[ad_1]

Regardless of the dangers and the failures related to central bank digital currencies (CBDCs), international policymakers are pushing ahead to make them a actuality.

In November alone, officers from the Worldwide Financial Fund (IMF), Bretton Woods Committee, and Financial institution for Worldwide Settlements (BIS) issued rallying requires governments to push ahead on CBDCs with braveness and dedication. However somewhat than double down on a foul thought and waste additional assets on this pursuit, policymakers ought to let this concept go and concentrate on extra basic reforms that might create a freer monetary system.

The November CBDC marketing campaign started when IMF managing director Kristalina Georgieva advised policymakers, “If something… we have to decide up velocity [with CBDC development].” Bretton Woods Committee chair Invoice Dudley likewise referred to as not just for the USA to develop a CBDC, however for the BIS to ascertain a global commonplace for CBDCs. And BIS Innovation Hub head Cecilia Skingsley advised an viewers that CBDCs shouldn’t be dismissed as a “resolution looking for an issue” as a result of they is likely to be helpful in the future.

Associated: Milei vowed to close Argentina’s central bank — But will he do it?

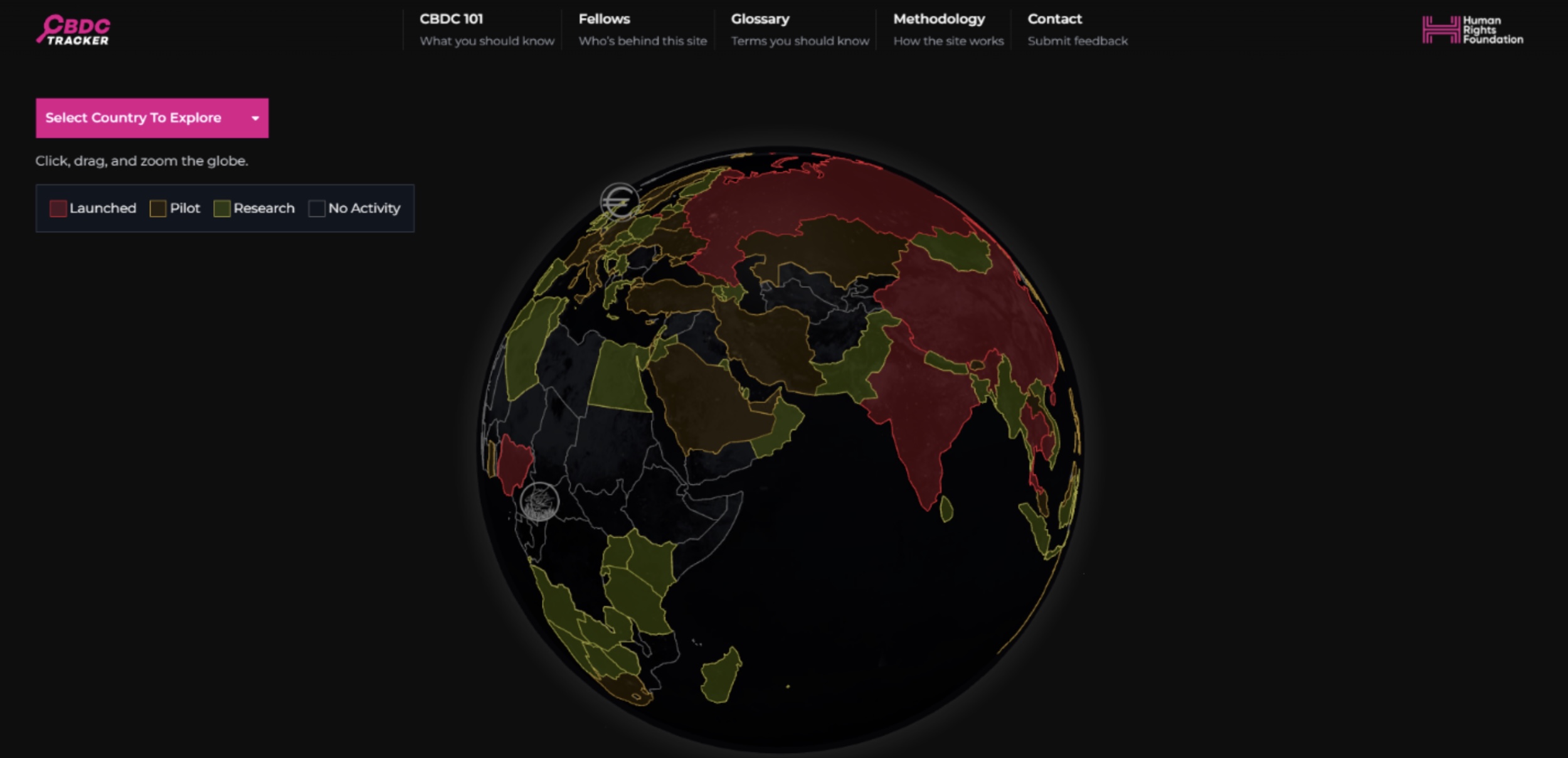

These calls come at an odd time. Because the Human Rights Basis’s CBDC Tracker signifies, 9 international locations and the eight islands that compose the Jap Caribbean Forex Union have launched CBDCs; 38 international locations and Hong Kong have CBDC pilot applications; and 68 international locations and a couple of foreign money unions are researching CBDCs. But, none of those initiatives have confirmed worthwhile.

But, some governments could not even have the cash to provide away. In Thailand, plans to provide residents 10,000 baht ($288) via a CBDC had been delayed partly as a result of the federal government had not recognized the place the 548 billion baht ($15.8 billion) wanted to cowl the handout would come from. Worse but, others warned that the handout could not even be authorized. It wasn’t till later that the prime minister introduced that it could be funded by authorities loans.

Elsewhere, the CBDC expertise has been a lot worse. Nigeria’s CBDC struggled to realize adoption a lot that the Nigerian government started pulling cash off the streets. Inside weeks, it created a money scarcity so extreme that it led to protests exterior of banks and riots within the streets. Nonetheless, CBDC adoption solely elevated from 0.5 p.c to six p.c.

