[ad_1]

Bitcoin (BTC) has new BTC worth targets to reckon with as a cascade of liquidations take crypto markets decrease.

Because of regulatory enforcement action by the USA Division of Justice, largest international alternate Binance is in line for a serious positive. Its CEO, Changpeng Zhao, informally often called CZ, can be pressured to give up his publish and should even face jail time.

This was a watershed second for one of many crypto trade’s family names, and markets reacted with arguably comprehensible concern.

BTC/USD fell to $35,600, per knowledge from Cointelegraph Markets Pro and TradingView — its lowest ranges since Nov. 16 — earlier than rebounding because of brief positions closing.

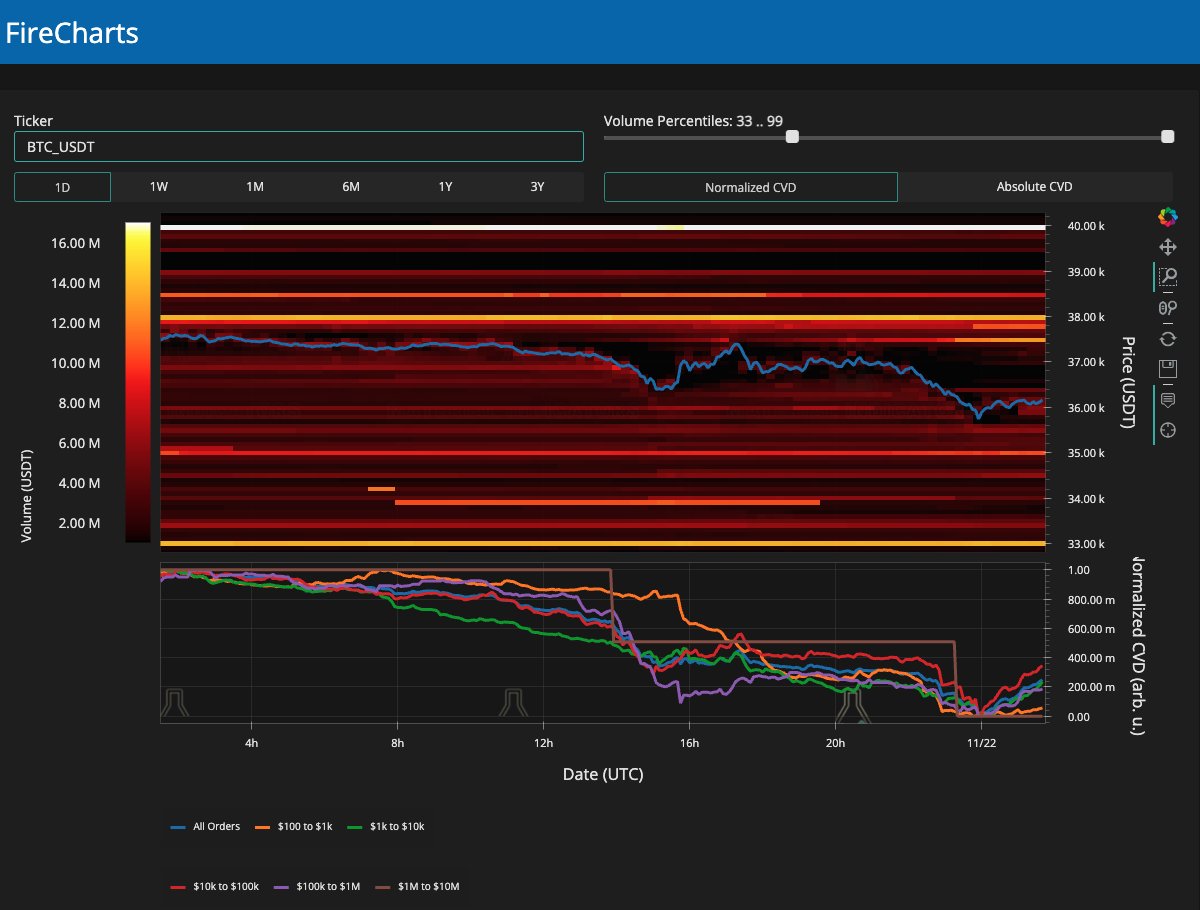

$BTC

Longs rinsed on this dumpworth bounced from shorts closing & taking revenue (OI down & delta up + worth up)

PC charts quickly since im awake now https://t.co/xqPVoFphRp pic.twitter.com/0czcBwdWMf

— Skew Δ (@52kskew) November 22, 2023

Altcoins fared worse, and on the time of writing, many giant cap tokens stay 3-5% decrease on the day.

