[ad_1]

Advertisment

The subject of Bitcoin Alternate-Traded Funds (ETF) and their approval around the globe has grow to be part of many debates not too long ago. These monetary devices have emerged as a possible game-changer, providing a bridge between conventional finance and the world of digital property. On this article, we discover the idea of Bitcoin ETFs, their significance, and the influence they may have on the broader digital asset ecosystem.

What are Bitcoin ETFs?

A Bitcoin ETF is a sort of funding fund that tracks the value of bitcoin, permitting traders to realize publicity to the main digital asset with out really proudly owning it. In contrast to conventional investments in digital currencies, the place traders should handle private keys and digital wallets, Bitcoin ETFs simplify the method by providing a well-recognized funding automobile. Buyers should buy and promote shares of the ETF on inventory exchanges, identical to another conventional exchange-traded fund.Bitcoin ETFs present a neater and far much less complicated method for traders to place their cash on BTC by way of regulated platforms. Furthermore, for institutional traders and conventional asset managers who could have been hesitant to dive straight into the risky and unfamiliar world of digital property, these ETFs present a regulated and acquainted entry level.The volatility of the digital asset sector and the regulatory uncertainty of buying and selling platforms are among the greatest hurdles confronted by traders, and Bitcoin ETFs deal with these issues. This accessibility is an important consider attracting a broader investor base, doubtlessly contributing to the mainstream acceptance of bitcoin.

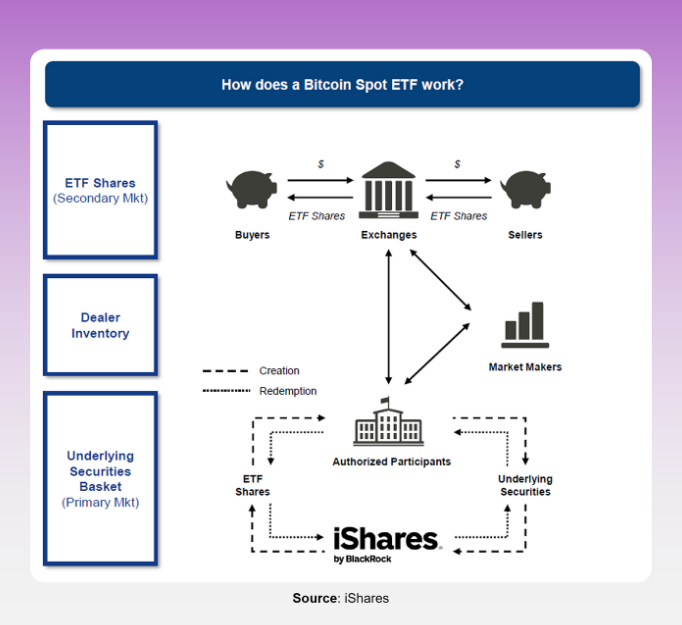

How do Bitcoin ETFs Work?

As talked about above, Bitcoin ETFs present oblique publicity to traders to the value motion of BTC, permitting them to bypass the effort of shopping for and promoting the digital asset. There are some steps concerned within the creation of a Bitcoin ETF:

-

An asset administration agency or monetary establishment decides to create a Bitcoin ETF and registers the ETF with regulatory authorities and exchanges the place it intends to record the fund.The ETF supplier must safe custody of the particular bitcoin that may again the ETF. This includes partnering with a trusted custodian to carry the bitcoin treasury securely. Within the case of BlackRock’s iShares Bitcoin Belief, the asset supervisor partnered with Coinbase.As soon as custody is secured, the ETF supplier creates shares of the ETF. Every share is often designed to symbolize a sure fraction of BTC. Thereafter, the ETF is listed on conventional inventory exchanges.Investors should buy and promote shares of the Bitcoin ETF on the inventory change, much like buying and selling conventional shares. This gives a well-recognized and controlled method for traders to realize publicity to bitcoin with out straight holding the cryptocurrency.Additionally, traders should pay charges to cowl the prices related to managing the fund. These charges can embody administration charges, custodial charges, and operational bills.

Advantages of Bitcoin ETFs

One of many key benefits of bitcoin ETFs is their potential to scale back limitations to entry for retail traders. Main digital asset exchanges like Binance and Coinbase might be intimidating and sophisticated, particularly for these new to the area. Nonetheless, with ETFs, traders can leverage their current brokerage accounts to realize publicity to bitcoin with out the necessity to create new accounts on exchanges.

Moreover, the liquidity of Bitcoin ETFs can contribute to a extra secure and mature marketplace for the underlying digital asset. The bitcoin market is taken into account extraordinarily risky, and typically liquidity might be a problem. Due to this fact, Bitcoin ETFs can improve the present liquidity. With time, as extra traders take part via ETFs, the general buying and selling quantity and liquidity of the ETF shares enhance, doubtlessly resulting in extra secure worth actions for bitcoin.It’s essential to notice that america Securities and Alternate Fee (SEC) has acquired dozens of purposes over time for the approval of a Bitcoin Spot ETF by asset administration companies like ARK Make investments, 21Shares, Constancy, BlackRock, Invesco, Grayscale, and WisdomTree. Nevertheless, approval is but to be seen.

TheBitcoinNews.com – Bitcoin Information supply since June 2011 –

Digital forex shouldn’t be authorized tender, shouldn’t be backed by the federal government, and accounts and worth balances are usually not topic to client protections. TheBitcoinNews.com holds a number of Cryptocurrencies, and this info does NOT represent funding recommendation or a proposal to take a position.

Every part on this web site might be seen as Advertisment and most comes from Press Releases, TheBitcoinNews.com is shouldn’t be liable for any of the content material of or from exterior websites and feeds. Sponsored posts are all the time flagged as this, visitor posts, visitor articles and PRs are most time however NOT all the time flagged as this. Skilled opinions and Worth predictions are usually not supported by us and comes up from 3th half web sites.

Promote with us : Advertise

[ad_2]

Source link