[ad_1]

United Arab Emirates agency Phoenix Group has disclosed a brand new buy of {hardware} gear from WhatsMiner, aimed toward increasing its portfolio of hydro cooling rigs. In response to an announcement on Dec. 7, the $380 million deal represents WhatsMiner’s largest order in two years.

Beneath the settlement, Phoenix acquired mining gear valued at $136 million, with a further possibility value $246 million out there. WhatsMiner’s line of hydro cooling gear was launched in 2022, with present costs starting from $1,008 to $2,484, in accordance with the corporate’s web site.

WhatsMiner’s hydro cooling {hardware} makes use of a closed-loop water system, preserving the amount and high quality of water inside pipes. In response to the corporate, the system gives extra environment friendly warmth switch since water is a more practical warmth conductor than air or oil. The advantages of this method embody a discount in operational prices and a minimized environmental influence, the corporate claims.

Since 2022, Phoenix has been the unique distributor of WhatsMiner gear. This new collaboration, in accordance with Phoenix, is a vital step for establishing Excessive-Efficiency Computing (HPC) knowledge facilities. It is unclear the place the gear might be deployed since Phoenix has mining services not solely within the UAE but in addition in Canada and the US.

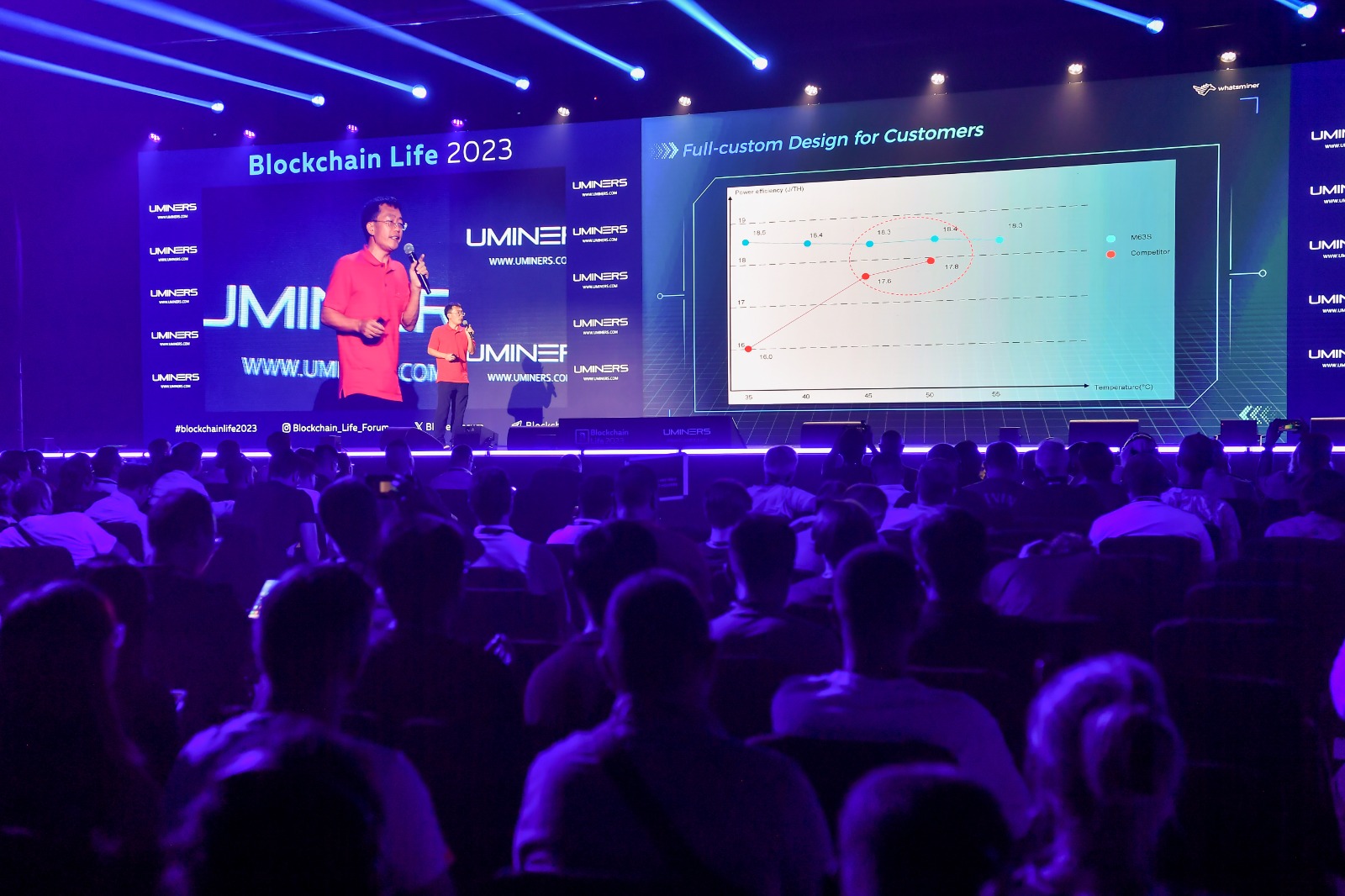

WhatsMiner is a model owned by MicroBT, based by Zuoxing Yang in 2016, a former worker of Bitmain and one of many designers behind its Antminer S9. In October, WhatsMiner launched its newest mining rigs with hydro, immersion, and air-cooling programs.

Phoenix is just not solely an unique distributor of WhatsMiner {hardware} but in addition Bitmain’s official Center East distributor. The corporate debuted trading on the Abu Dhabi Securities Exchange (ADX) on Dec. 5, with its inventory value opening at 2.25 dirhams ($0.60), hovering over 50% from its preliminary public providing (IPO) of 1.50 dirhams ($0.41). Phoenix IPO subscriptions exceeded the supply by 33 instances, with 907,323,529 shares bought for 1.3 billion dirhams ($371 million).

Crypto mining firms have been going through robust instances because of rising vitality prices and decrease Bitcoin costs since early 2022. Mining agency Canaan, for example, recently raised capital due to a sharp decline in income.

Journal: Bitcoin is on a collision course with ‘Net Zero’ promises

[ad_2]

Source link