[ad_1]

The value of Dogecoin (DOGE) is down right now, mirroring traits elsewhere in the cryptocurrency market.

Why is Dogecoin value down right now?

On Nov. 28, DOGE’s value dropped over 3.5% to $0.076, underperforming the crypto market, which fell by round 1.25% in the identical interval. The memecoin’s value decline is a part of a broader correction that has witnessed practically a 12.5% retreat in over per week.

Let’s take a more in-depth take a look at the most probably causes behind Dogecoin’s newest pullback.

Bearish divergence

Dogecoin’s drop right now precedes a interval of rising bearish divergence between its value and a key momentum indicator.

Notably, between Oct. 6 and Nov. 17, DOGE’s value rallied, forming increased highs. However, in the identical interval, its every day relative strength index (RSI) dropped, forming decrease highs.

As a rule of technical evaluation, a divergence between rising costs and falling RSI signifies weak spot within the prevailing uptrend, prompting merchants to safe earnings at native value highs.

Rising Bitcoin dominance

Dogecoin’s value drop right now is a part of the decline within the broader altcoin market weight versus Bitcoin (BTC).

Notably, the Bitcoin Dominance Index, which measures the highest cryptocurrency’s market share versus the mixed weight of all altcoins, has risen 0.83% up to now 24 hours. In easy phrases, merchants have rotated their capital from altcoins to Bitcoin.

In distinction, Dogecoin’s market dominance versus the remainder of the crypto market declined by over 1% on Nov. 28.

Psychological resistance

Dogecoin’s value decline right now seems to be a results of a bearish rejection by certainly one of its strongest distribution areas.

Notably, DOGE’s value reversed after retesting its 0.236 Fib line close to $0.081 as resistance. Since Might 2023, its try to shut above this value stage has failed, as illustrated under.

Consequently, DOGE’s chance of constant its pullback transfer is excessive in December 2023, with its 50-day exponential transferring common (50-day EMA; the purple wave) close to $0.072 performing as the first draw back goal.

DOGE whales promote

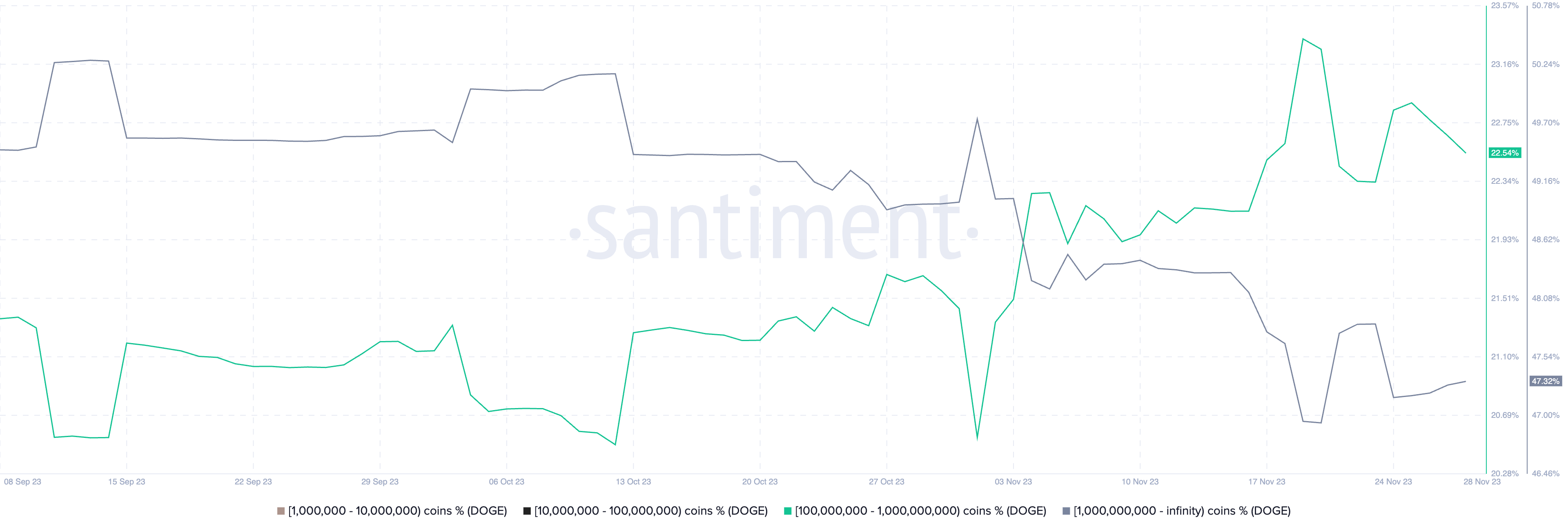

Dogecoin’s value decline coincides with a discount within the DOGE provide held by its richest traders.

Notably, the provision managed by Dogecoin addresses with a steadiness between 100 million and 1 billion DOGE tokens (the inexperienced wave) has dropped practically 1% up to now two weeks. Apparently, the provision held by the subsequent cohort — these holding over 1 billion DOGE (the black wave) — has jumped 0.5% in the identical interval.

The 1 billion-plus DOGE steadiness cohort could embrace addresses related to crypto exchanges and over-the-counter trading desks, indicating whales have transferred their Dogecoin to such platforms for the aim of promoting.

Is Dogecoin bull market over?

From a technical perspective, DOGE wants to interrupt above the higher trendline of its prevailing descending triangle setup. If this bullish situation performs out, the worth could attain $0.10, its September 2022 resistance, by the top of 2023.

The bears, nonetheless, will attempt to pull down DOGE/USD by 25% to $0.056 by the yr’s finish, and maybe even by 70% to $0.023 in Q1, 2024 if the worth breaks under the triangle’s decrease trendline.

Associated: Director YOLO’d $4M of Netflix budget into Dogecoin, made $27M: Report

A descending triangle forming in a downtrend is taken into account a bearish continuation setup. The sample resolves when the worth breaks under its decrease trendline and falls by as a lot as the utmost distance between its higher and decrease trendline.

This text doesn’t include funding recommendation or suggestions. Each funding and buying and selling transfer entails danger, and readers ought to conduct their very own analysis when making a call.

[ad_2]

Source link