[ad_1]

Australians are more and more trying to cryptocurrency to safe a peachy retirement, with allocation to the asset class from self-managed retirement funds growing 400% in simply 4 years — with the expansion price surpassing shares and bonds.

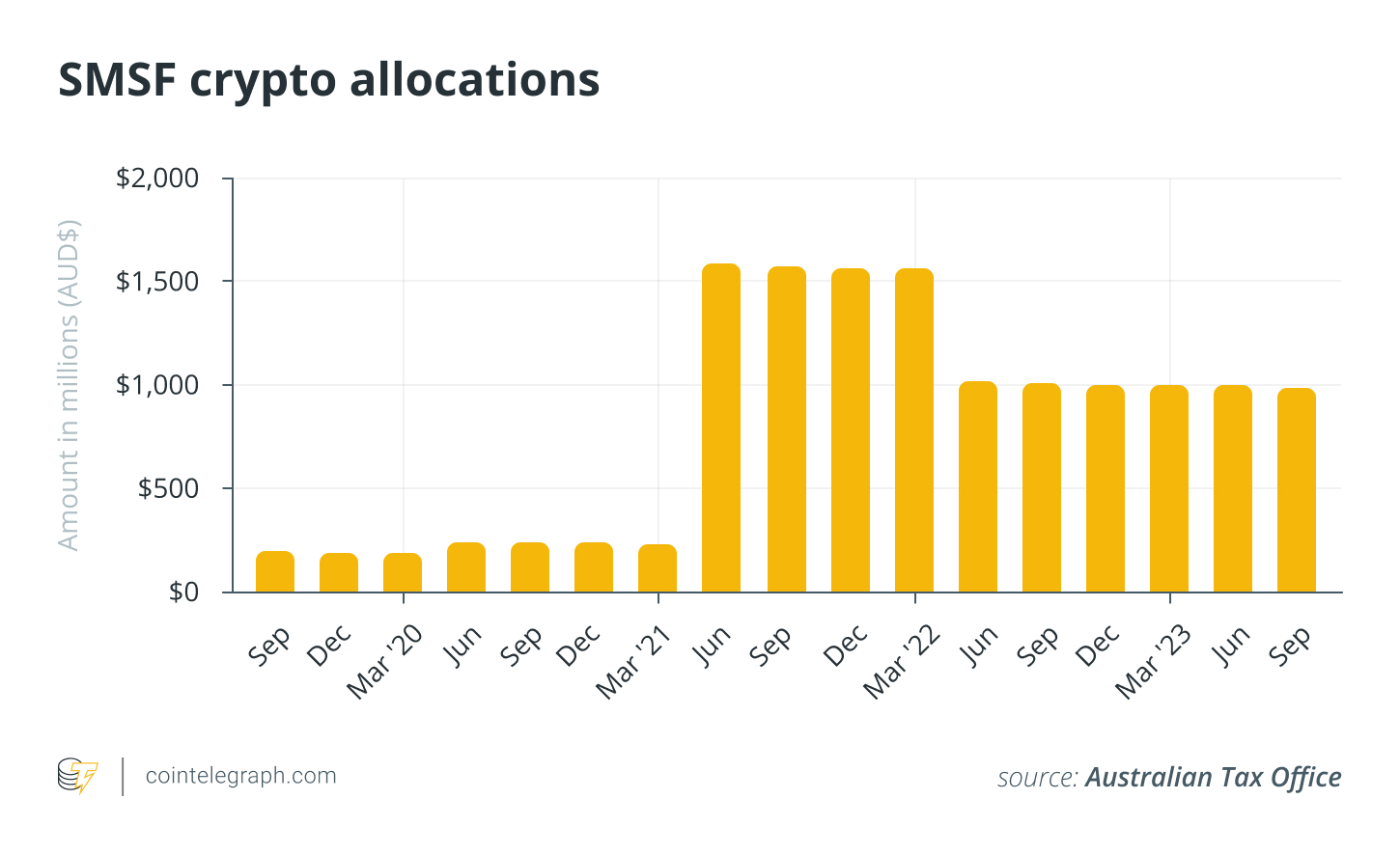

As of the quarter ending in September, the almost 612,000 self-managed tremendous funds (SMSFs) are holding a complete of $658.6 million (992 million Australian {dollars}) price of cryptocurrencies, statistics released on Nov. 26 from the Australian Tax Workplace (ATO) present.

The newest determine is a 400% enhance from the identical quarter in 2019 — which closed out at just below $131.5 million (198 million Australian {dollars}).

In Australia, self-managed tremendous funds — also referred to as non-public superannuation funds — permit people to manage how their retirement funds are invested. The retirement scheme is overseen by the Australian Tax Workplace, and the SMSFs are nonetheless required to adjust to superannuation legal guidelines.

Crypto tax supplier Koinly’s head of tax Danny Talwar informed Cointelegraph this makes crypto the “largest rising asset class in SMSFs.”

Compared, listed shares — representing the most important allocation class for SMSFs on the finish of the final quarter — grew 28% over the identical time. Allocations to debt securities, similar to bonds, fell 5.8% over the previous 4 years.

Nonetheless, whole SMSF allocations to crypto noticed a slight 0.8% drop from the quarter ending June 2023 and a 2.4% drop in comparison with the earlier 12 months.

Nonetheless, the quantity of crypto held in self-managed funds is down 38% in comparison with the all-time excessive of almost $1.06 billion (1.6 billion Australian {dollars}) within the quarter ending June 2021 over the past crypto bull cycle.

Associated: Australia’s tax agency won’t clarify its confusing, ‘aggressive’ crypto rules

Nonetheless, Talwar highlighted that crypto solely made up 0.1% of the full web property held in Australian SMSFs on the finish of the final quarter. He additionally famous that small-sized SMSFs tended to have a bigger allocation to cryptocurrencies of their portfolios.

Holding crypto inside an excellent fund is one thing Talwar stated he’s seeing “an increasing number of” of, and native crypto exchanges providing crypto superannuation merchandise are “on the rise.”

“Folks wish to wish to maintain crypto. You may maintain crypto in tremendous, however there are some stricter guidelines round it,” Talwar warned.

“Your SMSF technique should will let you maintain crypto. It have to be for the only goal of offering you with a retirement profit. You must get all the pieces audited. You must segregate SMSF holdings from private holdings, you may’t have a blurred line between the 2.”

Particular cryptocurrencies SMSFs maintain and what acquire or loss has been made is unknown because the ATO doesn’t present data on portfolio holdings or efficiency.

Journal: Best and worst countries for crypto taxes — Plus crypto tax tips

[ad_2]

Source link