[ad_1]

Bitcoin (BTC) returned to $38,000 on Dec. 1 after the November month-to-month shut turned its greatest since April 2022.

Bitcoin bears fail to spark month-to-month shut sell-off

Knowledge from Cointelegraph Markets Pro and TradingView tracked spectacular in a single day BTC value efficiency,which held key assist.

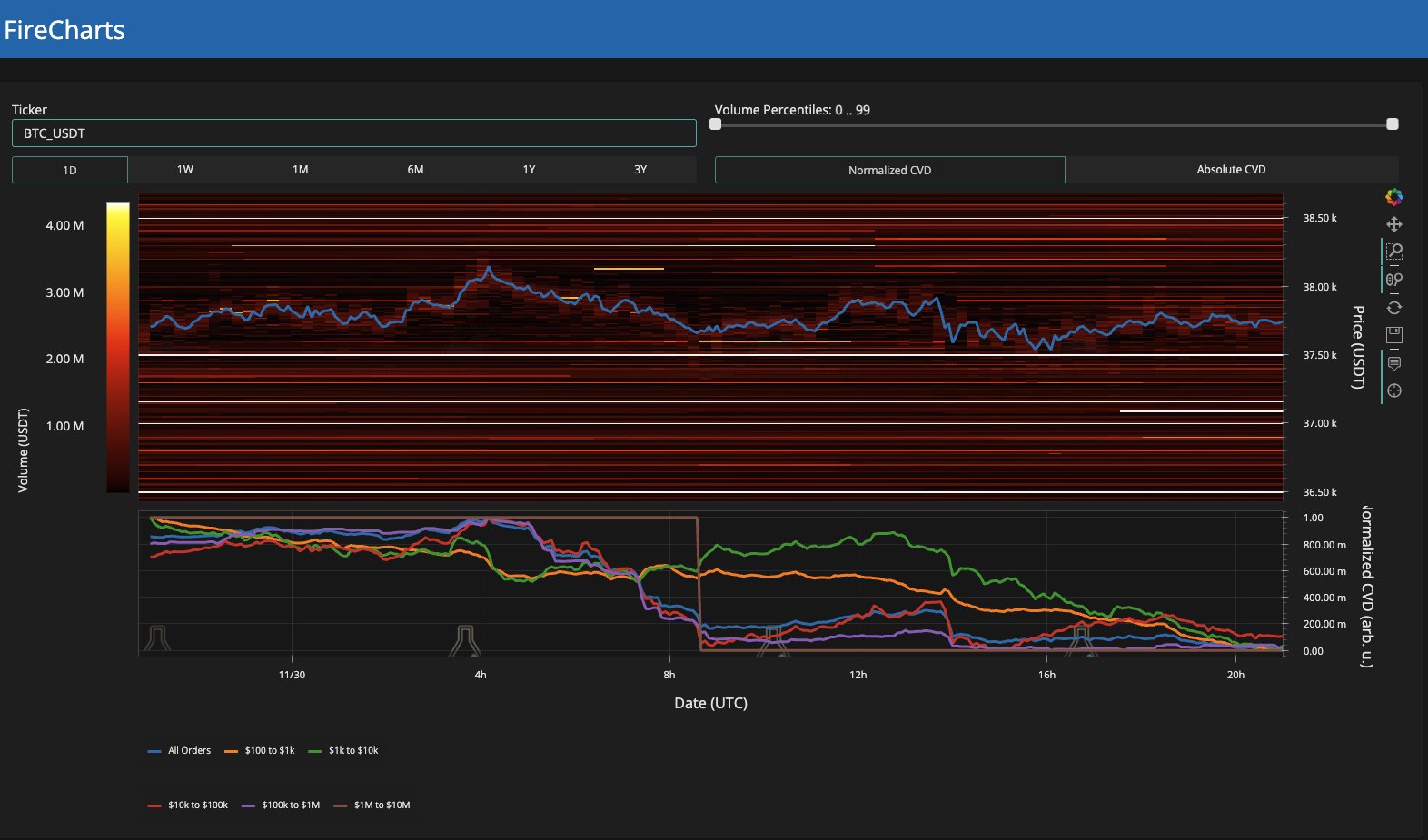

The shut got here in at simply over $37,700, with bid liquidity preserving the intraday vary and avoiding a last-minute sell-off, per order book data from buying and selling useful resource Materials Indicators.

“Month-to-month shut seems to be fairly good closing above $35K,” widespread dealer Skew reacted on X (previously Twitter.)

“May see some multi week compression between $35K – $39K.”