What may occur subsequent and the way are Bitcoin market members preempting volatility? Cointelegraph takes a take a look at a few of the fashionable BTC worth targets now in play.

“Max ache” BTC worth is now $32,000

Neglect a couple of “quiet” week in crypto — the Binance bombshell has put an finish to boring Bitcoin buying and selling, says James Van Straten.

In a reaction, the analysis and knowledge analyst at crypto insights agency CryptoSlate warns that volatility catalysts will maintain coming.

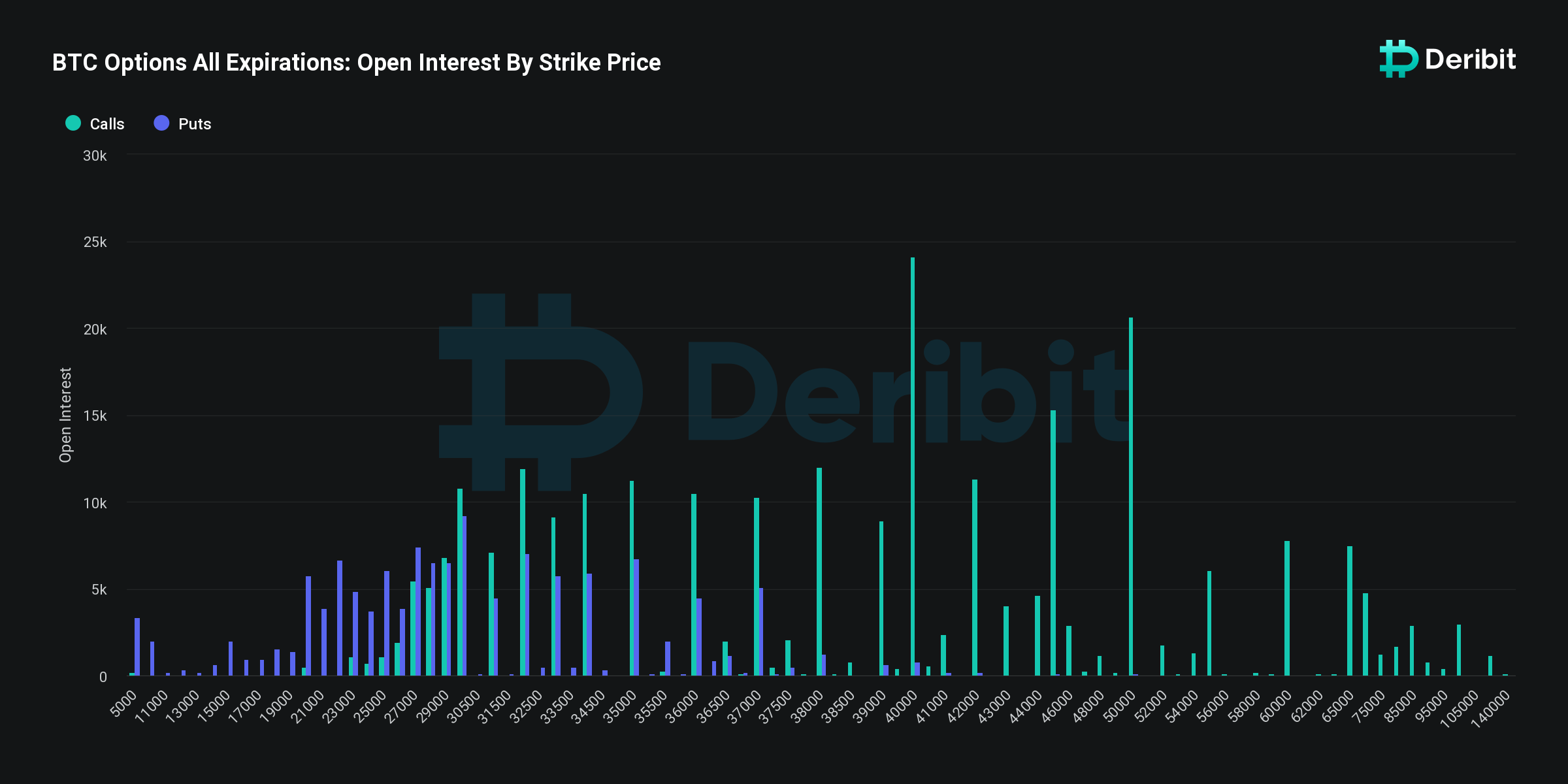

That is because of an enormous $3.8 billion or 104,000 BTC choices open curiosity expiry occasion the day after the U.S. Thanksgiving vacation, doubtlessly including contemporary gas to an already nervous market setting.

Because of their composition, Van Straten says, essentially the most punishing BTC worth drop would now be one to $32,000.

“With the put/name ratio standing at 0.77, the information signifies a predominantly bullish sentiment, as substantiated by the upper name open curiosity, roughly 58,000 Bitcoin, in comparison with the 45,000 Bitcoin put choices,” he writes.

“What catches the attention is the ‘max ache worth’— a major metric within the choices market — pegged at $32,000, a determine that’s at the moment beneath Bitcoin’s market worth. This means a possible stress on the Bitcoin worth because the expiration date nears.”

Van Straten provides that whereas choices figures “point out an expectation that the value was anticipated to hover round these ranges,” Bitcoin would nonetheless be bullish had been the $32,000 situation to turn into actuality.

“The bull market thesis would nonetheless be in tact,” he told X subscribers.

Betting on the “Infamous B.I.D.”

Analyzing order ebook composition, on-chain monitoring useful resource Materials Indicators can be predicting a slide nearer to $30,000.

This was already on the cards, with evaluation arguing that Bitcoin ought to retest areas of bid liquidity after its swift ascent to 18-month highs of practically $38,000.

