[ad_1]

In 2013, the launch of a dog-themed crypto token as a non-public joke between a few software program builders was a innocent piece of enjoyable. The truth that Dogecoin (DOGE) has since amassed a market capitalization higher than $13 billion (as of Dec. 13) is past the understanding of most traders, however it looks like it is right here to remain. The sector that DOGE has impressed, although, is turning into a menace to an trade that should evolve.

Memecoins are harmful. They’re harmful as a result of the massive majority of those that put their cash into them by no means see it once more; they’re harmful in the best way they injury the credibility of the complete cryptocurrency trade; they’re harmful in the best way possession is so extremely concentrated, and they’re harmful as a result of they’re proliferating.

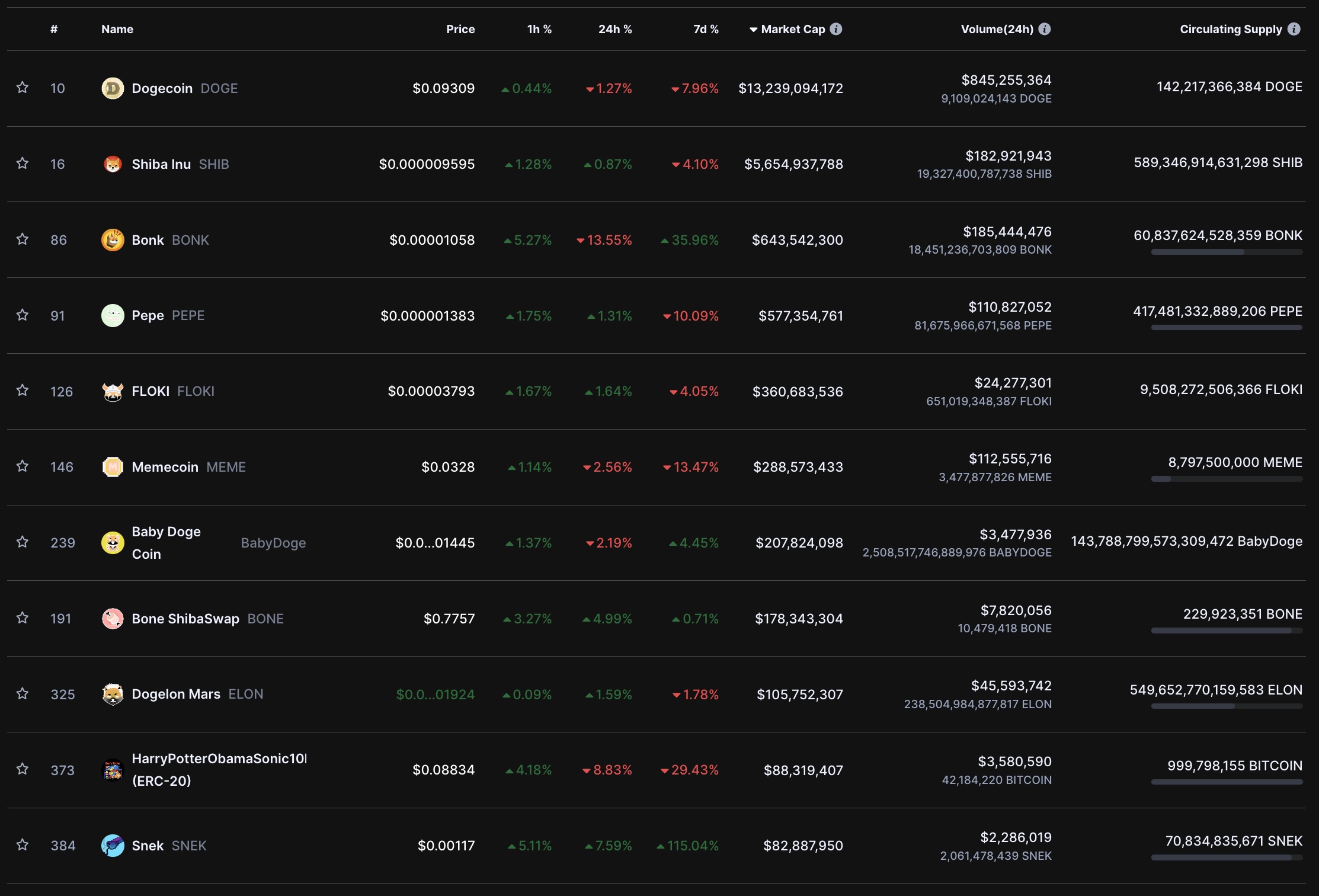

As of Dec. 13, there are round 1,300 memecoins in circulation with a collective market cap of about $22 billion, a large determine. Nevertheless, take a detailed have a look at the CoinMarketCap memecoin sector, and also you’ll discover that 9 of these itemizing pages include totally nugatory cash.

