[ad_1]

Bitcoin (BTC) begins a brand new week conserving merchants guessing close to its highest ranges in 18 months — what’s subsequent?

BTC value motion has held greater after spiking above $38,000 final week, however since then, a testing “micro-range” has left bulls and bears locked in battle.

Whether or not a deeper retracement will come or a visit to $40,000 will go away naysayers behind is now the important thing short-term query for market contributors.

Arising over the subsequent few days are varied potential catalysts to assist impact pattern emergence for Bitcoin, whereas beneath, there are mounting indicators that the market is due a lift.

Volatility is ready to return by the hands of the month-to-month shut in a while, however earlier than then, a bunch of macroeconomic occasions has the power to inject some shock value motion.

Cointelegraph takes a have a look at these points and extra within the weekly rundown of Bitcoin value volatility triggers for the week forward.

Month-to-month shut looms with BTC value up lower than 10%

The month-to-month shut types the important thing diary date for day merchants this week, with Bitcoin at a crossroads.

As Cointelegraph reported, untested liquidity ranges to the draw back and the lure of $40,000 to the upside — this surrounded by resistance — makes for a cussed every day buying and selling vary.

Neither bulls nor bears have been in a position to dislodge an more and more slim hall for BTC/USD, and even new greater highs on every day teimframes have been few and brief lived.

On the newest weekly shut, a well timed drop noticed bids starting to be stuffed, with Bitcoin dropping to lows of $37,100 earlier than recovering, information from Cointelegraph Markets Pro and TradingView reveals.

For standard dealer Skew, it’s now time for bid momentum to return.

“Spot takers led the bounce & finally perp takers had been the pressured bid; principally shorts pressured out of the market,” he wrote in a part of dedicated analysis on X (previously Twitter.)

“Now as we go into EU session & US session vital to see if spot bids or not.”

Skew likewise referenced blocks of liquidity each above and beneath spot value, with $37,000 and $38,000 the important thing ranges to observe.

“Plenty of bid liquidity beneath $37K so if spot takers proceed to be internet sellers this is able to be the momentum required to fill these restrict bids beneath,” he wrote concerning the order guide on largest world trade Binance.

“As for ask liquidity aka provide, that continues to be between $38K – $40K space ~ vital space for greater.”