So at finest, the CBDC expertise appears to be considered one of authorities waste. At worst, the CBDC expertise is considered one of authorities management. And it’s in opposition to this backdrop that it’s obscure why worldwide organizations just like the IMF, the Bretton Woods Committee, and the BIS are nonetheless calling for policymakers to cost forward with CBDCs.

Associated: History tells us we’re in for a strong bull market with a hard landing

After seeing the failures in follow and contemplating the dangers nonetheless looming, neither the U.S. authorities nor governments overseas ought to launch a CBDC. Put merely, the prices outweigh the advantages. There’s little question that central banks and different organizations have invested their time, assets, and reputations in growing CBDCs. Nevertheless, it could be a mistake to let these investments be a motive to fall sufferer to the sunk-cost fallacy.

With that stated, if policymakers are keen to rework the monetary system in a method the advantages everybody, there’s a lot that may be carried out to create a freer, extra accessible, and open monetary system.

In reality, there is no such thing as a scarcity of coverage reform concepts on the desk. From strengthening monetary privateness protections to establishing oversight of federal regulators, there are a lot of alternatives to reform the monetary system at present.

For instance, think about simply the thought of reigning within the monetary surveillance presently happening. U.S. monetary establishments spent an estimated $46 billion complying with monetary reporting necessities in 2022. These are prices that find yourself making their method all the way down to folks making an attempt to open accounts or purchase loans. Extra so, there’s additionally the unseen prices of delays in transfers and funds as establishments work to confirm identities, spending habits, and problem particular person reviews to the federal government. Reforming monetary coverage alone holds the potential to create a less expensive and quicker monetary system.

Maybe better of all, reforming monetary privateness doesn’t require reinventing the cash in everybody’s pockets.

Nicholas Anthony is a coverage analyst on the Cato Institute’s Heart for Financial and Monetary Options. He’s the writer of The Infrastructure Funding and Jobs Act’s Assault on Crypto: Questioning the Rationale for the Cryptocurrency Provisions and The Proper to Monetary Privateness: Crafting a Higher Framework for Monetary Privateness within the Digital Age.

This text is for normal info functions and isn’t meant to be and shouldn’t be taken as authorized or funding recommendation. The views, ideas, and opinions expressed listed here are the writer’s alone and don’t essentially replicate or characterize the views and opinions of Cointelegraph.

[ad_2]

Source link