[ad_1]

Bitcoin (BTC) briefly reached $38,000 on Nov. 24 however confronted formidable resistance on the value stage. On Nov. 27, Bitcoin value traded beneath $37,000, which is unchanged from per week in the past.

What’s eye catching is the unwavering power of BTC derivatives, which indicators that bulls stay steadfast with their intentions.

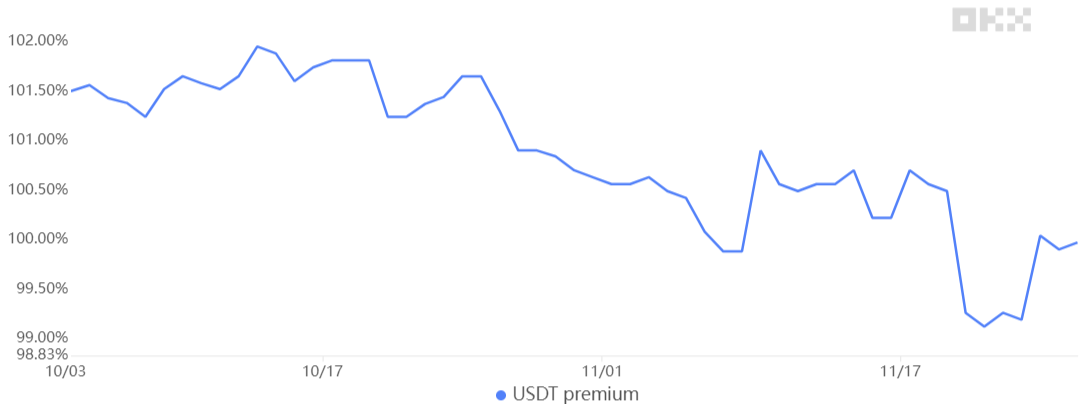

An intriguing growth is unfolding in China as Tether (USDT) trades beneath its honest worth within the native forex, the Yuan. This discrepancy typically arises attributable to differing expectations between skilled merchants engaged in derivatives and retail purchasers concerned within the spot market.

How have rules impacted Bitcoin derivatives?

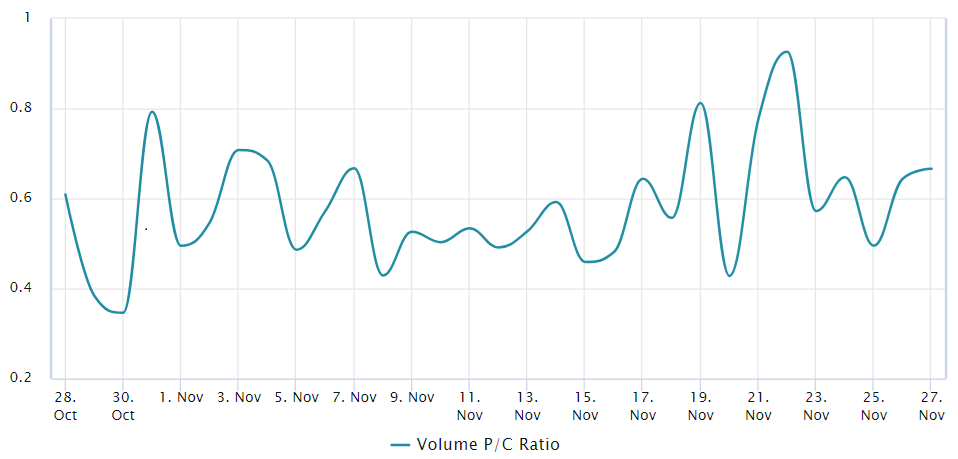

To gauge the publicity of whales and arbitrage desks utilizing Bitcoin derivatives, one should assess BTC choices quantity. By inspecting the put (promote) and name (purchase) choices, we are able to estimate the prevailing bullish or bearish sentiment.

Since Nov. 22, put choices have persistently lagged behind name choices in quantity, by a median of 40%. This means a diminished demand for protecting measures—a shocking growth given the intensified regulatory scrutiny following Binance’s plewith the U.S. Department of Justice (DoJ) and the U.S. Securities and Trade Fee’s (SEC) lawsuit against Kraken exchange.

Whereas buyers might not foresee disruptions to Binance’s providers, the probability of additional regulatory actions in opposition to exchanges serving U.S. purchasers has surged. Moreover, people who beforehand relied on obscuring their exercise may now assume twice, because the DoJ beneficial properties entry to historic transactions.

Moreover, it is unsure whether or not the association struck by Changpeng “CZ” Zhao with authorities will lengthen to different unregulated exchanges and cost gateways. In abstract, the repercussions of latest regulatory actions stay unsure, and the prevailing sentiment is pessimistic, with buyers fearing further constraints and potential actions concentrating on market makers and stablecoin issuers.

To find out if the Bitcoin choices market is an anomaly, let’s look at BTC futures contracts, particularly the month-to-month ones—most well-liked by skilled merchants attributable to their mounted funding fee in impartial markets. Sometimes, these devices commerce at a 5% to 10% premium to account for the prolonged settlement interval.

Between Nov. 24 and Nov. 26, the BTC futures premium flirted with extreme optimism, hovering round 12%. Nevertheless, by Nov. 27, it dipped to 9% as Bitcoin’s value examined the $37,000 assist—a impartial stage however near the bullish threshold.

Retail merchants are much less optimistic after the ETF hopium fades

Transferring on to retail curiosity, there’s a rising sense of apathy because of the absence of a short-term constructive set off, such because the potential approval of a spot Bitcoin exchange-traded fund (ETF). The SEC isn’t anticipated to make its ultimate resolution till January and February 2024.

The USDT premium relative to the Yuan hit its lowest level in over 4 months at OKX change. This premium serves as a gauge of demand amongst China-based retail crypto merchants and measures the hole between peer-to-peer trades and the U.S. greenback.

Since Nov. 20, USDT has been buying and selling at a reduction, suggesting both a major want to liquidate cryptocurrencies or heightened regulatory issues. In both case, it’s miles from a constructive indicator. Moreover, the final occasion of a 1% constructive premium occurred 30 days in the past, indicating that retail merchants aren’t significantly enthused in regards to the latest rally towards $38,000.

Associated: What’s next for Binance’s Changpeng ‘CZ’ Zhao?

In essence, skilled merchants stay unfazed by short-term corrections, whatever the regulatory panorama. Opposite to doomsday predictions, Binance’s standing stays unaffected, and the decrease buying and selling quantity on unregulated exchanges might increase the possibilities of a spot Bitcoin ETF approval.

The disparity in time horizons might clarify the divide between skilled merchants and retail buyers’ optimism. Moreover, latest regulatory actions might pave the way in which for elevated participation by institutional buyers, providing a possible upside sooner or later.

This text is for normal data functions and isn’t meant to be and shouldn’t be taken as authorized or funding recommendation. The views, ideas, and opinions expressed listed below are the creator’s alone and don’t essentially replicate or characterize the views and opinions of Cointelegraph.

[ad_2]

Source link