[ad_1]

The Information Act — a contentious piece of European Union laws that features a clause requiring the power to terminate sensible contracts — has been approved by the European Parliament. If launched, the laws would require a sensible contract to have a “kill change.”

In a Nov. 9 press launch, the parliament introduced that the laws was handed with 481 votes in favor and 31 towards. The subsequent step for it to turn into legislation is to realize the approval of the European Council.

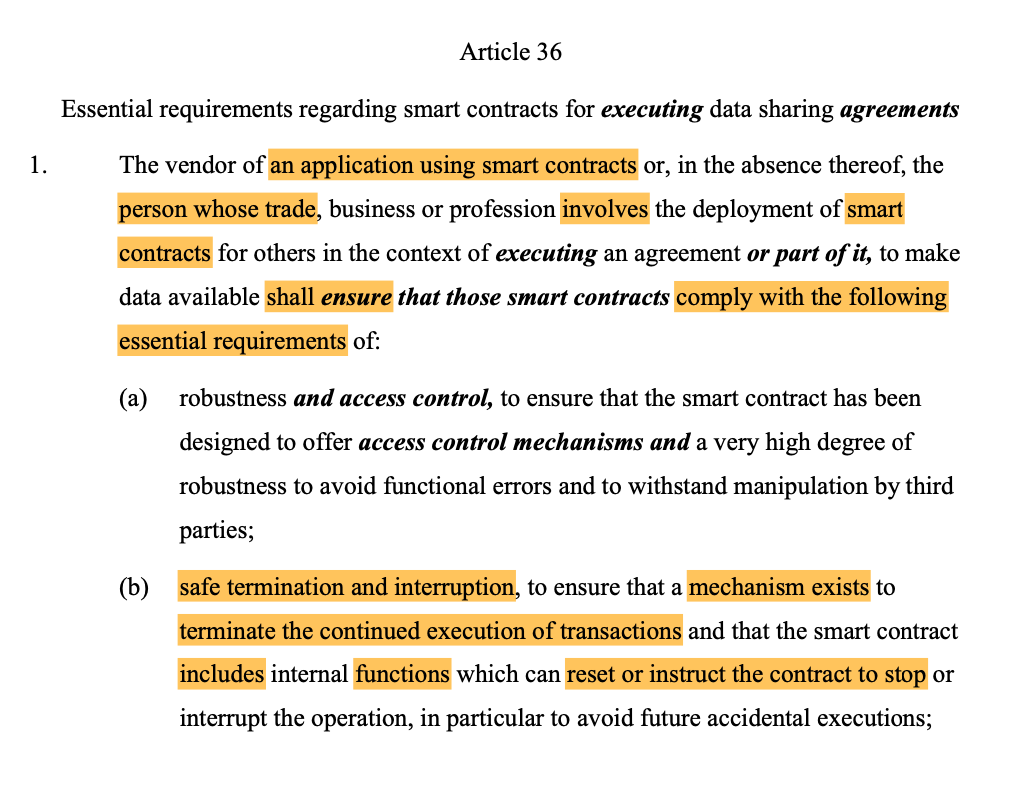

In its present type, the Information Act stipulates that sensible contracts should have the potential to be “interrupted and terminated,” and it mandates controls that enable for the resetting or halting of the contract. The stipulation seems to be a major departure from the blockchain’s foundational ethos of decentralization.

How such kill switches could be carried out, and the way they might influence the event and use of sensible contracts stays unclear. Scott McKinney and Laura De Boel, attorneys with Wilson Sonsini Goodrich & Rosati, instructed Cointelegraph that such a kill change is “basically incompatible with what a sensible contract is” and the way it’s seen.

They added that the definition of a sensible contract included within the Information Act is “overbroad” and prone to embody laptop applications that wouldn’t at present be thought of a smart contract. They added:

“Nonetheless, it’s essential to grasp that the EU Information Act’s sensible contract necessities will doubtless solely apply to a comparatively small subset of sensible contracts (or potential sensible contracts), i.e., sensible contracts for executing of ‘knowledge sharing agreements’ ruled by the Information Act.“

Given the EU’s necessities — together with the kill change and knowledge archiving obligations — they instructed that many corporations getting into relevant knowledge sharing agreements “will merely determine to not use sensible contracts of their functions.”

Gracy Chen, managing director at cryptocurrency trade Bitget, instructed Cointelegraph that the implementation of such a kill change “introduces a centralized factor,” which can “erode belief in sensible contracts, as customers might watch out for counting on contracts that exterior entities might probably modify or shut down.”

Because the EU strikes nearer to probably cementing a sensible contract kill change into legislation, it’s unclear how it could implement its software.

Imposing a “kill change”

Implementing and regulating such a mechanism would, based on Wirex co-founder and CEO Pavel Matveev, see sensible contract deployers “self-assess compliance with important necessities and situation an EU declaration of conformity.”

