[ad_1]

Whereas the ossification of Bitcoin’s codebase has introduced stability and reliability, it’s made Bitcoin just a little… properly, boring. The place as soon as the Bitcoin ecosystem fashioned a hub of innovation and a hive of exercise, that momentum has shifted to second- and third-generation chains whose structure is healthier suited to supporting a number of use instances and purposes. Not less than that was the case till the emergence of Ordinals, a know-how that has sparked a brand new wave of innovation on Bitcoin.

All through 2023, Bitcoin’s ecosystem developed quickly. Rising asset varieties, exemplified by Ordinals NFTs and BRC-20 tokens, have sparked widespread group enthusiasm, resulting in a considerable enhance in BTC miners’ earnings.

Associated: Expect some crypto companies to fail in the wake of Bitcoin’s halving

Now, tokens may be issued on the Bitcoin community by initiatives whose very safety is anchored to the Bitcoin blockchain. And the very best half? Ordinals have not required altering a single line in Bitcoin’s code. Moreover, the BRC-20 requirements are evolving quickly, positioning them to change into an indispensable new ingredient inside the BTC ecosystem sooner or later.

One coin spawns many tokens

Ordinals is a protocol constructed on high of the Bitcoin blockchain. Every Bitcoin may be damaged down into 100 million models, often called sats. Every of those sats may be given a singular identifier utilizing Ordinals and transferred over the Bitcoin community with this knowledge connected. The Ordinals idea, developed by Casey Rodarmor, has confirmed phenomenally profitable. It is opened the floodgates to a wave of Bitcoin-based NFTs. Due to it, a nearly infinite variety of tokens can now be traded on Bitcoin.

