[ad_1]

Bitcoin (BTC) might hit $100,000 in a single 12 months’s time because of “sooner than anticipated” exchange-traded funds (ETF) launching, says Normal Chartered.

In a analysis observe issued on Nov. 28 quoted by sources together with Enterprise Insider, the banking large doubled down on its bullish BTC worth targets.

Normal Chartered nonetheless expects six-figure BTC worth

Bitcoin is in line to commerce at six figures by the tip of 2024, the most recent forecast from Normal Chartered concludes.

Because of the USA doubtlessly approving Bitcoin spot worth ETFs, BTC/USD has the power to nearly treble from its present $37,700 over the approaching 12 months.

“We now anticipate extra worth upside to materialize earlier than the halving than we beforehand did, particularly through the earlier-than-expected introduction of US spot ETFs,” Geoff Kenrick, Normal Chartered’s head of EM FX Analysis, West and Crypto Analysis, wrote.

“This implies a danger that the USD 100,000 stage could possibly be reached earlier than end-2024.”

The determine continues the patron banking large’s already optimistic imaginative and prescient of how Bitcoin will develop within the coming years.

In July, analysis eyed the declining availability of the BTC provide as a purpose to imagine that a lot increased costs have been in retailer. Particularly, Kenrick mentioned on the time that $50,000 was on the cards by the tip of 2023.

He additionally steered that miners would start hoarding extra of their very own BTC shares amid rising hash price and the upcoming block subsidy halving reducing BTC earned per block by 50%.

“Elevated miner profitability per BTC (bitcoin) mined means they’ll promote much less whereas sustaining money inflows, decreasing internet BTC provide and pushing BTC costs increased,” he summarized.

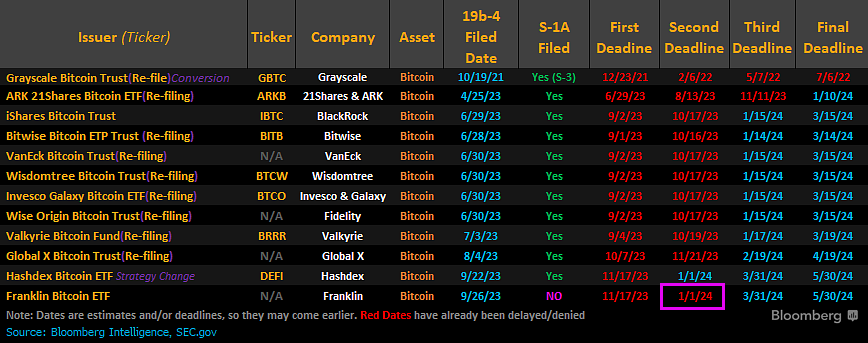

Bitcoin spo ETF: Counting down the weeks

The ETF narrative is firmly in the spotlight this month as derivatives premiums shoot increased and buzz round a possible approval in January heightens.

Associated: Spot Bitcoin ETF: Why this time is different

BTC worth trajectory has been delicate to associated information. Earlier in November, the market gained rapidly over anticipation of a doable approval coming from U.S. regulators earlier than the January window.

On the identical time, issues linger over large-volume investors selling off as soon as the greenlight seems — in what would represent a “purchase the rumor, promote the information” occasion, which may depart latecomers at a loss.

This text doesn’t comprise funding recommendation or suggestions. Each funding and buying and selling transfer entails danger, and readers ought to conduct their very own analysis when making a choice.

[ad_2]

Source link