[ad_1]

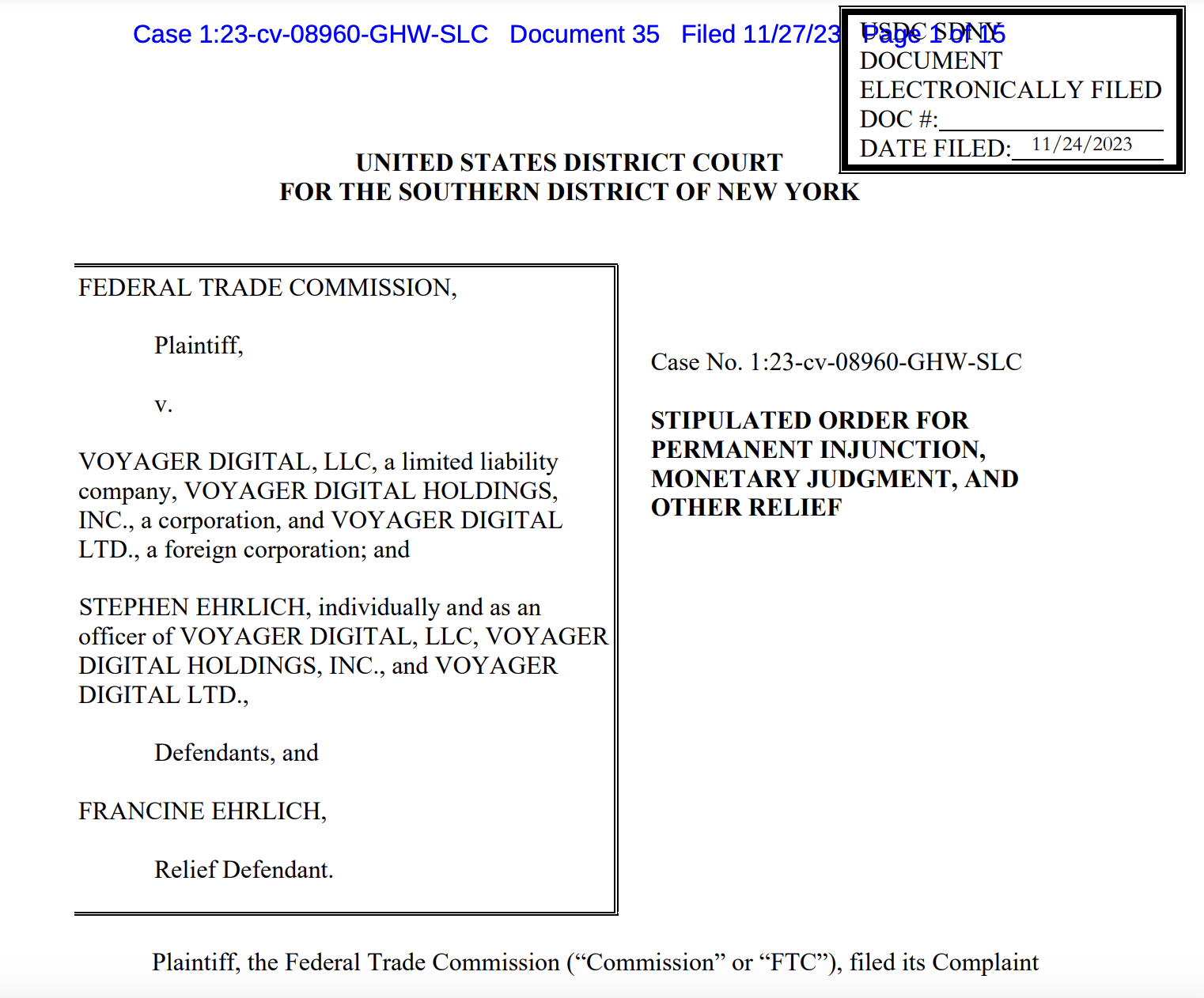

A federal decide has accredited an order requiring crypto lending agency Voyager Digital and its associates to pay $1.65 billion in financial reduction to america Federal Commerce Fee (FTC).

In a Nov. 28 submitting in U.S. District Court docket for the Southern District of New York, Decide Gregory Woods ordered Voyager to pay $1.65 billion following a settlement between the lending agency and the FTC introduced in October. As a part of the settlement, Voyager will likely be “completely restrained and enjoined” from advertising and marketing or offering services or products associated to digital belongings.

In line with Decide Woods, the order will largely not affect proceedings in chapter courtroom, the place Voyager filed for Chapter 11 protection in July 2022 and disclosed liabilities starting from $1 billion to $10 billion. In Could, the courtroom approved a plan permitting Voyager customers to obtain 35.72% of their claims from the lending agency initially.

Underneath the settlement, events related to Voyager should cooperate with FTC officers, together with testimony at hearings, trials and discovery. After a 12 months, Voyager should additionally report on its compliance with the proceedings, topic to monitoring by the fee.

Associated: FTC enhances investigative procedures to deal with AI-related lawbreaking

In October, the U.S. Commodity Futures Buying and selling Fee and the FTC filed parallel lawsuits in opposition to former Voyager CEO Stephen Ehrlich, alleging he made deceptive statements concerning the use and security of buyer funds. Ehrlich claimed on the time that Voyager’s staff “persistently communicated and labored intently” with regulators, largely denying the allegations.

In July, the FTC ordered crypto lending firm Celsius to pay $4.7 billion in charges, alleging the corporate’s co-founders misappropriated consumer belongings and misled traders in regards to the platform’s companies. U.S. officers arrested former Celsius CEO Alex Mashinsky, who stays free on bail till his trial, scheduled to begin in September 2024.

Journal: US enforcement agencies are turning up the heat on crypto-related crime

[ad_2]

Source link