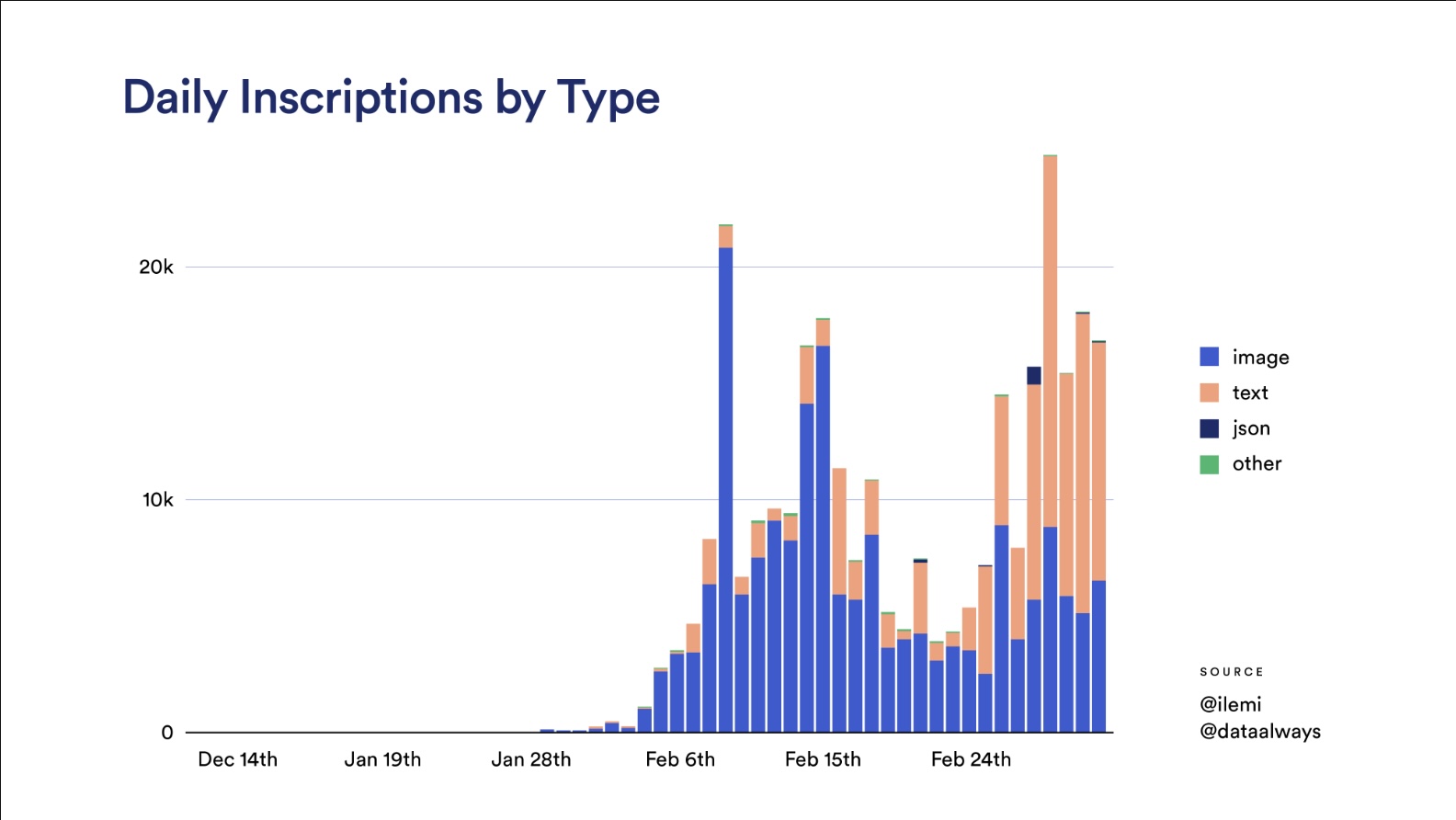

At first, Ordinals have been latched onto by tech-minded Bitcoiners who may meet the excessive bar for minting and buying and selling them. The method, in spite of everything, requires sending a sat to a Taproot-compatible pockets and inscribing metadata with the transaction. Initially, this required working a Bitcoin node and having familiarity with a command line interface, however code-free options have since emerged and have been chargeable for mainstreaming Ordinals, notably for the good thing about the Ethereum group.

NFTs have been the primary use case for the Ordinals protocol, however the identical know-how can be utilized to subject fungible tokens, much like the ERC-20 tokens that Ethereum helps. In actual fact, the token normal that’s emerged for these Bitcoin-native belongings even bears the identical naming construction: BRC-20.

Already, there are BRC-20 initiatives arising with Bitcoin-based tokens, forming a fledgling tokenized ecosystem that’s coalescing round Bitcoin and Ordinals. A number of of those tokens have captured the market’s creativeness, discovering their approach to tier-1 exchanges and spreading the phrase in regards to the BRC-20 takeover within the course of.

From sats to SATS

Most of the communities which have fashioned round Ordinals and Bitcoin are targeted on enjoyable, at first. Gaming, amassing, speculating, socializing and interacting forward of significant stuff like enterprise or institutional utilization. $SATS is the proper working example. Bitcoin’s very personal memecoin, SATS is of course a BRC-20 token, however it’s additionally a lot extra.

A complete provide of two,100,000,000,000,000 means $SATS is actually the Bitcoin provide instances 100 million. In different phrases, there’s a SAT for each sat. Initiatives like this will not be altering the world, however they’re making Bitcoin enjoyable once more, and within the course of, educating newcomers on key traits which might be enshrined in Bitcoin’s structure.

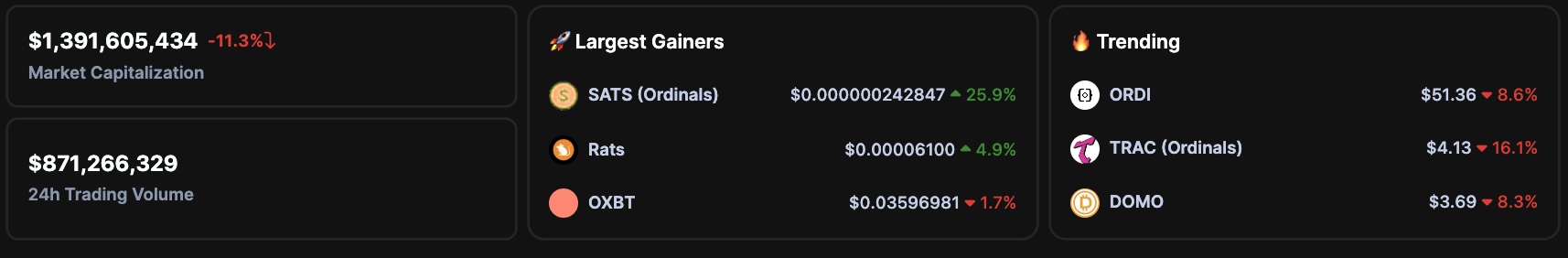

Different BRC-20 tokens have additionally carved out market share whereas bolstering the case for Ordinals on Bitcoin. Mixed, the market cap of all BRC-20 tokens is more than $1 billion (as of Dec. 7), most of which may be credited to ORDI, which suggests there may be nonetheless loads of room for development.