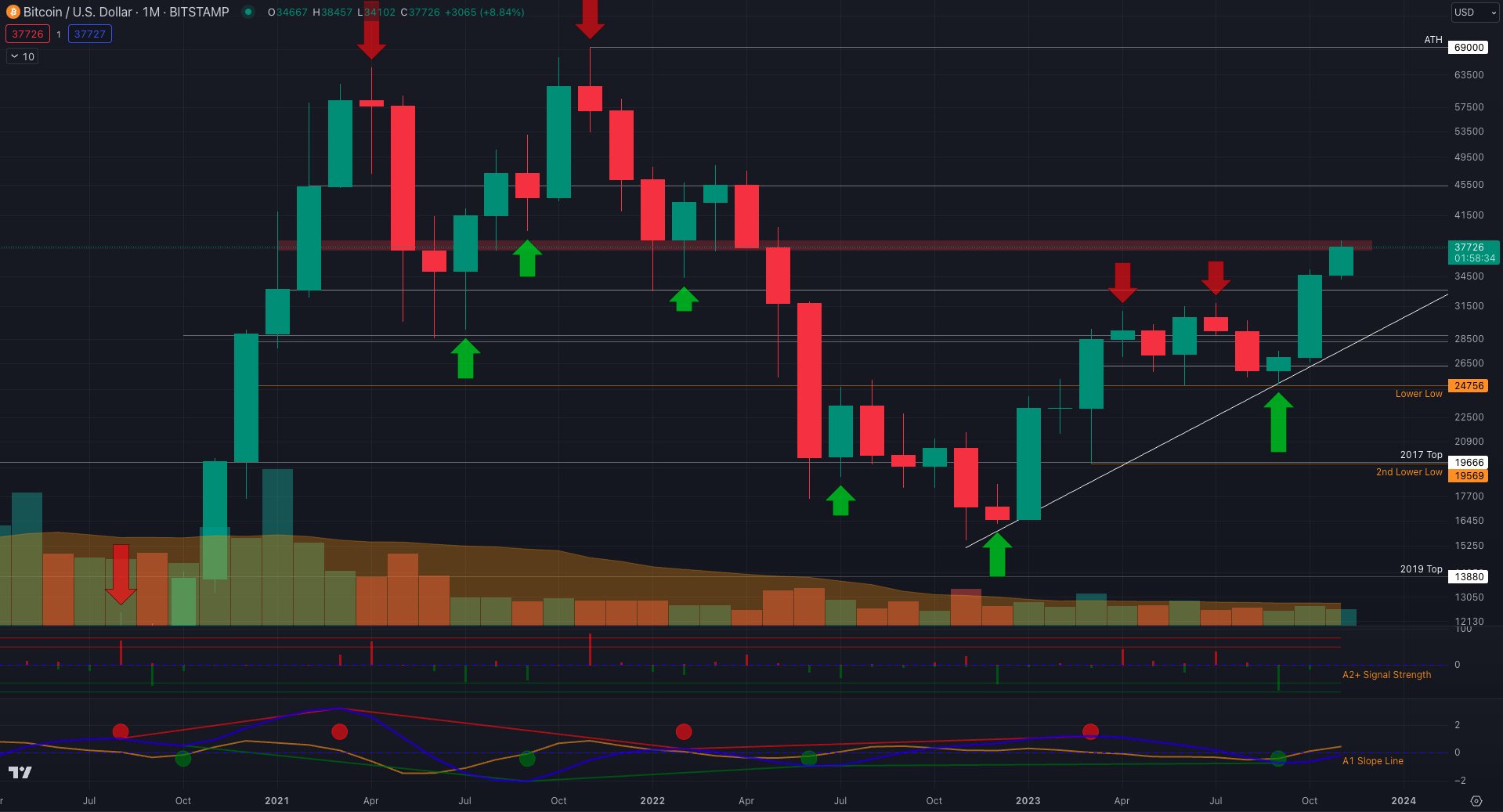

Skew added that main resistance on month-to-month timeframes now lay larger — at $47,000 and across the 2021 all-time excessive of $69,000.

“Month-to-month candle was wonderful with a candle physique low of $34.5K, that is vital in that the decrease candle BODY low was larger then the previous candle BODY excessive. This can be a signal of power!” fellow dealer and chartist JT continued in a part of his personal abstract.

“And lest we neglect we closed $3K larger this month than final month, and thats progress!”

JT described the high-timeframe chart outlook as “constant and constructive.”

Bitcoin breaking out on low time-frame. pic.twitter.com/MBBXmZ2iBz

— The Wolf Of All Streets (@scottmelker) December 1, 2023

The journey above the $38,000 mark, which got here hours after the shut, marked Bitcoin’s first noticeable transfer within the latter half of the week. United States macroeconomic knowledge prints conversely failed to attract a lot of a response.

Jerome Powell, Chair of the Federal Reserve, was because of converse on the day in what can be the final probability for exterior volatility to be triggered.

BTC value vary has “vital” options

Highlighting the cussed nature of the present vary beneath $40,000, in the meantime, Materials Indicators co-founder Keith Alan argued that clearing it could be extremely vital.

Associated: Bitcoin ETF will drive 165% BTC price gain in 2024 — Standard Chartered

Alan referenced the historic resistance/assist (R/S) strains in play throughout the vary, these of comparable significance to these already cleared, such because the earlier cycle’s 2017 all-time excessive close to $20,000.

“If you happen to suppose BTC is hovering round an arbitrary value you’d be mistaken. There’s a vital quantity of historic confluence on this little R/S Flip Zone,” he wrote in a single day.

An accompanying chart confirmed the degrees to notice on the month-to-month chart, together with lengthy and quick alerts from one in every of Materials Indicators’ proprietary buying and selling indicators.

This text doesn’t include funding recommendation or suggestions. Each funding and buying and selling transfer entails danger, and readers ought to conduct their very own analysis when making a call.

[ad_2]

Source link