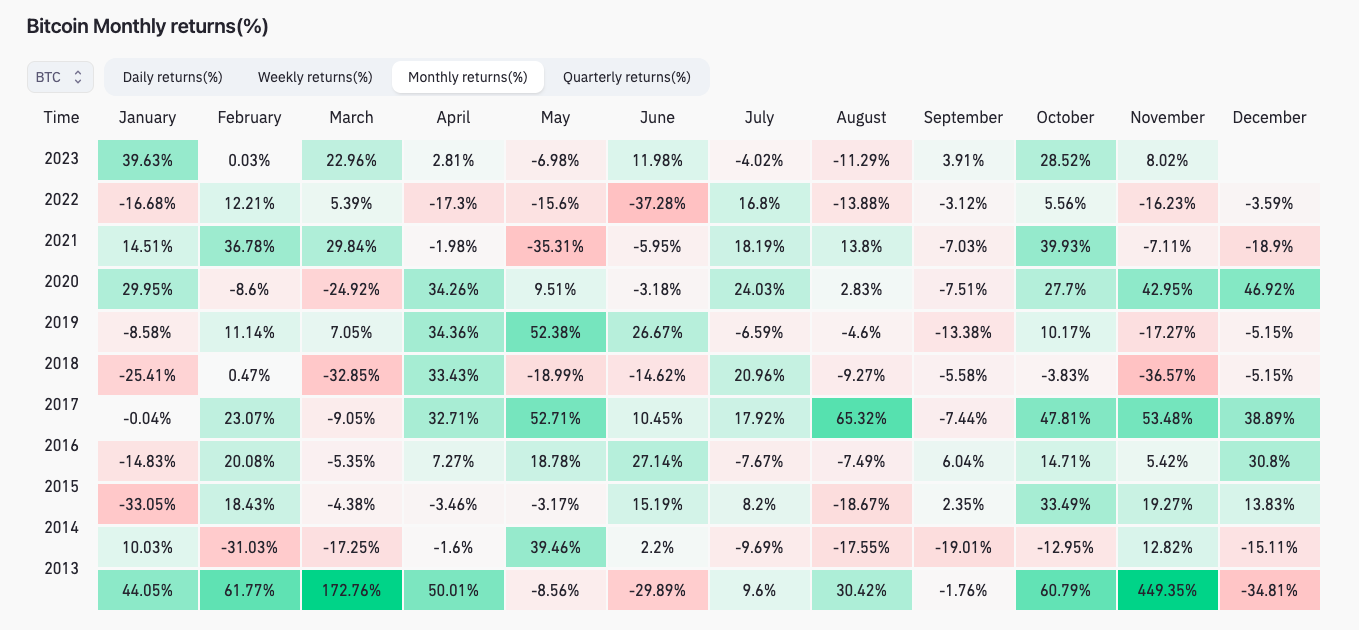

With the month-to-month shut simply days away, Bitcoin is presently up 7.8% month-to-date, making November 2023 totally common in comparison with years passed by.

Information from monitoring useful resource CoinGlass reveals that November is generally characterised by a lot stronger BTC value strikes, and that these will be each up and down.

This fall general, in the meantime, has thus far delivered features of practically 40%.

Key Fed inflation markers lead macro catalysts

A traditional macro week with volatility triggers to match awaits Bitcoin merchants as November attracts to a detailed.

America Federal Reserve will obtain some key information on inflation over the approaching days, this feeding into subsequent month’s resolution on rate of interest coverage.

Fed Chair Jerome Powell will communicate on Dec. 1, following feedback from senior Fed officers all through the week.

The information releases of essentially the most curiosity to markets will possible be Q3 GDP and Private Consumption Expenditures (PCE) print for October, coming Nov. 29 and Nov. 30, respectively.

Beforehand, U.S. macro information started to indicate inflation abating more quickly than markets anticipated, resulting in constructive reevaluations amongst threat belongings.

Key Occasions This Week:

