[ad_1]

S&P World has launched a stablecoin stability evaluation. In its preliminary rankings of the eight stablecoins, none got the highest mark, however two obtained the bottom, primarily based on their skill to keep up their fiat pegs.

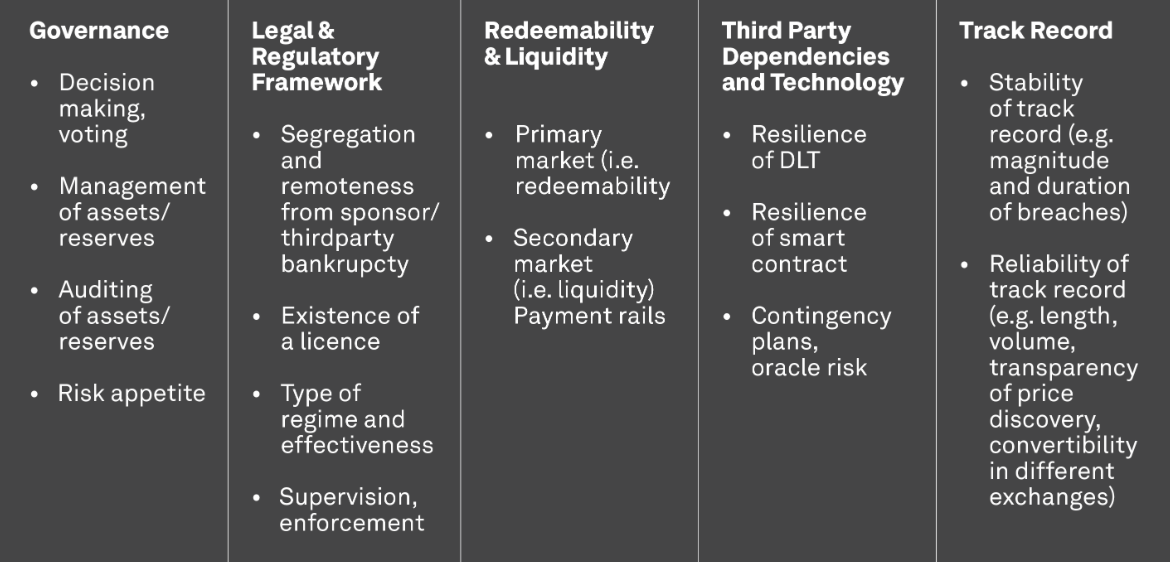

In keeping with an announcement, to determine its rankings, S&P World first examines asset high quality dangers, then components mitigating the dangers, after which considers governance, authorized and regulatory framework, redeemability and liquidity, know-how and third-party dependencies, and monitor document.

S&P World, previously often called Customary & Poor’s, is greatest identified for the S&P 500 Index of enormous firms listed on United States inventory exchanges. It has turned its attention to stablecoin earlier than, however not with the depth of the brand new rankings. S&P World Scores senior analyst Lapo Guadagnuolo stated:

“We see stablecoins changing into additional embedded into the material of economic markets, appearing as an necessary bridge between digital and real-world property. Nonetheless, it is necessary to acknowledge that stablecoins will not be resistant to components comparable to asset high quality, governance, and liquidity.”

Gemini (GUSD), Pax (USDP) and USD Coin (USDC) obtained rankings of two (robust), the best given, due to the standard of their asset backing. Gemini and Pax are each supervised by the New York State Division of Monetary Providers.

Associated: France’s 3rd-largest bank, Société Générale, launches euro-pegged stablecoin

Tether (USDT), by far the main stablecoin by market cap, was rated 4 (constrained). The evaluation was largely based on the dearth of transparency of its property. TrueUSD’s 5 (weak) ranking was additionally primarily based on a lack of understanding. FRAX was rated 5 as effectively, resulting from its persevering with dependence on an algorithm, regardless of a community decision in March to transition to USD backing.

Crypto might not care, however the a lot larger mainstream will. S&P releases stablecoin assessments utilizing 1-5 rating.

1 “Very Robust” none

2 “Robust” USDC/USDP/GUSD

3 “Ample” none

4 “Constrained” USDT/FDUSD/DAI

5 “Weak”FRAX/TUSDhttps://t.co/D1VkXZ3NkG— Novacula Occami (@OccamiCrypto) December 12, 2023

Moody’s ranking service moved into stablecoin analysis in November with its Digital Asset Monitor service primarily based on synthetic intelligence.

Journal: Unstablecoins: Depegging, bank runs and other risks loom

[ad_2]

Source link