[ad_1]

A call from the USA Fed to pause and probably decrease rates of interest subsequent 12 months will doubtless function a “optimistic increase” for cryptocurrencies and crypto shares.

In a Dec. 13 interview with Bloomberg, Blackrock fund supervisor Jeffrey Rosenberg described the Fed’s charge pause — and its trace at charge cuts subsequent 12 months — as a “inexperienced mild” for buyers, with the S&P 500 rallying 1.37% on the choice.

“This bullish sentiment can go on for some time, not less than till we get a brand new spherical of financial knowledge, and till then the message is evident: the fed is greater than prepared to see an easing in monetary circumstances.”

Crypto shares have witnessed important features on the again of the announcement too, with shares of Coinbase (COIN) and MicroStrategy (MSTR) respectively spiking 7.8% and 5% on the day, whereas Bitcoin miner Marathon Digital (MARA) jumped 12.6%.

Good storm ⛈️: #Bitcoin Halving;#Bitcoin Spot ETFs;

Fed stops elevating charges whereas signaling 3 cuts in 2024;

Good Court docket outcomes in @Ripple / @Grayscale circumstances;

Binance settlement;

Election 12 months = charges cuts, coupled with ️ go brrrrr and elevated liquidity.— John E Deaton (@JohnEDeaton1) December 13, 2023

Henrik Andersson, chief funding officer at funding fund Apollo Crypto informed Cointelegraph that he expects right this moment’s pause and the expectation of lowered rates of interest within the coming 12 months to be a “optimistic increase” for cryptocurrencies and crypto-related shares, including:

“If we see the likes of BlackRock and Constancy launch Bitcoin ETFs we will anticipate plenty of different conventional monetary establishments to enter the crypto markets as effectively.”

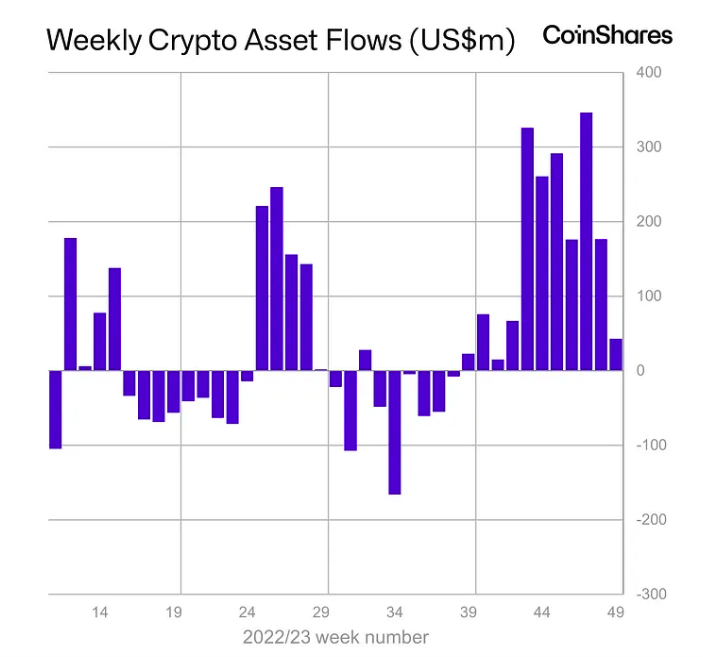

Notably, blockchain equities just lately skilled their largest weekly inflows on report, with a staggering $126 million flowing into crypto-related shares, in line with a Dec. 11 report from CoinShares.

CoinShares’ head of analysis, James Butterfill, additionally discovered that digital asset funding merchandise skilled their eleventh straight week of inflows, posting one other weekly acquire of $43 million.

Tina Teng, market analyst at CMC Markets, informed Cointelegraph the Fed’s charge pause would undoubtedly enhance market enthusiasm for crypto merchandise.

“The pivot boosted broad risk-on sentiment and improved expectations for future liquidity circumstances, thereby buoying crypto shares in the identical method.”

Associated: Bitcoin to surge to $80K as stablecoins overtake Visa in 2024: Bitwise

Teng mentioned buyers can anticipate to see related bullish developments not seen since earlier rate-cute cycles, one thing that can be amplified by institutional curiosity in pending spot Bitcoin ETFs, that are at present slated for a choice in early January.

Nevertheless, Andersson added {that a} aspect impact of decrease rates of interest could possibly be the cooling of the real-world asset (RWA) tokenization narrative, with anticipated will increase in DeFi yields changing into extra enticing to buyers in a low-rate setting.

“A number of the curiosity up to now has been in tokenizing treasuries. We now see an setting the place we will generate in extra of 10% yield in DeFi whereas conventional yields are heading the wrong way,” he added.

Like many market commentators, Teng and Andersson each seemed to the upcoming Bitcoin halving — at present slated for April subsequent 12 months — as a significant catalyst for total crypto market development in 2024.

Journal: Breaking into Liberland — Dodging guards with inner-tubes, decoys and diplomat

[ad_2]

Source link