Taproot made tokens potential

The thought of issuing tokens on the Bitcoin community can’t be discovered within the Bitcoin whitepaper: that use case hadn’t been envisioned in 2008. In actual fact, it wasn’t even potential to take action again then. It was not till the Taproot upgrade, which went reside on the Bitcoin community in November 2021, that this turned potential. Ordinals sprung up three months later, and the NFTs it spawned have been adopted by an assortment of BRC-20 token initiatives.

Taproot permits knowledge to be added to dam house, offering a method of minting tokens on Bitcoin. A single satoshi is minted and knowledge regarding a whole set of fungible tokens is connected. That is finished utilizing JSON knowledge the place the token’s identify, ticker, provide and suchlike may be entered. Regardless of sharing the identical naming construction as ERC-20, it’s clear that BRC-20 tokens work very in a different way. This isn’t stunning on condition that they’re, technically, a workaround for a community that wasn’t designed to assist tokens.

Associated: 3 theses that will drive Ethereum and Bitcoin in the next bull market

Whereas the structure could also be unorthodox, the web outcome is identical. Simply as communities fashioned round shared tokens and shared pursuits following the launch of Ethereum’s ERC-20 token normal, one thing related is going on on Bitcoin. BRC-20s aren’t beloved by all Bitcoiners, it ought to be famous: some take exception to the block house the tokens take up, which might trigger charges to spike. Others merely aren’t enthusiastic about something that isn’t pure BTC.

Look to the long run

When Ethereum launched, it had the power to assist a wealthy and numerous ecosystem of token-based initiatives — and that’s precisely what it did finally. It took time for the communities to type and tooling to be constructed out, nevertheless. Bitcoin and the BRC-20 normal are at present the place Ethereum was in 2017: filled with potential that has but to be realized.

Key infrastructure connecting Bitcoin tokenization to the EVM chains is being accomplished, with MultiBit the newest mission to make headway right here, launching a two-way bridge for BRC-20 and ERC-20 transfers. 12 months from now, what’s going to the BRC-20 panorama resemble, and what alternatives will it have delivered to these daring sufficient to have gotten in early? The surge of ERC-20 tokens and ICOs in 2017 propelled Ether’s (ETH) worth thirtyfold inside a 12 months. Whereas present market dynamics are completely different, the prospect of Bitcoin replicating Ethereum’s success stays promising.

For a rising band of supporters who’re bored with what they understand as stagnation on Ethereum and who don’t fairly slot in with Bitcoin maximalists, Ordinals and BRC-20 tokens have made crypto enjoyable once more. To them, the motion represents a return to Bitcoin’s experimental, inventive roots. If there’s an opportunity to make some cash alongside the way in which, whereas advancing their understanding of Bitcoin and spreading memes into the discount, all the higher.

Gracy Chen is the managing director of the crypto derivatives change Bitget, the place she oversees market enlargement, enterprise technique, and company growth. Earlier than becoming a member of Bitget, she held govt positions on the Fortune 500 unicorn firm Accumulus and venture-backed VR startups XRSPACE and ReigVR. She was additionally an early investor in BitKeep, Asia’s main decentralized pockets. She was honored in 2015 as a International Shaper by the World Financial Discussion board. She graduated from the Nationwide College of Singapore and is at present pursuing an MBA diploma on the Massachusetts Institute of Expertise.

This text is for basic data functions and isn’t meant to be and shouldn’t be taken as authorized or funding recommendation. The views, ideas and opinions expressed listed here are the writer’s alone and don’t essentially mirror or characterize the views and opinions of Cointelegraph.

[ad_2]

Source link