[ad_1]

Bitcoin (BTC) value is down 5% over the past 24 hours to commerce at $41,645 on Dec. 11. Regardless of the sharp value correction, technical indicators and on-chain knowledge present that Bitcoin nonetheless shows energy as bulls try to push the worth again above $44,000.

On-chain knowledge exhibits Bitcoin value “over-extended”

Bitcoin dropped as a lot as 7.2% falling to $40,300 on Coinbase, triggering a dialog amongst analysts. Julio Moreno, head of analysis at on-chain analytics agency Cryptoquant mentioned that the worth of the flagship cryptocurrency was “overheating after the current rally above” the $40,000 psychological stage.

Some metrics are flagging #Bitcoin value is overheating after the current rally above $40K (purple areas).

1. The Bull-Bear Market Cycle Indicator: overheated bull part for the primary time since July.

2. The miner revenue/loss sustainability: block reward rising a lot quicker than… pic.twitter.com/irpVvBSV3G

— Julio Moreno (@jjcmoreno) December 7, 2023

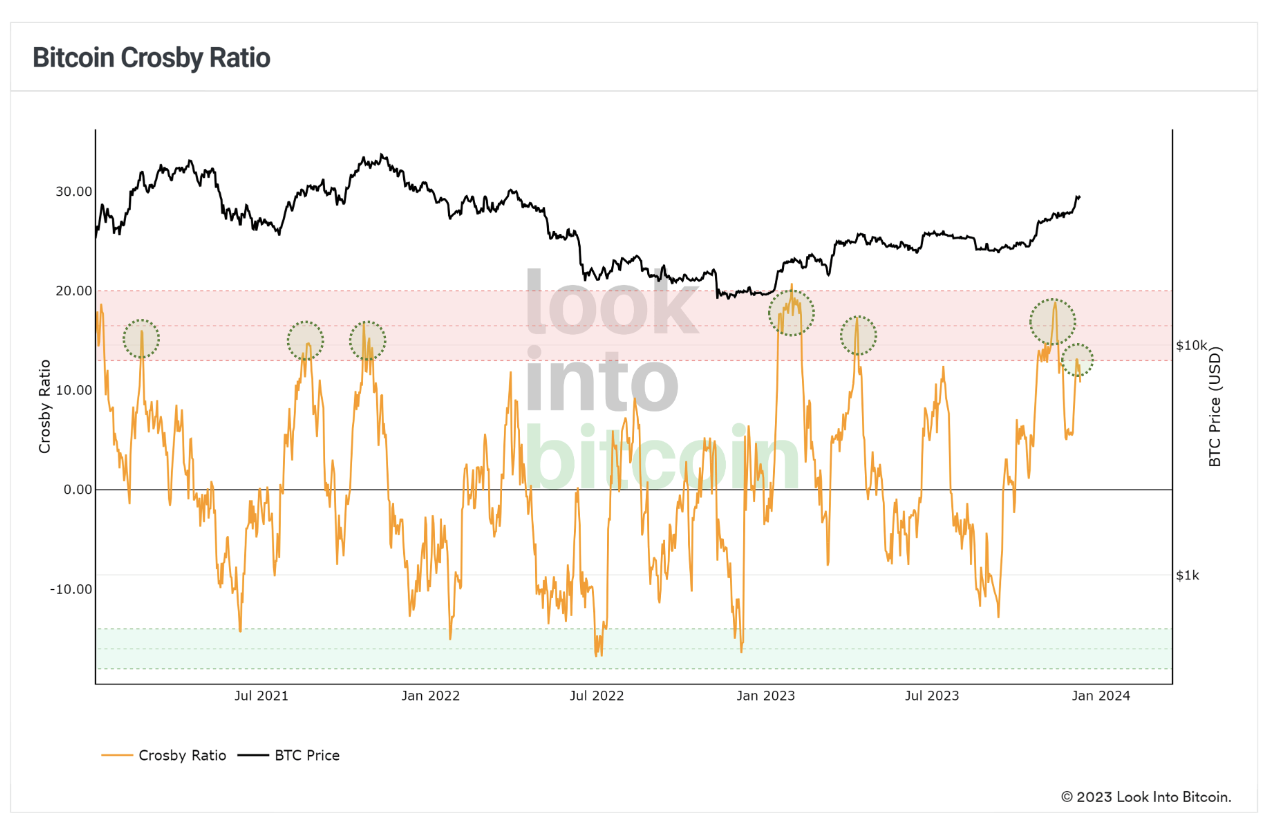

Extra knowledge from on-chain knowledge evaluation agency Lookintobitcoin highlighted exhaustion amongst bulls. In accordance with its December 2023 report, the Bitcoin value has reached its golden ratio multiplier near-term goal, highlighted by the Crosby Ratio, which exhibits Bitcoin’s near-term value at “over-extended ranges” leading to the necessity to appropriate, or at the least decelerate.

The golden ratio multiplier is an indicator that explores Bitcoin’s adoption curve and market cycles to know how the worth might behave in medium to long-term time frames.

In different phrases, the Bitcoin value reached overbought circumstances above $40,000 as purchaser exhaustion set in. Observe that the flagship cryptocurrency’s relative energy index (RSI) confirmed that the worth has been massively overbought over the since Dec, 5.

That is an early signal that purchasing strain may ultimately diminish as merchants noticed the rally operating out of steam and probably selected to e book earnings.

Bitcoin value faces stiff resistance round $44,000

The continuing correction within the Bitcoin market is because of the stiffness of the barrier across the $44,000 provide zone. Lookintobitcoin golden ratio multiplier indicator, which explores Bitcoin’s adoption curve and market cycles, exhibits that the 1.6 multiplier goal has now been reached across the $44,000 space. Observe that BTC has been caught right here for the previous week “unable to interrupt above it convincingly”.