A snapshot of BTC/USDT after the Binance information reveals bids shifting up the order ebook nearer to identify worth as a way to halt additional draw back.

“The order ebook additionally reveals nervous sellers shifting asks all the way down to entrance run $38k, however that might change if bulls can acquire sufficient momentum to reclaim the 21-Day MA. In the event that they fail to take action, I count on to grind decrease,” Materials Indicators defined on the time.

It referenced the 21-day easy shifting common (SMA), which now stands at $36,228 — to date as soon as once more beneath spot.

Finally, it summarized, a patch of bid help at $33,000, which is changing into often called the “Infamous B.I.D.,” should maintain.

“$35k feels appears like a viable goal from right here,” the evaluation concluded.

“In full disclosure, I actually wish to see a retest of $33k fail, however I am undecided Infamous B.I.D. goes to let that occur but.”

Binance withdrawals keep modest

As Cointelegraph reported, numerous bearish Bitcoin forecasts have surfaced this month, even previous to the Binance bulletins.

Associated: BTC price returns key profit mark to Bitcoin exchange users at $34.7K

These include a $30,900 floor as a part of a broader BTC worth channel which has but to be exited by bulls.

Commenting in the marketplace’s response in a single day, in the meantime, the dealer behind it, CryptoQuant contributor Gaah, famous a scarcity of sustained stablecoin withdrawals from Binance in consequence.

Earlier this yr, issues over liquidity and a regulatory crackdown on the alternate sparked mass withdrawals of funds.

Regardless of the stepping down of CZ, Binance’s CEO, in the previous couple of hours there have been no vital outflows of BTC or Stablecoin from @binance

➡️You may comply with this knowledge on @cryptoquant_com https://t.co/GadYLsQIJF pic.twitter.com/c8IBKXGY44

— G a a h (@gaah_im) November 21, 2023

The views, ideas and opinions expressed listed here are the authors’ alone and don’t essentially mirror or symbolize the views and opinions of Cointelegraph.

[ad_2]

Source link