[ad_1]

Open-source blockchain developer Iota has taken one other step to satisfy institutional demand for asset tokenization by integrating its Shimmer EVM-compatible chain with Fireblocks.

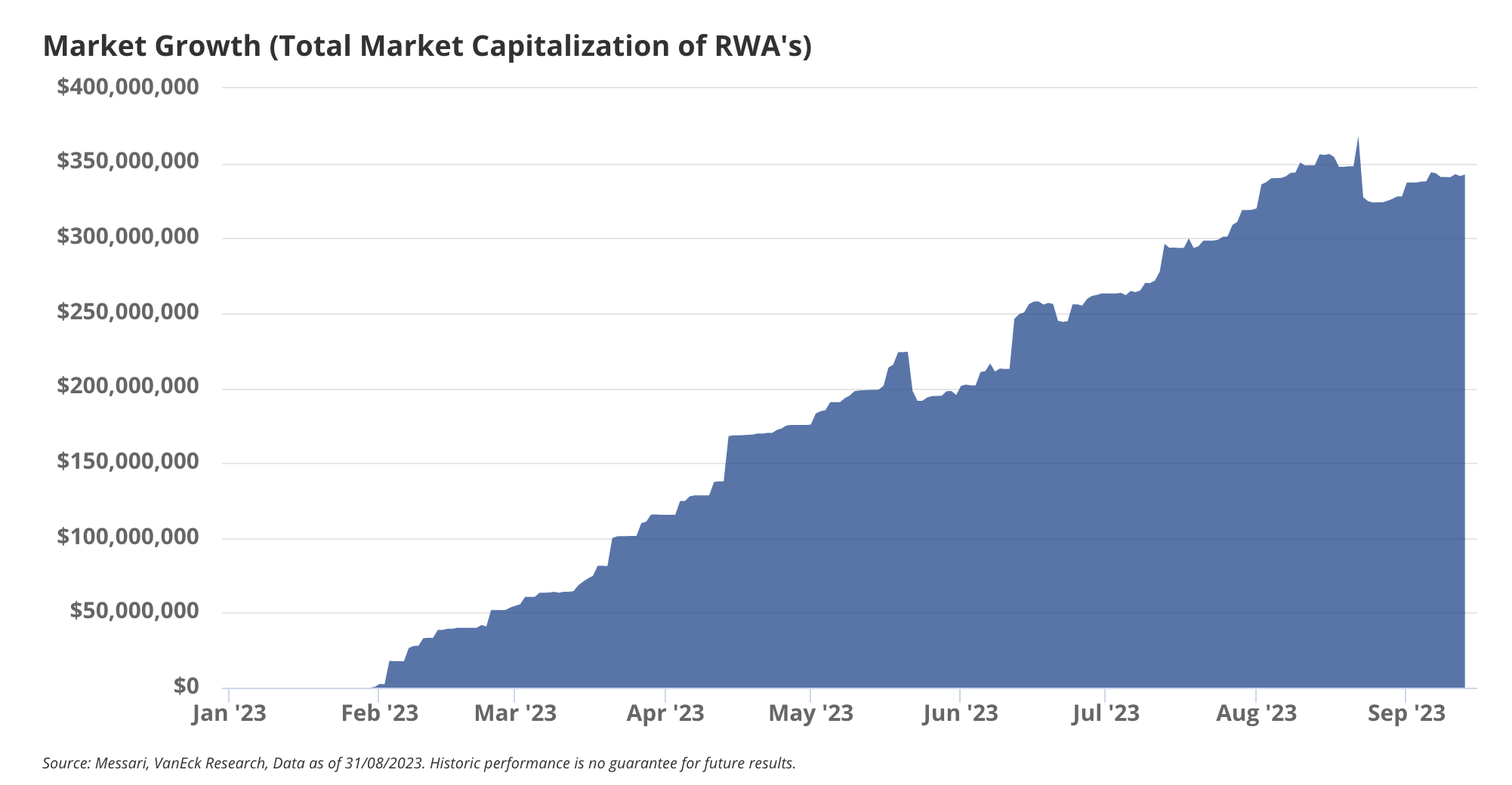

Knowledge from VanEck Analysis reveals the overall market capitalization for tokenized real-world property (RWA) reached $342 billion in September, regardless of the bear market and the crypto trade headwinds. In line with Dominik Schiener, co-founder of Iota, the community is constructing infrastructure and options to handle the escalating demand for RWA tokenization.

“We are able to anticipate many giant institutional buyers and monetary establishments to offer their public help for digital property in 2024. With clear rules and newfound public help by these establishments and the upcoming ETFs, we’re effectively on our option to make institutional buyers the dominant market contributors,” famous Schiener.

Tokenization of property refers to bringing tangible or intangible property from the normal monetary world to the blockchain. There are a number of property that may be included right here, resembling actual property, commodities, firm shares, and even monetary devices like bonds and invoices. One of many predominant advantages of tokenization is the increased liquidity of assets.

ShimmerEVM is an Ethereum-compliant good contract constructed on high of the Shimmer blockchain, which serves as a staging community for Iota, which means it is a testing and growth surroundings the place new options and purposes might be validated earlier than being built-in into the Iota mainnet.

The combination will enable Fireblocks clients to custody tokenized property on ShimmerEVM, in addition to provoke transactions on the chain instantly from Fireblocks console and API. Fireblocks provides direct crypto custody and different options for institutional buyers. The corporate claims to have 1,800 purchasers, together with notable monetary establishments resembling BNY Mellon and BNP Paribas.

In November, Iota disclosed its distributed ledger technology (DLT) foundation within the Center East to push for accelerated progress of decentralized applied sciences and asset tokenization within the area. “With the latest registration and approval of the primary DLT Basis within the UAE, we’re on a path to tokenize RWA property on IOTA and on Shimmer,” Schiener added.

Journal: Ethereum restaking — Blockchain innovation or dangerous house of cards?

[ad_2]

Source link