[ad_1]

The New Jersey Basic Meeting might take into account a invoice that might resolve when a digital asset or digital forex is a safety beneath state legislation.

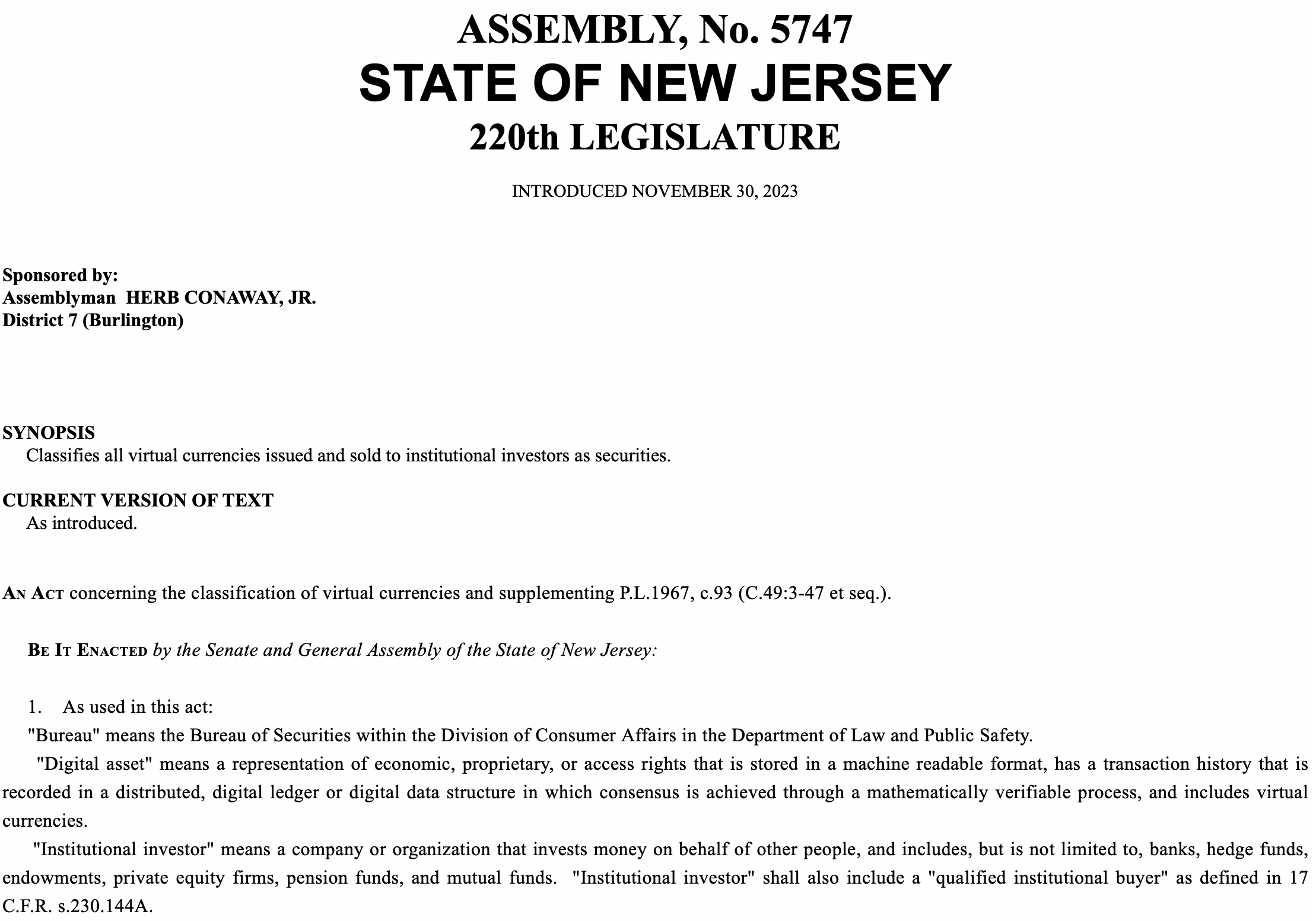

All digital currencies issued and offered to institutional traders could be thought-about securities within the U.S. state of New Jersey beneath the invoice launched by Democratic Assemblyman Herb Conaway, Jr. on Nov. 29. In response to the quick text of the invoice, the laws would complement the New Jersey Uniform Securities Legislation, which presently makes no point out of digital, digital or cryptocurrency.

The invoice pertains solely to institutional traders, that are outlined as “an organization or group that invests cash on behalf of different individuals.” It additionally specifies that stablecoins could possibly be decided to be digital currencies by the state’s Bureau of Securities.

Associated: Coinbase pauses staking services in four US states following regulators’ orders

The invoice would solely apply to transactions ruled by New Jersey legislation and wouldn’t influence the federal Securities and Trade Fee.

Two different payments are pending in New Jersey that have an effect on crypto. The “Digital Forex and Blockchain Regulation Act” would offer regulation for client digital property and decentralized autonomous organizations (DAOs). It just lately handed each homes of the New Jersey legislature and is presently awaiting motion by the governor.

#NewJersey introduces A5747, which might outline all #virtualcurrency offered to #institutitonal traders as #securities. h/t to @kkirkbos for recognizing this one! /1 https://t.co/f7vnwoentn

— Drew Hinkes (@propelforward) December 5, 2023

As well as, the “Digital Asset and Blockchain Know-how Act” would require the state Division of Treasury to evaluate and approve a digital cost platform for state-approved companies “that should not have entry to conventional monetary providers and are compelled to function in cash-only or cash-heavy environments.” The platform would use a digital forex pegged to the USD and would facilitate audits, compliance and native tax funds.

Assemblyman Conaway’s workplace declined to touch upon his invoice when approached by Cointelegraph.

Journal: Crypto regulation: Does SEC Chair Gary Gensler have the final say?

[ad_2]

Source link