[ad_1]

Decentralized finance protocol Yearn.finance is hoping arbitrage merchants will return $1.4 million in funds after a multisignature scripting error, leading to a considerable amount of the protocol’s treasury being drained.

“A defective multisig script induced Yearn’s total treasury stability of three,794,894 lp-yCRVv2 tokens to be swapped,” according to a Dec. 11 GitHub publish by Yearn contributor “dudesahn.”

The error occurred whereas Yearn was changing its yVault LP-yCurve (lp-yCRVv2) — earned from efficiency charges on vault harvests — into stablecoins on decentralized change CowSwap.

$1.4M WIPED OUT

Yearn Finance acknowledged that their treasury fund misplaced round $1.4M attributable to a defective script

In a while, their workforce claimed that solely their LP place was affected, no consumer’s funds have been focused pic.twitter.com/4FNXN8DAYp

— De.Fi Antivirus Web3 ️ (@DeDotFiSecurity) December 13, 2023

Yearn suffered vital slippage when it acquired 779,958 DAI yVault (yvDAI) tokens from the commerce, leading to a 63% fall in liquidity pool worth from its treasury — relative to lp-yCRVv2’s spot worth on the time.

Yearn confirmed the $1.4 million determine in a be aware to The Block.

Nonetheless, Dudesahn mentioned the affected tokens have been “strictly protocol-owned liquidity” in Yearn’s treasury and that buyer funds weren’t impacted.

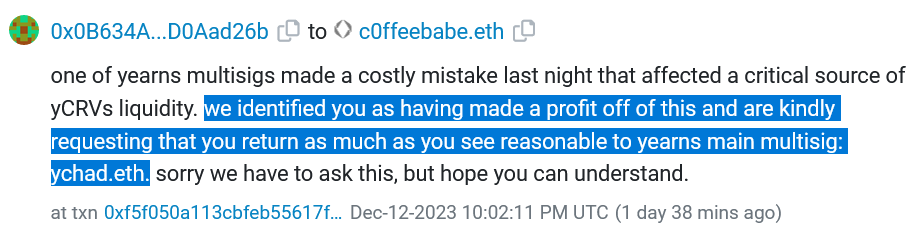

Given how “crucial” these tokens are to Yearn’s yCRV liquidity, the agency has requested any profitable arb merchants that profited from the occasion to think about sending a few of the funds again:

“We’re asking anybody who profitably arbed this error to return an quantity that they really feel is cheap to Yearn’s principal multisig.”

Yearn took its restoration efforts one step additional, writing on-chain messages to a few of the merchants.

Associated: Yearn.finance token tumbles 43%, community speculates on exit scam

One arbitrager has already transferred 2 Ether (ETH), value $4,500, again to Yearn’s treasury tackle, according to Etherscan. “Sorry to listen to that lads, occurs to one of the best of us. Did not revenue that bigly like some others did, and we did tackle some threat and helped the peg, however this is some again anyway,” they added in an on-chain message.

To stop related errors sooner or later, Yearn mentioned it should separate protocol-owned liquidity into particular supervisor contracts, implement human-readable output messages and implement stricter worth affect thresholds.

Yearn fell sufferer to an $11.6 million exploit on April 11 after the hacker managed to mint one quadrillion Yearn Tether (yUSDT) tokens and commerce it for different stablecoins.

Journal: US enforcement agencies are turning up the heat on crypto-related crime

[ad_2]

Source link