[ad_1]

The cryptocurrency alternate ByBit launched its 4th quarter report on Dec. 4, highlighting and evaluating traits between its institutional and retail buyers.

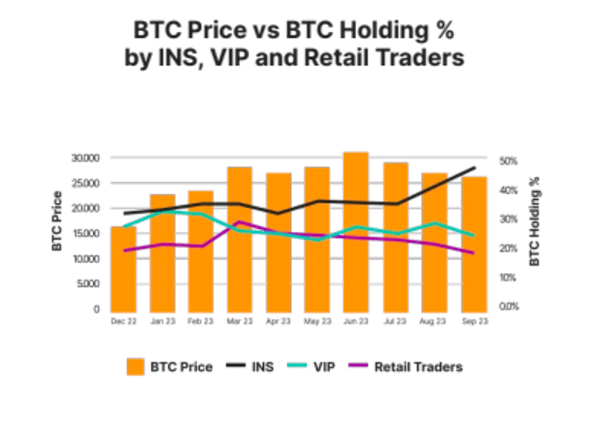

The report discovered that institutional merchants had some 45% of their property in stablecoins, with the remaining break up 35% in Bitcoin (BTC), 15% in Ether (ETH) and solely 5% in altcoins, which the alternate categorizes as something aside from the aforementioned digital property.

The survey means that the “flight” to “safer property,” like stablecoins, in a bear market “would possibly clarify this risk-averse asset allocation from merchants.”

Nonetheless, institutional merchants’ allocation of Bitcoin (BTC) did spike in September, which differentiated itself from the holding patterns of different forms of customers.

In accordance with ByBit, the alignment of a surge in institutional (BTC) holdings with the prevailing optimistic market perspective towards Bitcoin might be correlated with “favorable lawsuit outcomes, fostering anticipation for the SEC’s potential approval of a spot BTC ETF.”

On Dec. 4, (BTC) surged above $41,000 for the primary time in 19 months, and the general market cap for the digital asset passed $800 billion, overtaking the true property firm Berkshire Hathaway and now behind corporations like Meta (previously Fb) and Nvidia.

Associated: Coinbase warns customers about subpoena in apparent CFTC Bybit probe

ByBit additionally famous that its retail merchants had the bottom holdings, percentage-wise, of Bitcoin in comparison with its different forms of customers. Comparatively, its retail merchants held extra stablecoins, and though stablecoins nonetheless made up a big portion of institutional portfolios, their holdings started to say no.

Earlier this yr the alternate mentioned its consumer base hit 20 million, and final yr, it was ranked among the many prime ten cryptocurrency exchanges on the earth by quantity.

Parallel to (BTC) costs persevering with to climb, the curiosity from main establishments appears to be on the rise. On Dec. 4, Brazil’s largest bank, Itau Unibanco, reportedly launched a (BTC) buying and selling service for its purchasers related to its funding platform.

Journal: 65% plunge in Web3 Games in ’23 but ‘real hits’ coming, $26M NFL Rivals NFT: Web3 Gamer

[ad_2]

Source link