[ad_1]

Bitcoin (BTC) choices open curiosity reached an unprecedented milestone, surging to a staggering $20.5 billion on Dec. 7. This exceptional achievement signifies the lively involvement of institutional investors within the cryptocurrency area. In contrast to futures contracts, BTC choices include predetermined expiration costs, providing precious insights into merchants’ expectations and the markets’ sentiment.

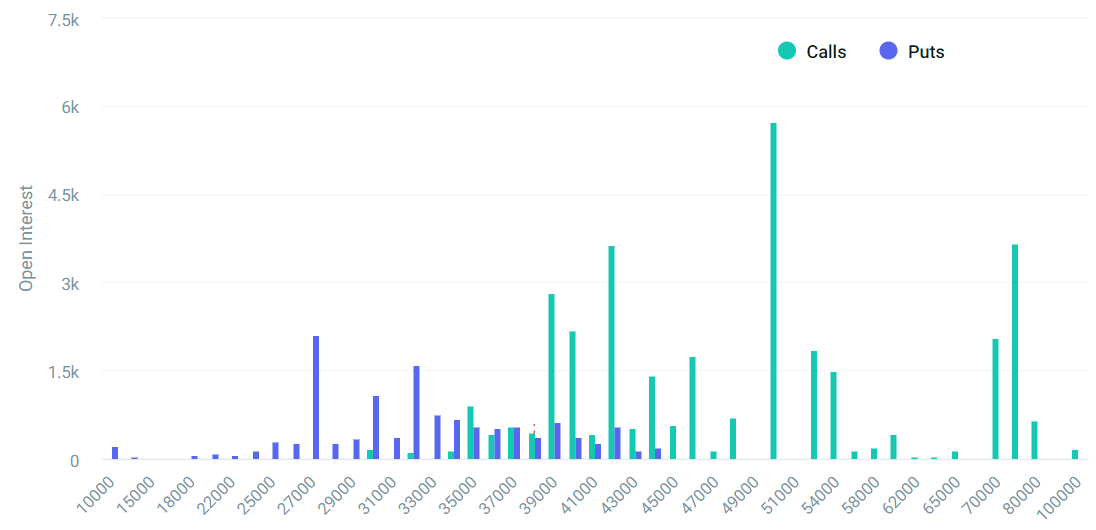

On the forefront of the Bitcoin choices market stands Deribit, boasting a formidable 90% market share. The alternate at present holds a considerable $2.05 billion open curiosity for choices expiring on Jan. 26. Nevertheless, it is value noting that a good portion of those bets might lose their worth because the deadline approaches.

Nonetheless, with the prospect of a spot exchange-traded fund (ETF) gaining regulatory approval, beforehand sidelined bullish bets are reentering the taking part in subject.

How expensive is a Bitcoin name (purchase) choice?

Presently, the $54,000 name choice set to run out on Jan. 26 is buying and selling at 0.02 BTC, equal to $880 at present market costs. This selection necessitates a 25% enhance in Bitcoin’s worth over the subsequent 49 days for the client to show a revenue. It is noteworthy that sellers can hedge their positions utilizing BTC futures whereas pocketing the choices premium, mitigating a number of the perceived danger related to this commerce.

Analysts have emphasised the importance of the $250 million open curiosity stemming from the $50,000 name choices on Deribit. On the present value of $44,000, these choices are collectively valued at $8.8 million. This valuation may expertise appreciable development if regulatory authorities greenlight the spot ETF plans. Nevertheless, it stays unsure whether or not the consumers of those $50,000 name choices intend to make use of them for bullish methods.

The comparatively modest demand for name choices inside the $70,000 to $80,000 vary, accounting for lower than 20% of the open curiosity, suggests a scarcity of exuberance amongst bulls. These choices, with an publicity of $285 million, are at present valued at simply $1.2 million. Compared, the open curiosity for $60,000 and $65,000 name choices set to run out on Dec. 29 quantities to $250 million.

Turning to the put choices, merchants seem to have positioned themselves cautiously for the January expiry, with 97% of bets positioned at $42,000 or decrease. Until the present value trajectory undergoes a big reversal, the $568 million open curiosity in put choices might face bleak prospects. However, promoting put choices can provide merchants a way to achieve constructive publicity to Bitcoin above particular value ranges, although estimating the precise impression stays difficult.

Associated: SEC discussing ‘key technical details’ with spot crypto ETF applicants- Report

Bitcoin put choices shouldn’t be dismissed (but)

The open curiosity in Jan. 26 name choices surpasses that of put choices on Deribit by an element of two.6, signaling a higher demand for neutral-to-bullish methods. Whereas the attract of the $50,000 name choices is simple and holds the potential to drive Bitcoin’s value greater, it is important to do not forget that the expiration value is set solely at 8:00 UTC on Jan. 26, making it untimely to expend substantial efforts at this stage.

For Bitcoin bears, the perfect state of affairs hinges on the ETF proposal being rejected, though the SEC might request extra time to achieve a last resolution, particularly contemplating current amendments to many filings. Presently, business specialists, together with senior ETF analysts at Bloomberg, estimate a 90% likelihood of approval in 2024, a projection extending past January.

With 49 days remaining till the Jan. 26 expiry, prematurely dismissing the 97% of put choices as nugatory appears unwarranted. Moreover, bears have the regulatory panorama on their aspect, because the trial involving Binance and its founder, Changzeng Zhao, has solely simply commenced.

This text is for normal info functions and isn’t meant to be and shouldn’t be taken as authorized or funding recommendation. The views, ideas, and opinions expressed listed here are the creator’s alone and don’t essentially replicate or signify the views and opinions of Cointelegraph.

[ad_2]

Source link