[ad_1]

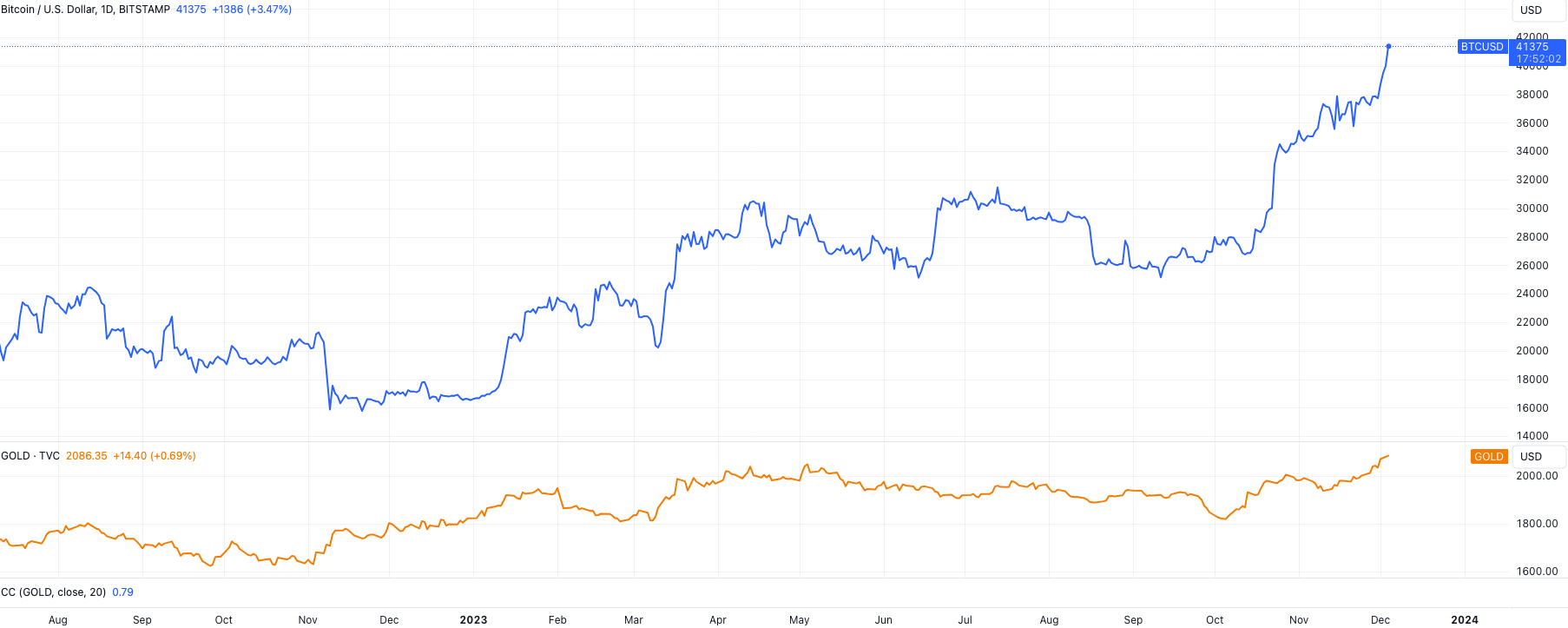

The worth of gold has damaged by means of a brand new all-time excessive, surpassing the numerous degree of $2,100 throughout the Asian session on Monday, Dec. 4. In the meantime, Bitcoin (BTC) has additionally surged above $41,000 for the primary time in 19 months.

Bitcoin value breaks $40K…and $41K

Bitcoin has made a triumphant return to the $40,000 threshold, a determine unseen because the heights of April 2022. This included a swift 2% leap over 24 hours, marking a 19-month peak for the cryptocurrency.

Wild tailwinds for bitcoin:

✅ New ATH in gold

✅ to abolish central financial institution

✅ Worst bond crash in 250yrs

✅ BTC ETF on the cusp (?)

✅ Actual property trembling

✅ Shopper Tech languishing

✅ Banks shaking

✅ Fed on the point of pump

✅ Halving in April

✅ Bitcoin L2 is right here— Tuur Demeester (@TuurDemeester) December 4, 2023

What’s extra, Bitcoin has now risen over 140% because the starting of the yr.

Insights from Matrixport’s analysis head, Markus Thielen, suggest an even brighter future. With historic tendencies of post-bear market bull cycles and upcoming Bitcoin halving occasions as a backdrop, projections place Bitcoin at over $60,000 by April subsequent yr and as excessive as $125,000 by the top of 2024.

Associated: BTC price models hint at $130K target after 2024 Bitcoin halving

Such predictions relaxation on the historic sample of value will increase previous halving occasions, with an anticipated surge of over 200%.

“On the eve of a spot Bitcoin ETF”

The speculative winds are additional fanned by the potential approval of a spot Bitcoin exchange-traded fund (ETF) in the USA.

With 13 bidders, together with business giants like BlackRock and Grayscale, the anticipation is constructing towards a choice by the Securities and Change Fee (SEC).

Bloomberg’s ETF analysts see a high probability of simultaneous approvals for all pending bids by Jan. 10, which might mark not solely a brand new period of institutional participation and funding in Bitcoin, however probably a lift for BTC value as properly.

“It is very probably we’re on the eve of a Bitcoin spot ETF,” commented Bitcoin analyst Willy Woo on X in regards to the new highs in gold value. “The primary commodity ETF was SPDR Gold Belief. It supplied a easy means for traders to entry gold of their portfolio.”

Woo added:

“When it launched, gold went on to an 8-year rally with no single down yr between 2005 – 2012.”

Subsequently, Bitcoin’s newest transfer above the psychological $40,000 degree displays bullish market sentiment fueled by the likely approval of a spot Bitcoin ETF in January and the prospect of regulatory developments typically. Bitcoin’s halving occasion, in the meantime, is just anticipated to provide additional tailwinds for BTC value over the following 5 months.

This text doesn’t comprise funding recommendation or suggestions. Each funding and buying and selling transfer entails danger, and readers ought to conduct their very own analysis when making a choice.

[ad_2]

Source link