1. New Dwelling Gross sales information – Monday

2. Client Confidence information – Tuesday

3. Q3 GDP information – Wednesday

4. PCE Inflation information – Thursday

5. Fed Chair Powell Speaks – Friday

6. Whole of 10 Fed speaker occasions

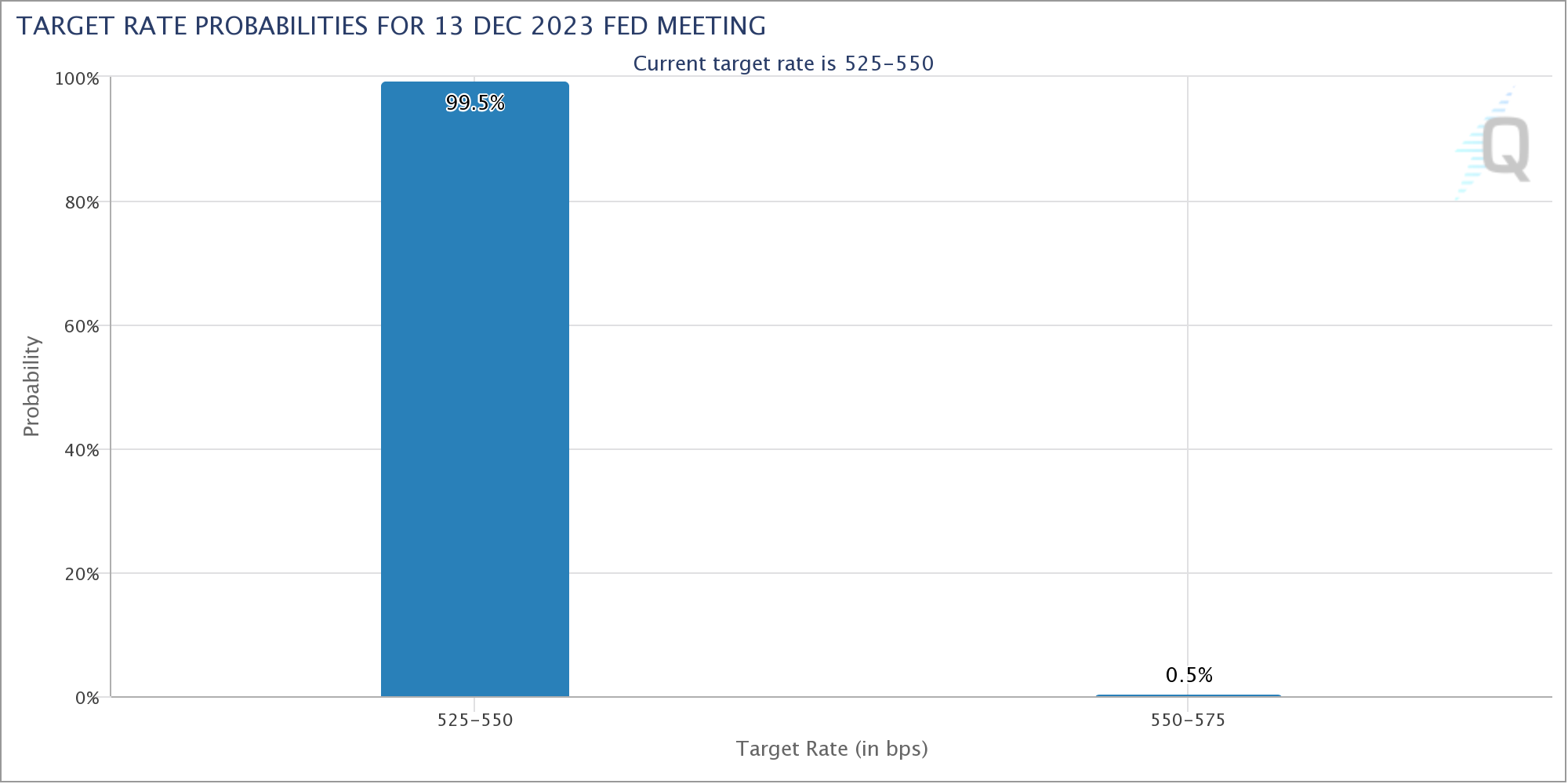

We’re two weeks out from the December Fed assembly.

— The Kobeissi Letter (@KobeissiLetter) November 26, 2023

“Full buying and selling week forward and volatility is right here to remain,” monetary commentary useful resource The Kobeissi Letter summarized on X.

Information from CME Group’s FedWatch Tool presently places the percentages of the Fed holding charges at present ranges at an virtually unanimous 99.5%.

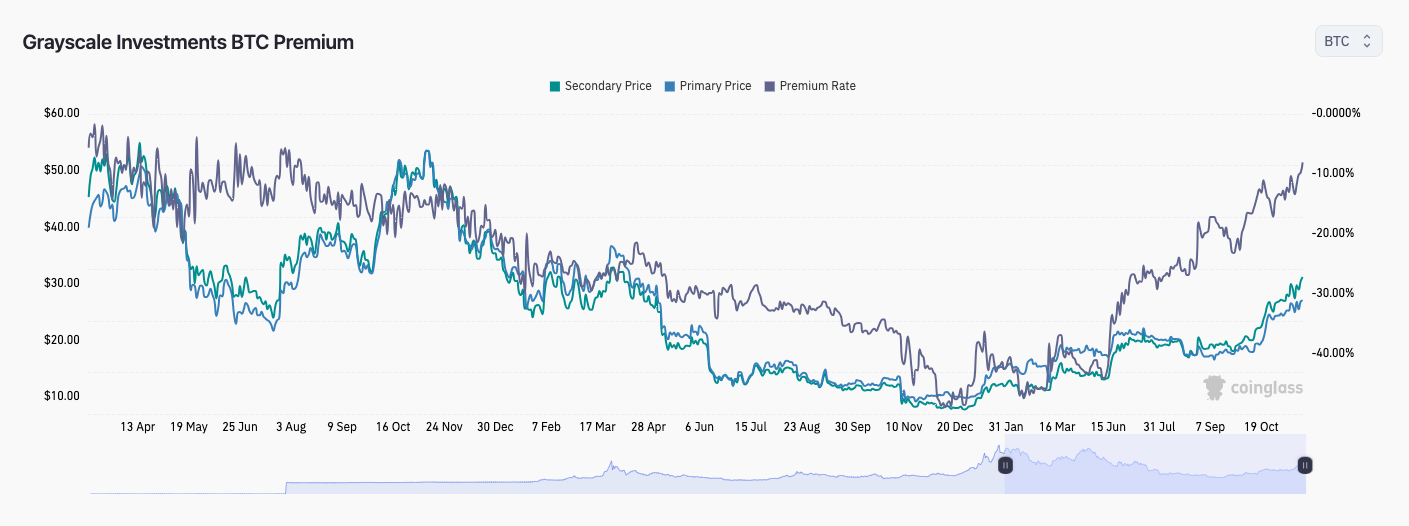

GBTC eyes BTC value parity

Whereas Bitcoin remains to be ready for U.S. regulators to greenlight the nation’s first spot value exchange-traded fund (ETF), markets present that the temper continues to palpably change for the higher.

