[ad_1]

High Tales This Week

Bitcoin ETF race will get thirteenth entrant, BlackRock revises ETF mannequin

Asset supervisor Pando Asset has become an unexpected late entrant into the spot Bitcoin ETF race in the USA. On Nov. 29, Pando submitted a Kind S-1 — used to register securities with the company — to the U.S. Securities and Alternate Fee for the Pando Asset Spot Bitcoin Belief. Like different ETF bids, the belief goals to trace Bitcoin’s worth with the custody arm of the crypto alternate Coinbase to carry Bitcoin on behalf of the belief. Pando is the thirteenth applicant for an authorised spot Bitcoin ETF within the U.S. and joins the race with a dozen others, together with BlackRock, ARK Make investments and Grayscale.

Binance will finish help for BUSD stablecoin in December

Crypto alternate Binance is winding down the services for its native stablecoin, Binance USD (BUSD). In line with an announcement, the alternate will stop help for all BUSD merchandise following Paxos halting the minting of recent cash. Binance stated customers ought to withdraw or convert their current BUSD into different property earlier than Dec. 15, previous to it starting the method of disabling withdrawals for BUSD on Dec. 31. At that time, current balances will routinely be transformed into First Digital USD for sure customers.

CME Bitcoin futures present traders betting on $40K BTC worth

The demand of institutional traders for Bitcoin (BTC) became evident on Nov. 10 as the Chicago Mercantile Exchange (CME) Bitcoin futures flipped Binance’s BTC futures markets by way of dimension. In line with BTC derivatives metrics, these traders are exhibiting sturdy confidence in Bitcoin’s potential to interrupt above the $40,000 mark within the quick time period. CME’s present Bitcoin futures open curiosity stands at $4.35 billion, the best since November 2021, when Bitcoin hit its all-time excessive of $69,000 — a transparent indication of heightened curiosity. The spectacular 125% surge in CME’s BTC futures open curiosity from $1.93 billion in mid-October is undoubtedly tied to the anticipation of the approval of a spot Bitcoin exchange-traded fund.

ChatGPT’s first yr marked by existential worry, lawsuits and boardroom drama

With ChatGPT, OpenAI has developed the most popular synthetic intelligence software on the planet. It was launched a yr in the past, on Nov. 30, 2022, and catapulted to 100 million month-to-month customers inside its first three months. In simply 12 months, ChatGPT’s existence has contributed to narratives surrounding the extinction of humankind, accusations that OpenAI constructed it by allegedly committing mass-scale copyright infringement, and a tumultuous CEO firing and rehiring that pundits are nonetheless making an attempt to know.

FTX and Alameda Analysis money out $10.8M to Binance, Coinbase, Wintermut

Wallets linked to defunct crypto buying and selling corporations FTX and Alameda Analysis moved $10.8 million to accounts in Binance, Coinbase and Wintermute utilizing eight cryptocurrencies. Blockchain evaluation agency Spot On Chain noticed the motion, estimating that the defunct entities have transferred $551 million since Oct. 24 utilizing 59 completely different cryptocurrency tokens. The funds’ motion dates again to March, when FTX and Alameda started the method of recovering property for traders.

