[ad_1]

Bitcoin (BTC) disregarded recent United States macro information into the Nov. 30 Wall Avenue open as merchants targeted on the month-to-month shut.

PCE retains Fed pivot strain alive

Information from Cointelegraph Markets Pro and TradingView confirmed BTC value actions sticking to a slim intraday vary beneath $38,000.

After a failed breakout the day prior, hopes have been excessive that the Federal Reserve’s “most popular” inflation metric, the Private Consumption Expenditures (PCE) Index, would assist gas volatility.

This, nevertheless, had not come to cross on the time of writing, with November’s closing Wall Avenue open nonetheless to return.

PCE got here in broadly in keeping with expectations — a lift for the Fed’s financial tightening and reinforcement of declining inflation.

Querying whether or not rates of interest would possibly now start to fall — the important thing takeaway for threat belongings — monetary commentary useful resource The Kobeissi Letter nonetheless stayed cautious.

“One other signal inflation is falling however nonetheless above the Fed’s 2% goal. Can the Fed actually pivot now?” it queried on X (previously Twitter) after the PCE outcomes.

Kobeissi as soon as once more alluded to phrases from Invoice Ackman, founder and CEO and founding father of hedge fund Pershing Sq. Capital Administration who earlier within the week predicted price cuts starting as soon as Q1, 2024.

“It is vital to notice that the consequences of financial coverage lag. Nevertheless, does the Fed actually need to threat leaping the gun and slicing charges too quickly?” it continued.

“We imagine requires price cuts in Q1 2024 are too formidable.”