Nowhere is that this extra obvious than within the largest Bitcoin instuttional funding car, the Grayscale Bitcoin Belief (GBTC).

Itself on account of be transformed to a spot ETF, GBTC is fast approaching parity with its underlying asset pair, BTC/USD.

As soon as practically 50% decrease, the GBTC share value had a mere 8% low cost to internet asset worth, or NAV, as of Nov. 24, per CoinGlass information.

The fund’s renaissance has fashioned a key narrative over each a profitable ETF go-ahead to return and the emergence of real mass institutional curiosity in Bitcoin for the primary time.

“Appears to be like just like the mkt is absolutely anticipating this ETF approval quickly,” William Clemente, co-founder of crypto analysis agency Reflexivity, reacted to the info on the weekend.

By way of the watershed second hitting, nevertheless, dates of observe now all come after the brand new yr.

In its newest market replace despatched to Telegram channel subscribers, buying and selling agency QCP Capital argued that Jan. 3, 2024 could be a well timed approval date, this coinciding with the fifteenth anniversary of the Bitcoin genesis block.

Thereafter, Jan. 10 marks an interim deadline for the primary spot ETF in line, that of ARK Make investments, as “the ultimate deadline for ARK’s utility is included within the first approval batch.”

“And within the case ARK is rejected and the remaining postponed but once more, the true make-or-break deadline is 15 March 2024 — the place Blackrock and the principle bunch of candidates face their very own closing deadline,” it added.

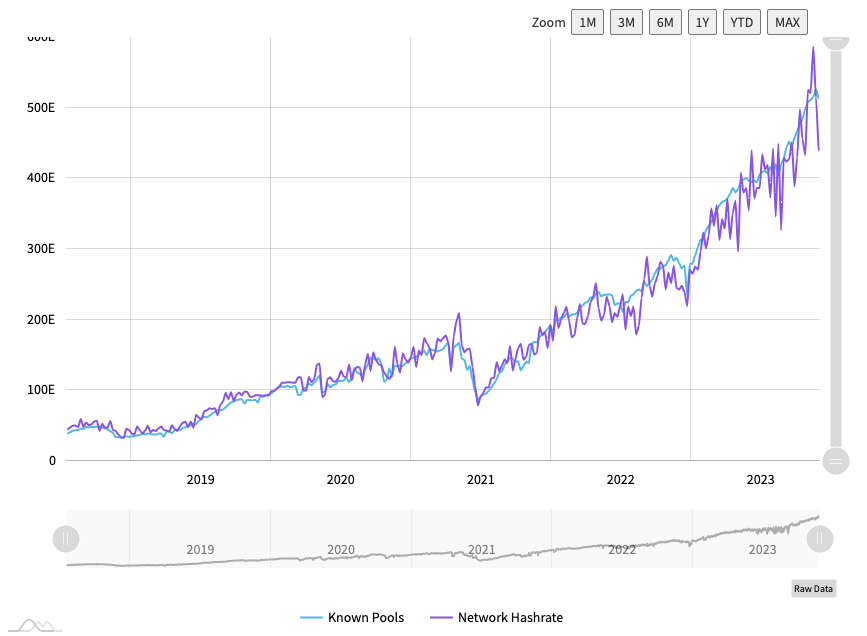

Bitcoin hash fee passes 500 exahash watershed

Prematurely of the upcoming block subsidy halving in April 2024, Bitcoin miners are deploying file processing energy to the community.

Hash fee — the estimated measure of this deployment — is now at its highest ranges ever, and this month handed 500 exahashes per second (EH/s) for the primary time.

The achievement not solely represents a psychological landmark, however underscores miners’ conviction to future profitability — even when BTC value efficiency nonetheless stays 50% beneath its personal peak.