Winners and Losers

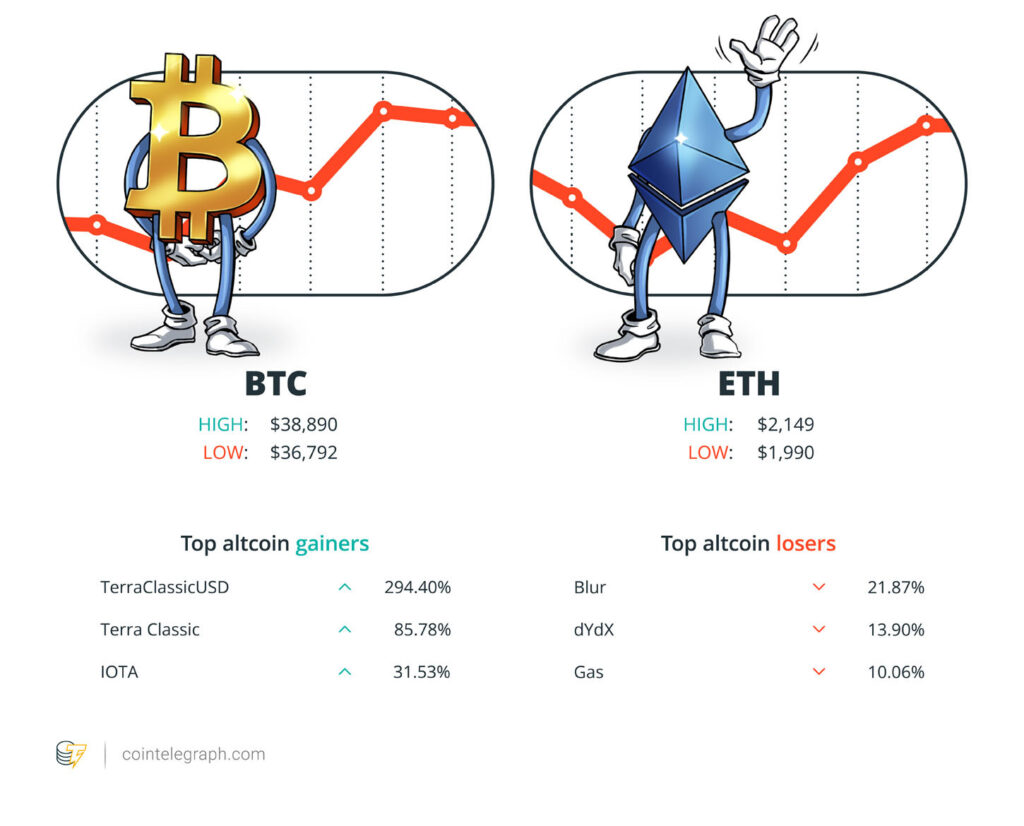

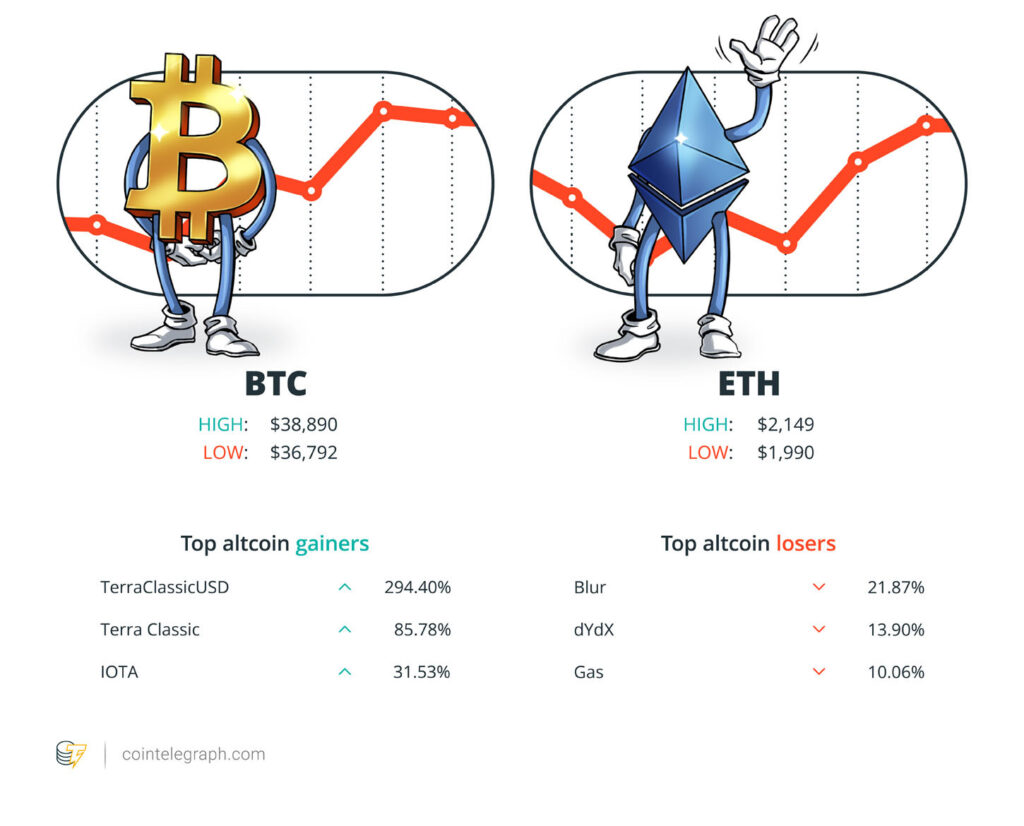

On the finish of the week, Bitcoin (BTC) is at $38,673, Ether (ETH) at $2,084 and XRP at $0.61. The overall market cap is at $1.45 trillion, according to CoinMarketCap.

Among the many greatest 100 cryptocurrencies, the highest three altcoin gainers of the week are TerraClassicUSD (USTC) at 294.40%, Terra Basic (LUNC) at 85.78% and IOTA (IOTA) at 31.53%.