Matveev instructed Coinelegraph that the Information Act’s definition of sensible contracts is “expansive and lacks precision concerning the circumstances underneath which interruptions or terminations needs to be initiated.”

McKinney and De Boel consider the regulation might hinder blockchain innovation within the EU as its necessities are “fairly strict, and distributors might want to undergo probably burdensome conformity assessments.”

Current: Milei presidential victory fuels optimism in Argentina’s Bitcoin community

Not the whole lot is a damaging, nonetheless, because the attorneys famous the Information Act offers “that European standardization organizations will probably be requested to draft harmonized requirements for sensible contracts.” They added:

“Elevated standardization might strengthen using blockchain within the EU, and will even result in better adoption of sensible contracts exterior of the info entry agreements which might be regulated by the Information Act.”

Arina Dudko, head of company fee options for cryptocurrency trade Cex.io, instructed Cointelegraph that as regulatory oversight of crypto corporations builds, many have “settled on a system of transparency and detailed reporting.” That system has seen them adhere to relevant directives.

Dudko additional in contrast the event of guidelines round blockchain tech to security and requirements guidelines for vehicles. When automobiles first hit roads, seatbelts weren’t necessary, security requirements different wildly, and when rules had been ultimately launched, “some vehemently fought progress in security requirements earlier than they grew to become accepted apply.”

Over time, she mentioned, rules surrounding these security requirements saved lives and led to safer roads. She likened these advances to the EU’s Information Act, saying it’s been dealing with a “comparable part of reactionary blowback.”

Dudko mentioned that very like “emergency exits and hearth codes, these lodging are vital to making sure the environments and merchandise we share are protected for all.” Crypto market members, she mentioned, want a option to escape in the event that they “get locked right into a nefarious or misguided dedication.”

“Whereas this might discourage hardliners from partaking with these sources, introducing fundamental person protections might serve to welcome skeptics and crypto-curious members to make their first transaction.”

Impression on blockchain adoption

The controversy on how the EU’s Information Act will influence the trade is ongoing, with some suggesting it might result in a retreat and even hinder adoption.

A number of provisions might hinder sensible contract adoption in Europe, together with geo-fencing providers to take care of regulatory compliance.

Based on Dudko, there’s an “unlucky aversion to regulation in some offshoots of the crypto ecosystem that runs antithetical to the trade’s founding ideas,” however to her, regulation is just a hindrance to these “with restricted imaginative and prescient.”

Dudko argued that the Bitcoin (BTC) genesis block reference to the 2008 monetary disaster was an “express point out” of the “pallid response” to the disaster, which was itself “the product of lax oversight.” She added:

“Retail prospects need much less danger of their transactions, and legislators are proper to hunt the power to tug the plug if a possibility proves too good to be true. The problem for builders now could be to work inside these confines and nonetheless stick the touchdown on person satisfaction.”

Chen mentioned that the kill change might “impose extra compliance necessities on builders,” which might result in delays and elevated prices when deploying sensible contracts.

On prime of that, the effectiveness and performance of those sensible contracts might endure as a consequence of strict knowledge obligations. Chen added, “The enforceability of sensible contracts closely depends on their autonomous and self-executing nature, and any intervention or interference by third events poses a danger to their integrity.”

Don’t make good the enemy of excellent

Whereas the EU’s new regulatory panorama poses some vital challenges for companies using sensible contracts, it offers an imperfect however seen algorithm that isn’t current in lots of jurisdictions.

In the US, regulators have been accused of regulation by enforcement after suing varied crypto exchanges, together with Coinbase, Kraken and Binance. To today, the very definition of cryptocurrency differs between completely different U.S. monetary watchdog companies.

Chen mentioned that the EU is “typically extra cautious and regulation-focused” than different main economies, whereas McKinney and De Boel mentioned Europe is “sometimes on the forefront relating to regulating data-driven industries.”

”The Information Act, as a part of this digital technique, units harmonized guidelines for knowledge sharing preparations. It’s the first main regulation of this sort having such particular necessities and implications for sensible contracts.”

In distinction, they mentioned that the U.S. doesn’t have a federal sensible contracts legislation and has “comparatively few state legal guidelines concerning sensible contracts, most of which merely make clear {that a} sensible contract generally is a legitimate, binding contract.“

Current: Bitcoin supercycle 2024: Is this the cycle to end them all?

Dudko mentioned the EU has led with “widespread sense rules that talk to the general public’s broad understanding and utilization of digital currencies,” including that “the U.S. and United Kingdom place “better emphasis on asset classification and promotional messaging respectively,” whereas the EU is “persevering with to set requirements round process and undertaking performance.”

Whereas the Information Act is progressing, it’s nonetheless but to be handed into legislation, that means the blockchain trade nonetheless has time to arrange. The trade will solely know the true scope of the legislation as soon as it has come into impact.

[ad_2]

Source link