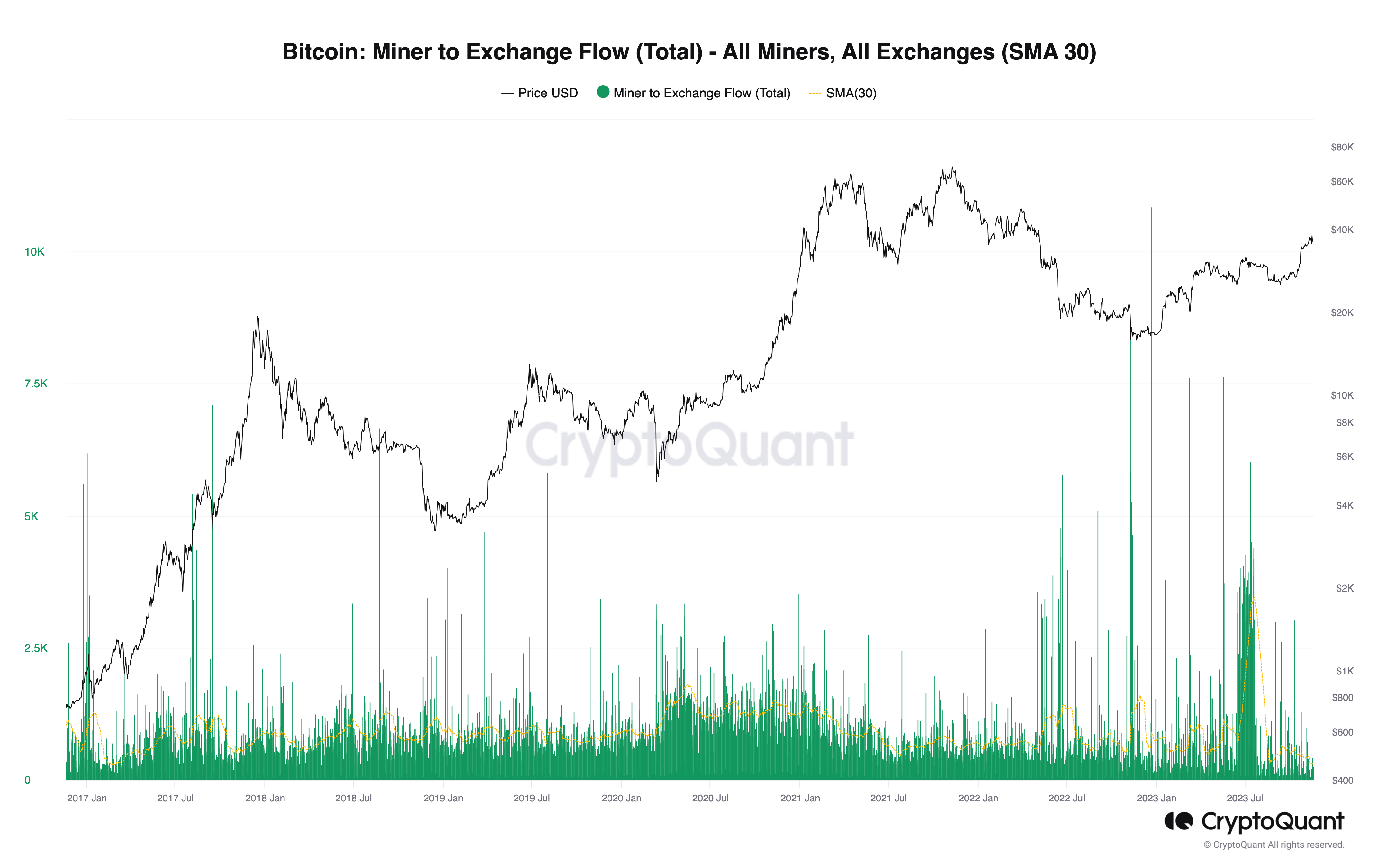

On the identical time, outflows from identified miner wallets to exchanges are at their lowest ranges in seven years, per information from on-chain analytics platform CryptoQuant.

“The circulate of motion from Bitcoin miner wallets to trade wallets in the end represents the exercise of those entities within the open market,” contributing analyst Caue Oliveira wrote in one in every of its Quicktake market updates.

“The entry of cash into exchanges will increase the liquidity of BTC on these platforms, offering extra promoting stress out there.”

Oliveira famous that miners are all the time promoting some portion of their holdings, however the present 90 BTC month-to-month common is the bottom since 2017.