It’s because most memecoins are unabashed scams. Sometimes created within the bedrooms of degens, these tokens are designed to capitalize on crypto’s affiliation with social media to quickly steal individuals’s cash. Whether or not it’s a Squid Video games token — which saw $3.38 million swiped — or cash launched on the loss of life of Charlie Munger and Henry Kissinger, these cash now pump and dump in a weekend, taking hundreds of thousands of {dollars} with them.

Associated: History tells us we’re in for a strong bull market with a hard landing

Initiatives equivalent to Shiba Inu (SHIBA), Pepe (PEPE) and Bonk (BONK), for instance, appear to not be blatant scams. BONK came at a time when the Solana (SOL) ecosystem was in determined want of excellent cheer and seems to be having fun with fairly the pump. Nevertheless, traders in these cash have nonetheless misplaced cash — PEPE, for one, shed an eye-watering 62% in a single ugly week in Could and has not recovered.

Then there was the spectacular rise and fall of Bald (BALD) in August: a meme coin constructed on Coinbase’s new layer-2 blockchain, Base. Launched on a Sunday morning, by BALD had achieved a market cap of $85 million by night. By Monday the lead developer had pulled his liquidity, sending the token’s price plunging by round 90%.

Along with being — at finest — a type of monetary starvation video games, memecoins additionally haven’t any utility: they bear no resemblance to real cryptocurrencies like Bitcoin (BTC) or Ether (ETH) of their construction or software. This doesn’t, nonetheless, cease the mainstream press from working countless headlines on each blow-up, delighting as they do in portraying digital property as nothing greater than these cynical pranks.

Whereas cryptocurrency typically has a difficulty with whales, memecoins specifically additionally undergo from sturdy focus. As a result of memes are all the time so low-cost — often a tiny fraction of a cent — huge traders usually maintain monumental baggage and may transfer the market in a single commerce. Ethereum creator Vitalik Buterin’s choice to burn $6.7 billion SHIB took out half the circulating provide. It disrupted market dynamics and raises critical questions on market manipulation.

Associated: BRC-20 tokens are presenting new opportunities for Bitcoin buyers

Memecoins, in brief, have gotten much less and fewer humorous. Whereas as soon as we might all have a superb chortle on the newest coin devoted to Elon Musk’s canine, the size at which these disasters are unfolding is resulting in steeper and steeper losses. However does this imply we must always ban them outright? No. There’s a place for memecoins in crypto.

Simply as we will in the true world, all customers in crypto needs to be free to gamble their cash away in the event that they so select. As a lot as regulators like to harangue the monetary trade, they see no downside with permitting anybody to wager their home on a horse. If that is the way you wish to spend your cash, it’s a free world.

Nevertheless, make no mistake: memecoins are playing, plain and easy. They aren’t investments, they don’t seem to be beneficial and they don’t seem to be helpful. They appeal to outsized unfavourable consideration from the press that makes us all look unhealthy. And for each fortunate individual that makes one million on a meme, 9 will lose. It is likely to be that someday all of us fly to the moon with DOGE, however it should almost definitely be in Elon’s rocketship, not our wallets.

Lucas Kiely is the chief funding officer for Yield App, the place he oversees funding portfolio allocations and leads the growth of a diversified funding product vary. He was beforehand the chief funding officer at Diginex Asset Administration, and a senior dealer and managing director at Credit score Suisse in Hong Kong, the place he managed QIS and Structured Derivatives buying and selling. He was additionally the pinnacle of unique derivatives at UBS in Australia.

This text is for basic data functions and isn’t supposed to be and shouldn’t be taken as authorized or funding recommendation. The views, ideas and opinions expressed listed below are the creator’s alone and don’t essentially mirror or characterize the views and opinions of Cointelegraph.

[ad_2]

Source link