The highest three altcoin losers of the week are Blur (BLUR) at 21.87%, dYdX (ethDYDX) at 13.90% and Gasoline (GAS) at 10.06%.

For more information on crypto costs, make certain to learn Cointelegraph’s market analysis.

Learn additionally

Most Memorable Quotations

“I feel [Binance’s settlement with the SEC is] a web optimistic for his or her firm. I feel it’s a web optimistic for our business.”

Mike Novogratz, CEO of Galaxy Digital

“Clearly, the therapy of CZ and Binance is absurd and solely highlights the arbitrary nature of punishment by the hands of the state.”

Arthur Hayes, entrepreneur and former CEO of BitMEX

“Allow us to not overlook that ‘innovation versus regulation’ is a false dichotomy that has for years been peddled by tech corporations to evade significant accountability and binding regulation.”

Agnes Callamard, secretary-general of Amnesty Worldwide

“AI is […] a brand new sort of thoughts that’s quickly gaining in intelligence, and it stands a critical likelihood of overtaking people’ psychological colleges and turning into the brand new apex species on the planet.”

Vitalik Buterin, co-founder of Ethereum

“Don’t be a loser. Get out of FAKE cash system. Get into gold, silver, Bitcoin now…. Earlier than it’s too late.”

Robert Kiyosaki, creator and entrepreneur

“[Blast] crossed traces in each messaging and execution.”

Dan Robinson, head of analysis at Paradigm

Prediction of the week

Bitcoin ETF will drive 165% BTC worth achieve in 2024 — Commonplace Chartered

Bitcoin is in line to trade at six figures by the top of 2024, the most recent forecast from Commonplace Chartered concludes. Because of the USA probably approving Bitcoin spot worth ETFs, BTC/USD has the power to virtually treble from its present $37,700 over the approaching 12 months.

“We now count on extra worth upside to materialize earlier than the halving than we beforehand did, particularly by way of the earlier-than-expected introduction of US spot ETFs,” Geoff Kendrick, Commonplace Chartered’s head of EM FX analysis, west and crypto analysis wrote. “This implies a danger that the USD 100,000 degree could possibly be reached earlier than end-2024.”

The determine continues the patron banking large’s already optimistic imaginative and prescient of how Bitcoin will develop within the coming years. In July, analysis eyed the declining availability of the BTC provide as a motive to imagine that a lot increased costs have been in retailer.

FUD of the Week

Crypto thieves steal $363M in Nov, probably the most ‘damaging’ month this yr

The cryptocurrency business has now seen its most “damaging” month for crypto thievery, scams and exploits in 2023, with crypto criminals strolling away with $363 million in November, in line with blockchain safety agency CertiK. Round $316.4 million got here from exploits alone, flash loans inflicted $45.5 million in injury, and $1.1 million was misplaced to numerous exit scams.

Bankless controversy forces founders to burn tokens and separate from DAO

Amid the continued controversy round cryptocurrency media agency Bankless and the related decentralized autonomous group, BanklessDAO, the founders of Bankless have suggested separating the brand from the DAO. Bankless co-founders David Hoffman and Ryan Sean Adams plan to submit a governance proposal to BanklessDAO to separate the 2 entities. Hoffman and Adams’ determination to separate Bankless from BanklessDAO got here in response to group criticism of BanklessDAO’s utility for a grant from Arbitrum.

KyberSwap hacker calls for full management over Kyber firm

The hacker behind the $46-million KyberSwap exploit has finally released their conditions for the return of the stolen funds, which embrace “full government management” over the Kyber Community firm. On Nov. 30, the KyberSwap hacker despatched an on-chain message addressing all related and events. The hacker laid out calls for, together with management over the corporate, short-term full authority and possession of its governance mechanism, the KyberDAO, all paperwork associated to the corporate, and all the Kyber Community firm’s property.

Learn additionally

High Journal Items of the Week

Outrage that ChatGPT gained’t say slurs, Q* ‘breaks encryption’, 99% pretend net: AI Eye

A blizzard of AI bullsh*t is taking over the net from the torrent of human outrage that presently lives there.

Actual AI use instances in crypto, No. 3: Sensible contract audits & cybersecurity

Experts believe AI will become a useful software for good contract auditing and cybersecurity — however it’s not there but.

Pudgy Penguins CEO says reward he will get ‘is definitely fairly unhappy’: NFT Creator

“You can’t really be an angry, depressing particular person after which go click on purchase on a Pudgy Penguin.”

Subscribe

Essentially the most participating reads in blockchain. Delivered as soon as a

week.

[ad_2]

Source link