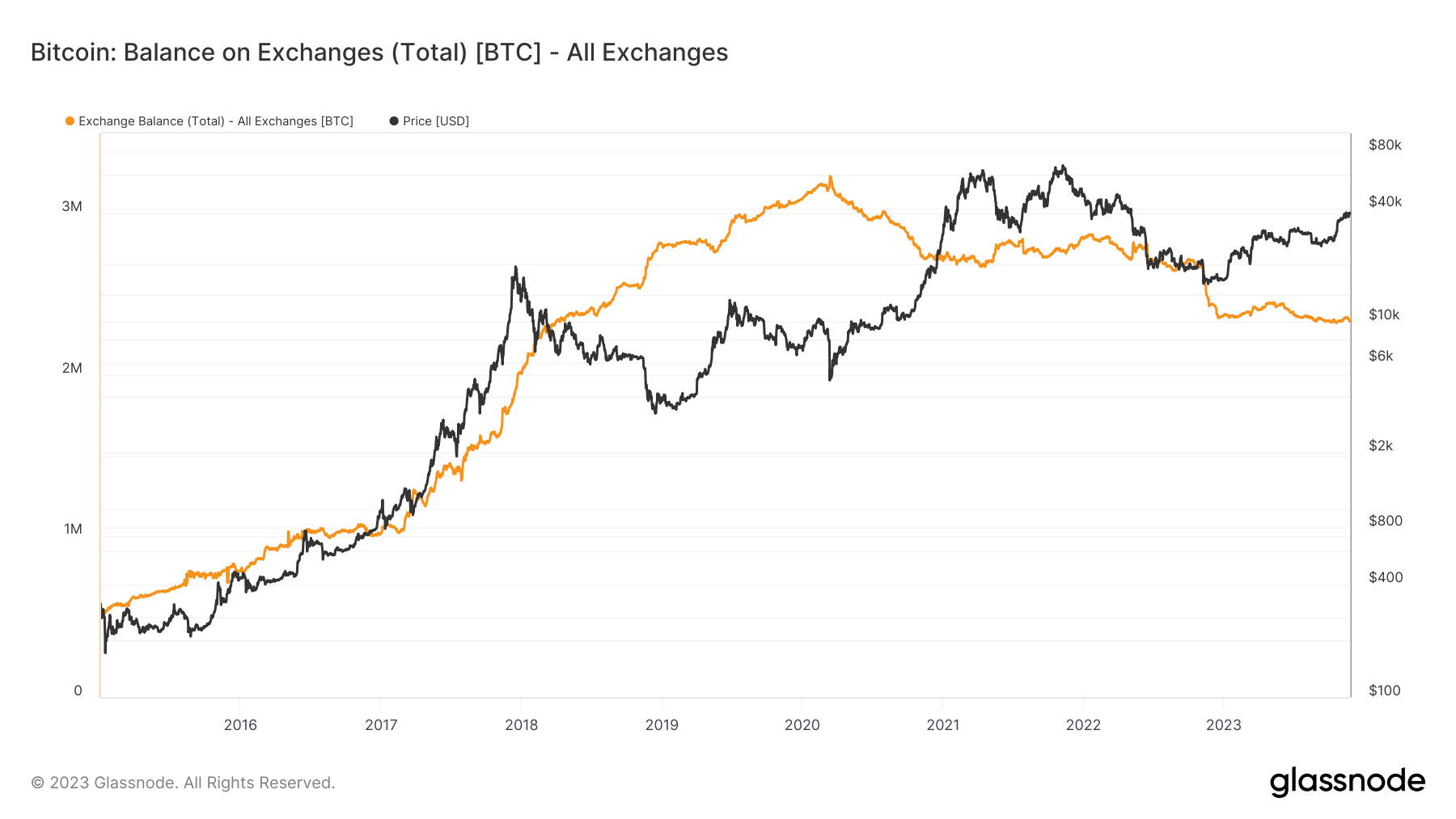

Bitcoin trade balances resume downtrend

After a month of turmoil attributable to withdrawal shut-offs and authorized motion towards a few of the largest crypto exchanges, BTC balances are trending down as soon as once more.

Associated: Bitcoin to $1M post-ETF approval? BTC price predictions diverge wildly

In keeping with the broader pattern in place for 5 years, exchanges’ shares of BTC are drifting ever decrease.

Based on the newest information from on-chain analytics agency Glassnode, the mixed holdings of the most important exchanges totaled 2.332 million BTC as of Nov. 26.

Excluding latest lows in October, that is the smallest quantity of obtainable BTC since April 2018. At its peak in March 2020, simply after the COVID-19 cross-market crash, the tally stood at 3.321 million BTC.

The image was difficult in November due to merchants’ reactions to Binance receiving a file $4.3 billion U.S. fine, together with Poloniex and HTX halting withdrawals altogether after a hack.

This text doesn’t include funding recommendation or suggestions. Each funding and buying and selling transfer entails threat, and readers ought to conduct their very own analysis when making a choice.

[ad_2]

Source link