In different phrases, Bitcoin value is going through fierce rejection from this provider congestion space, making it a tricky hurdle to leap for the bulls.

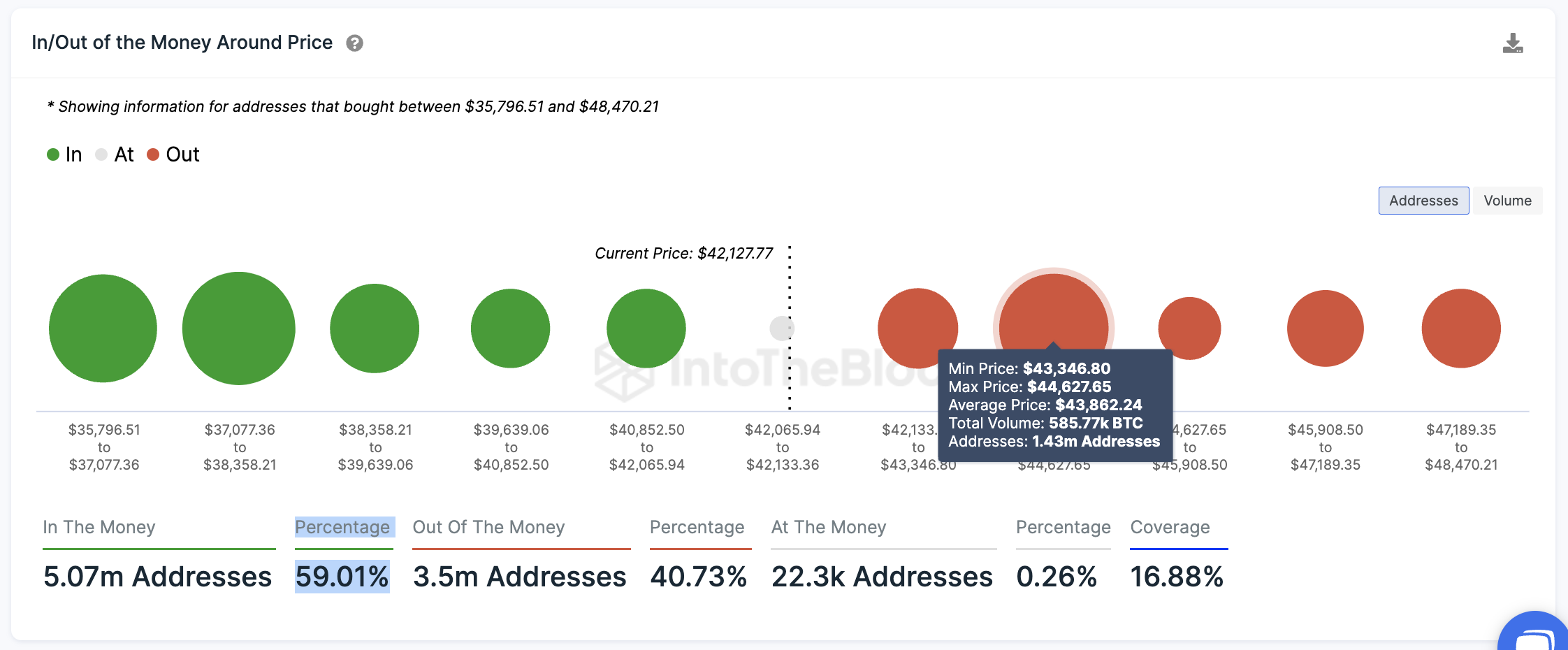

The stiffness of the barrier at $44,000 is accentuated by on-chain data from IntoTheBlock’s in/out of the cash round value (IOMAP) mannequin (proven under). In accordance with the IOMAP chart, this stage lies between the $43,346 and $44,627 value vary the place roughly 585.77 BTC have been beforehand purchased by roughly 1.43 million addresses.

Any makes an attempt to push the worth above this stage could be met by aggressive promoting from this cohort of sellers who might want to break even.

Associated: $300M crypto long liquidations — 5 things to know in Bitcoin this week

Can Bitcoin maintain the uptrend?

The continuing correction may, nonetheless, be a bear trap, as it could be thought-about a wholesome correction in an in any other case extensive bullish trend established over the previous few months.

Furthermore, knowledge from crypto market intelligence agency Santiment confirmed that Bitcoin’s alternate outflows have been rising. In accordance with the chart under, the BTC alternate move steadiness now stands at -347.

The destructive studying exhibits BTC outflows eclipsing inflows, suggesting that traders are extra inclined to carry than promote, which is a bullish signal.

This means that the most recent dip towards $40,000 might be a short-term correction giving merchants a possibility to purchase extra on the dip earlier than persevering with the upward development.

From a technical standpoint, Bitcoin value traded above all the most important transferring averages, which maintained their upward trajectory. Notably, these chart overlay indicators offered areas of robust help on the draw back.

The transferring common convergence divergence indicator (MACD) was nonetheless transferring above the impartial line within the constructive area. The MACD line (blue) was nonetheless positioned above the sign line (orange) after crossing above it on Oct. 16, suggesting that the market circumstances nonetheless favored the upside.

Subsequently, BTC’s value will possible proceed to rise from the present ranges with the consumers concentrating on a break above $44,000. Observe {that a} clear breakout above this stage may see Bitcoin rise to tag the $50,000 psychological stage going into the New 12 months when the USA Securities and Trade Fee is predicted to decide on spot Bitcoin exchange-traded fund functions earlier than it or within the spring of 2024 when the following Bitcoin-halving even takes place.

This text doesn’t comprise funding recommendation or suggestions. Each funding and buying and selling transfer entails danger, and readers ought to conduct their very own analysis when making a call.

[ad_2]

Source link