, the liquidation of $70 million leverage BTC longs decreased the stress from future destructive value oscillations, that means even when value revisits $35,000, there is not any indication of extreme optimism.

Because the ultimate spherical of ETF selections is scheduled for January and February, there’s little incentive for Bitcoin bears to stress the market whereas destructive information had zero impression. In the end, the trail to $40,000 turns into extra sure.

This text doesn’t include funding recommendation or suggestions. Each funding and buying and selling transfer entails threat, and readers ought to conduct their very own analysis when making a call.

[ad_2]

Source link