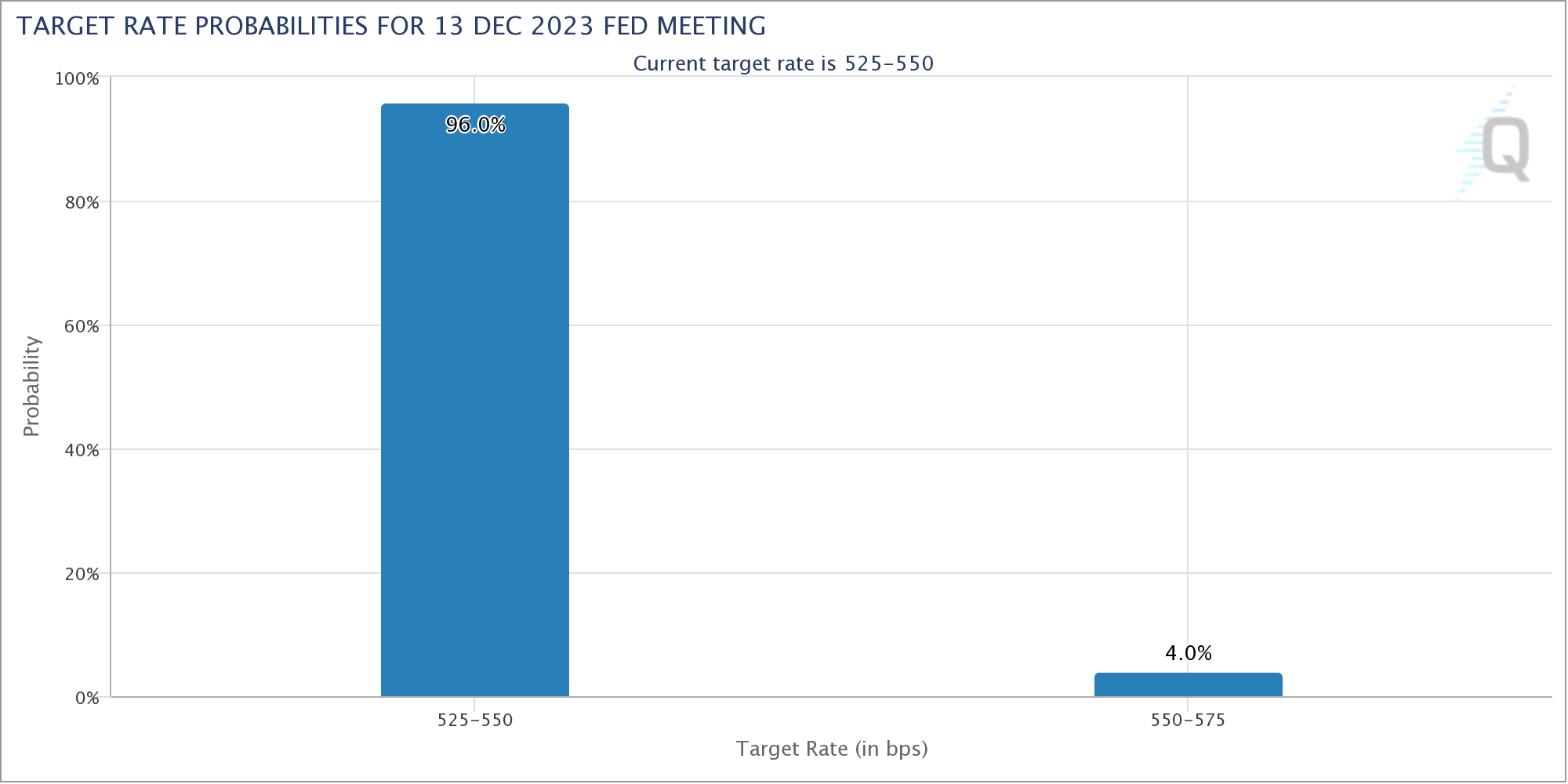

PCE didn’t handle to dent market expectations of Fed coverage, with information from CME Group’s FedWatch Tool nonetheless displaying nearly unanimous expectations of a price hike pause persevering with subsequent month.

November BTC value beneficial properties close to 10%

For Bitcoin market individuals, nevertheless, the month-to-month shut was of extra curiosity.

Associated: Bitcoin ETF will drive 165% BTC price gain in 2024 — Standard Chartered

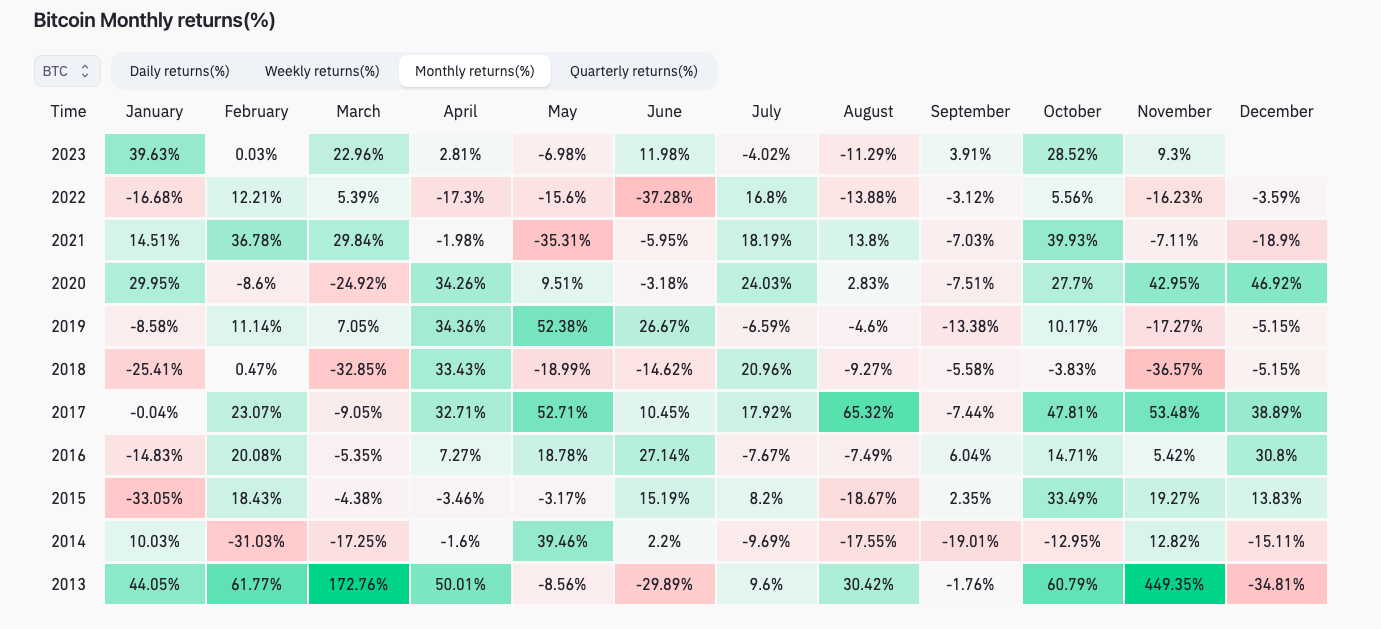

BTC/USD was up almost 10% in November on the time of writing, making it the primary “inexperienced” eleventh month of the yr since 2020. Above $37,660, the shut would change into its highest since Could 2022.

In November 2021 and 2022, Bitcoin fell 7.1% and 16.2%, respectively, per data from statistics useful resource CoinGlass.

Analyzing the present chart setup, in style dealer Jelle noticed causes to be bullish in Bitcoin’s relative energy index (RSI) readings.

“After spending the previous month build up an enormous hidden bullish divergence, Bitcoin has breached its RSI downtrend!” he told X subscribers earlier on the day.

An accompanying chart confirmed the required space for bulls to safe.

“If value can maintain the gray field, I feel this begins transferring increased quickly. All eyes on the month-to-month shut,” Jelle added.

This text doesn’t comprise funding recommendation or suggestions. Each funding and buying and selling transfer includes threat, and readers ought to conduct their very own analysis when making a choice.

[ad_2]

Source link