[ad_1]

Some collectors of cryptocurrency futures alternate CoinFLEX are alleging that OPNX, a brand new crypto alternate established partially by Three Arrows Capital (3AC) co-founders Kyle Davies and Su Zhu, was created utilizing CoinFLEX property with out their consent.

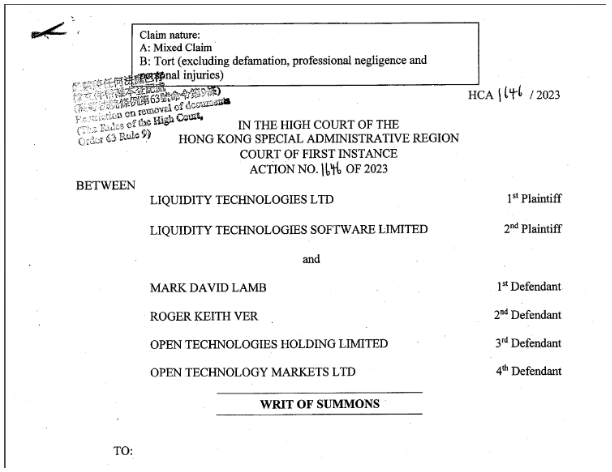

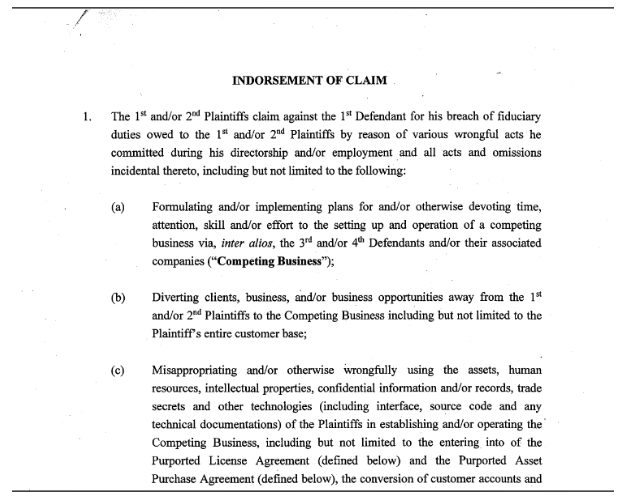

In line with a writ of summons filed within the Excessive Court docket of Hong Kong and seen by Cointelegraph, CoinFLEX collectors declare that OPNX co-founder and former CEO Mark Lamb is “misappropriating and/or in any other case wrongfully utilizing the property, human assets, mental properties, […] commerce secrets and techniques and different applied sciences” of CoinFLEX by diverting them into OPNX. It alleges that Lamb carried out these actions opposite to his tasks to CoinFLEX collectors throughout his tenure.

Citing the doc, collectors say that Lamb devoted “time, consideration, ability and/or effort” to establishing OPNX whereas concurrently being employed because the CEO of CoinFLEX.

The doc claims that the previous CEO diverted purchasers and enterprise alternatives to the rival alternate, misappropriated property that belonged to the collectors, falsely represented that OPNX was related to CoinFLEX collectors, divulged confidential commerce secrets and techniques to 3rd events, solicited staff and contractors to maneuver to OPNX, solid a faux nondisclosure settlement between himself and a third-party, and engaged in different actions that harmed the collectors.

In line with a creditor who spoke with Cointelegraph, CoinFLEX’s phrases of service required customers to settle disputes by arbitration in Hong Kong, which is why the collectors have pursued authorized motion in Hong Kong as a substitute of Seychelles, the agency’s place of domicile. The allegations haven’t been confirmed within the Excessive Court docket of Hong Kong.

The plaintiffs listed within the doc are two corporations: Liquidity Applied sciences and Liquidity Applied sciences Software program. In line with Crunchbase knowledge, the primary is the Seychelles-based authorized entity underneath which CoinFLEX initially operated. The doc lists Mark Lamb, crypto investor Roger Ver, Open Applied sciences Holdings, and Open Expertise Markets as defendants. Open Applied sciences holdings and markets are two corporations the doc claims are related to the OPNX crypto alternate.

In January, a pitch deck for OPNX was leaked to the public and was later confirmed by the founding group as genuine. The deck listed Davies and Zhu, Mark Lamb, and Sudhu Arumugam as OPNX co-founders. In September, Zhu was arrested in Singapore’s Changi International Airport for non-compliance with a Singaporean Court docket Order concerning 3AC’s chapter proceedings. Davies, too, was sentenced to 4 months in jail for contempt of court docket however was not inside Singapore’s jurisdiction on the time of sentencing. He has since been sighted in Bali, Indonesia.

Critics, together with BitMEX co-founder Arthur Hayes, Tech Crunch founder Michael Arrington, and monetary and macro-financial government Nik Bougalis, beforehand argued that traders shouldn’t give OPNX founders more money after they’d already misplaced hundreds of thousands, if not billions, of {dollars} in buyer property.

Nonetheless, OPNX pushed again towards this criticism. When the exchange opened in April, it argued that it might permit collectors to promote their claims on the alternate for fast money, benefiting them, and due to this fact was good for collectors of bankrupt companies. Kyle Davies even acknowledged that he would donate his share of the profit to 3AC creditors.

