[ad_1]

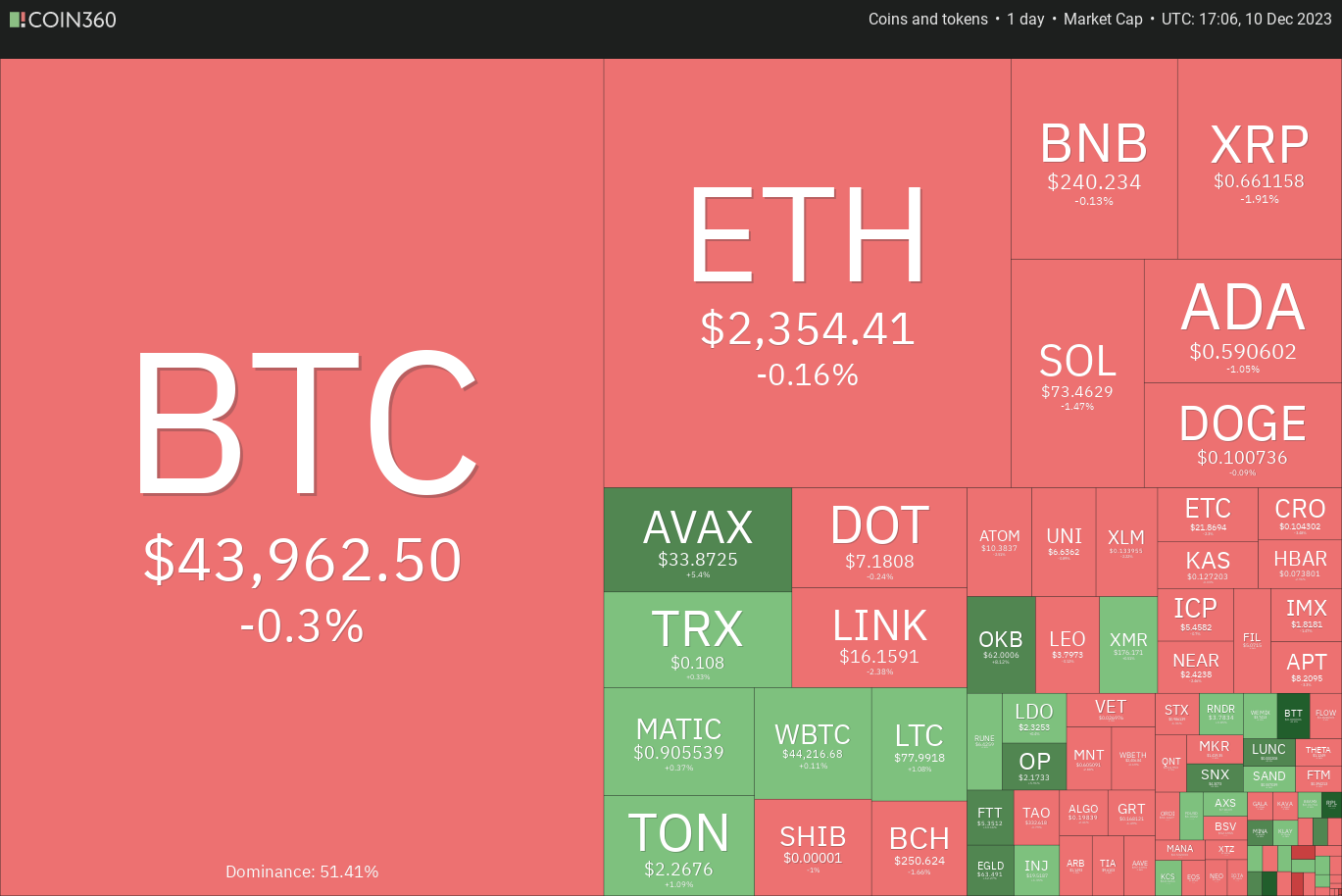

The S&P 500 Index (SPX) achieved its highest shut of the yr final week, and Bitcoin (BTC) additionally hit a brand new 52-week excessive, indicating that dangerous property stay sturdy going into the ultimate few days of the yr.

Some analysts consider Bitcoin is finished with its rally within the quick time period and should roll over. In style analyst and social media commentator Matthew Hyland cautioned in a submit on X (previously Twitter) {that a} drop in Bitcoin’s dominance beneath 51.81% could signal that the uptrend has ended “together with a possible high put in.”

Normally, the primary leg of the rally of a brand new bull market is pushed by the leaders, however after a big transfer, profit-booking units in and merchants begin to have a look at various alternatives. Though Bitcoin has not rolled over, a number of altcoins have began to maneuver larger, signaling a possible shift in curiosity.

Might Bitcoin proceed its up-move and hit $48,000 within the subsequent few days? Will that enhance curiosity in choose altcoins? Let’s take a look at the charts of the highest 5 cryptocurrencies that will stay sturdy within the close to time period.

Bitcoin worth evaluation

Bitcoin has been consolidating in a good vary close to the minor resistance at $44,700, indicating that the bulls aren’t dashing to the exit as they anticipate one other leg larger.

The upsloping shifting averages and the relative energy index (RSI) within the overbought zone point out that bulls stay in command. If the worth turns up from the present degree and rises above $44,700, it should sign the resumption of the uptrend. The BTC/USDT pair might then climb to $48,000.