In February, OPNX CEO Leslie Lamb, who can be the spouse of OPNX co-founder and CoinFLEX CEO Mark Lamb, posted to LinkedIn, stating, “We’re excited to announce that CoinFLEX can be formally rebranding to Open Change (OPNX).” In distinction to this assertion, the Writ of Summons filed with the Court docket claims that OPNX is a separate alternate that CoinFLEX collectors by no means approved.

In a dialog with Cointelegraph, a CoinFLEX creditor, who wished to be recognized as “Kirill,” offered additional particulars of the allegations being made by collectors. Kirill claimed he misplaced “a overwhelming majority of [his] internet price” when CoinFLEX stopped processing withdrawals. In line with Kirill, after withdrawals had been halted, he and different collectors put collectively an “advert hoc creditor committee” to kind out what to do with the now-insolvent firm. In addition they concerned a few of CoinFLEX’s preliminary traders. After months of deliberating, the committee determined to restructure the corporate and reopen the alternate.

Kirill acknowledged that in this time, he turned conscious that Mark Lamb was speaking to Davies and Zhu about investing within the new, restructured firm. Kirill claims they had been skeptical of involving the 3AC founders within the challenge. Nonetheless, they declare that there was no formal manner for CoinFLEX to both settle for or reject them as traders for the reason that agency was nonetheless going by a restructuring within the courts. The restructuring was approved on March 7, in response to a CoinFLEX weblog publish.

In line with Kirill, as soon as the restructuring was authorised, CoinFLEX collectors found that Mark Lamb was performing towards the pursuits of collectors within the methods described within the Writ of Summons.

Associated: Roger Ver denies CoinFLEX CEO’s claims he owes firm $47M USDC

After discovering these actions, the collectors filed the Writ of Summons, which Kirill claims was a required first step to acquiring an injunction towards Mark Lamb to wrest management of the corporate away from him. They then filed for the injunction, which Kirill claims was granted by the court docket. The injunction allegedly states that Mark Lamb “can’t maintain himself out to be a call maker for Coinflex with out specific majority consent of the board.”

On October 31, the official OPNX account for X (previously Twitter) posted a “Creditor Tender Supply” to CoinFLEX stakeholders. The supply acknowledged that CoinFLEX collectors who settle for it “will collectively obtain 25% fairness in OPNX, distributed in proportion to say dimension.” As well as, they’ll every obtain a portion of the alternate’s native token, OX, however these tokens can be vested for ten years. In response, Kirill claimed that this tender supply was not legally legitimate, stating:

“It is not legally legitimate. How’s Mark gonna do the supply? You want the shares [to be] transferred by boards. They are not transferred by impartial events. Mark will not be on the CoinFLEX board in Seychelles anymore. He would not have authority to switch shares.”

Kirill additionally claimed that the tender supply lacks the monetary info for traders to make an knowledgeable determination. In his view, this makes it unreasonable for an investor to simply accept the supply. “The one essential piece of Mark’s supply is that it is utterly devoid of any info,” Kirill acknowledged. “Any rational fiduciary would by no means approve a suggestion like this.”

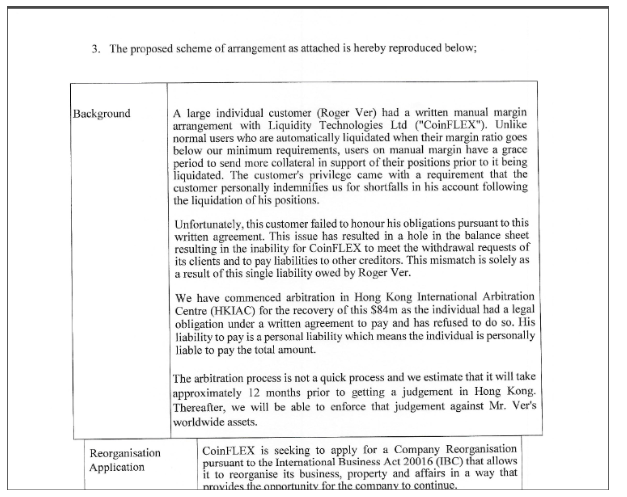

Cointelegraph additionally obtained an order from the Supreme Court docket of Seychelles, which sheds some gentle on Roger Ver’s position within the authorized dispute. In line with the order, CoinFLEX has accused “a big particular person buyer (Roger Ver)” of defaulting on a “written guide margin settlement.” This default initially induced the alternate to be unable to course of withdrawals, in response to CoinFLEX’s declare as quoted by the court docket’s order.

Cointelegraph reached out to Roger Ver for feedback. He denied that he walked away from a sound margin settlement. As an alternative, Ver acknowledged that CoinFLEX made third events conscious of his buying and selling positions, which data they used to commerce towards him to his detriment. He claimed that CoinFLEX has agreed to an arbitration permitting him to get better the funds from these third events.

“I used to be by no means in default and by no means owed CoinFLEX the $82M they initially claimed,” Ver acknowledged. “The truth, and one which CoinFLEX has now agreed to, is that I used to be the one owed cash your entire time, and I’m the most important sufferer.”

A spokesperson for OPNX declined to touch upon the allegations. Since launching in April, OPNX has developed a credit currency for margin buying and selling known as “oUSD” and has obtained a Lithuania license for spot buying and selling all through the EU.

In line with Coingecko, OPNX at the moment processes over $32,000 in spot buying and selling quantity and over $82 million in derivatives quantity every day. Felony and civil proceedings towards OPNX co-founders Davies and Zhu stay ongoing.

[ad_2]

Source link