Conversely, if the worth plunges beneath $42,821, the pair might droop to the 20-day exponential shifting common ($40,608). This can be a essential degree to control as a result of a bounce off it should recommend that the uptrend stays intact, however a tumble beneath it should point out the beginning of a deeper correction towards the 50-day easy shifting common ($37,152).

The 4-hour chart reveals that the bulls try to maintain the worth above the 20-EMA. If they’ll pull it off, the pair might rally above $44,700. The up-move might then surge to $48,000, which is more likely to act as a formidable resistance.

Alternatively, if the worth slides beneath the 20-EMA, it should recommend profit-booking by short-term merchants. The pair might fall to the 38.2% Fibonacci retracement degree of $41,993 and later to the 50% retracement degree of $41,157.

Uniswap worth evaluation

Uniswap (UNI) rose above the overhead resistance of $6.70 on Dec. 9, finishing a double backside sample.

The bears try to entice the aggressive bulls by pulling the worth again beneath the breakout degree of $6.70. In the event that they handle to try this, the UNI/USDT pair might drop to the 20-day EMA ($6.10), a crucial degree to be careful for.

If the worth rebounds off the 20-day EMA, the bulls will attempt to kick the worth above $6.70. In the event that they succeed, the pair might leap to $7.70 and ultimately to the sample goal of $9.60.

Contrarily, a fall beneath the 20-day EMA will recommend that the breakout was a bull entice. The pair might then plunge to the 50-day SMA ($5.32).

The pullback is attempting to take assist on the 20-EMA. If the worth rises and maintains above $6.70, the probability of a rally above $7.13 will increase. That will begin the subsequent leg of the uptrend towards $7.70.

As a substitute, if the 20-EMA fails to carry, the subsequent cease is more likely to be $5.80. That is a necessary assist for the bulls to defend as a result of whether it is breached, the pair might collapse to $4.80.

Optimism worth evaluation

After struggling for a number of days, the bulls pushed Optimism (OP) above the stiff overhead resistance of $1.87 on Dec. 7, indicating the beginning of a brand new uptrend.

Normally, the worth retests the breakout degree earlier than a brand new pattern begins. The bears will attempt to sink the worth again beneath $1.87, whereas the bulls will try and flip the extent into assist. If the worth snaps again from $1.87, the OP/USDT pair might rally to $2.30. A break above this resistance might propel the worth to $2.60.

This optimistic view might invalidate within the close to time period if the worth turns down and plummets beneath $1.87. The bears will acquire additional floor on a slide beneath $1.60.

The worth turned up from the 20-EMA, indicating that the sentiment stays constructive and merchants are shopping for on dips. The bulls will attempt to shove the worth above the native excessive at $2.30. In the event that they succeed, the pair might begin the subsequent leg of the uptrend.

Contrarily, if the worth turns down from the present degree and breaks beneath the 20-EMA, it should recommend revenue reserving by the bulls. That will drag the worth to the breakdown degree of $1.87. This degree is more likely to witness a troublesome battle between the bulls and the bears.

Associated: AI deepfake nude services skyrocket in popularity: Research

Celestia worth evaluation

Celestia (TIA) has been in a powerful uptrend, having risen from $1.90 on Oct. 31 to $11.50 on Dec. 6. This sharp rise might have tempted short-term merchants to e book income close to $11.50, leading to a pullback.

The bulls try to defend the 38.2% Fibonacci retracement degree at $9.01. Consumers should drive the worth above $10.50 to clear the trail for a retest of $11.50. A break and shut above this degree might begin the subsequent leg of the uptrend. The TIA/USDT pair might then soar to $14 and subsequently to $16.

Quite the opposite, if the $9.01 degree provides method, the pair might skid to the 20-day EMA ($7.75). If the worth rebounds off this degree, it should recommend that the uptrend stays intact, however a break beneath it might sign a pattern change within the quick time period.

The bulls try to guard the 50-SMA, however the failure to maintain the rebound off it might enhance the probability of a breakdown. If the 50-SMA provides method, the pair might droop to the 50% retracement degree of $8.25. The flattish 20-EMA and the RSI close to the midpoint recommend a range-bound motion within the close to time period.

Consumers should push the worth above the downtrend line to take care of the constructive momentum. The pair might then try a rally to $11.50.

Stacks worth evaluation

Stacks (STX) is correcting in an uptrend. The bulls try to stall the pullback close to the 38.2% Fibonacci retracement degree of $0.99, which is a constructive signal.

A shallow pullback signifies that bulls are keen to purchase on dips. That will increase the probability of a retest of the native excessive at $1.25. The bears are anticipated to mount a powerful protection within the zone between $1.25 and $1.31, but when the consumers clear it, the STX/USDT pair might prolong its up-move to $1.60.

The rapid assist on the draw back is at $0.96. If this degree is taken out, the pair might right to the 20-day EMA ($0.87). Such a deep fall might delay the beginning of the subsequent leg of the uptrend.

The pair is discovering assist close to the 50-SMA, indicating that decrease ranges proceed to draw consumers. The resistance to be careful for on the upside is $1.08. If bulls overcome this barrier, the pair might retest the native excessive at $1.26.

The 20-EMA is regularly sloping down, and the RSI is close to the midpoint, indicating a slight benefit to the bears. A break and shut beneath $0.96 might open the doorways for an additional draw back to the 50% retracement degree at $0.92.

This text doesn’t comprise funding recommendation or suggestions. Each funding and buying and selling transfer includes danger, and readers ought to conduct their very own analysis when making a call.

[ad_2]

Source link