[ad_1]

Because the cryptocurrency group has been centered on the potential approval of a spot Bitcoin (BTC) exchange-traded fund (ETF) in the USA, some crypto-linked ETFs have already been racking up vital features in 2023.

One such ETF is the VanEck Digital Transformation ETF (DAPP), which has surged practically 207% 12 months up to now (YTD), according to information from TradingView. Launched in April 2021, DAPP tracks the worth and efficiency of the MVIS International Digital Belongings Fairness Index, which, in flip, is predicated on the efficiency of main firms concerned within the digital asset financial system.

VanEck’s DAPP ETF holds Coinbase (COIN), MicroStrategy (MSTR) and Block (SQ) as its high publicity belongings. Coinbase and MicroStrategy have seen large development this 12 months, with the shares rising 312% and 302% YTD, respectively, in keeping with information from TradingView.

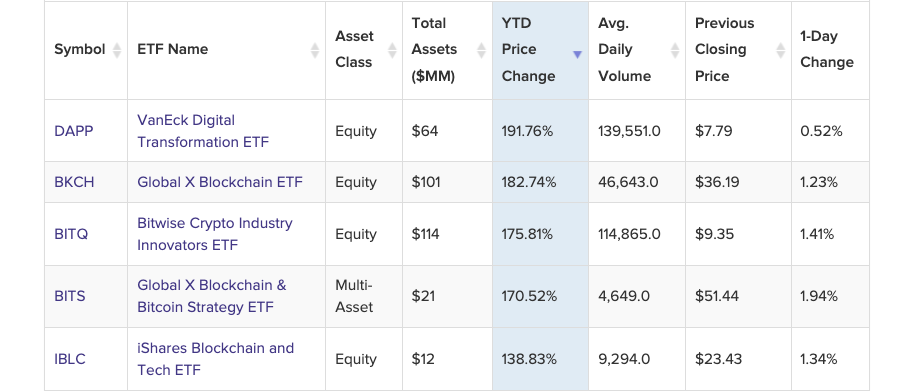

On the time of writing, DAPP is the top-performing blockchain ETF to this point in 2023, beating merchandise just like the International X Blockchain ETF (BKCH) and the Bitwise Crypto Trade Innovators ETF (BITQ), according to information from the ETF information supplier VettaFi.

In line with TradingView information, International X’s BKCH has surged practically 203% YTD, whereas Bitwise’s BITQ has returned virtually 192% to this point in 2023. Efficiency information on VettaFi is considerably completely different from information on TradingView, with the previous lagging as much as 50% in some circumstances.

Different main winners on the record of top-performing blockchain ETFs in 2023 embody the International X Blockchain & Bitcoin Technique ETF (BITS) and the iShares Blockchain and Tech ETF (IBLC), which have each added greater than 184% to their YTD worth, according to TradingView.

Regardless of posting large returns in 2023, some blockchain ETFs are nonetheless far off their all-time highs. For instance, the VanEck Digital Transformation ETF is down about 77% from its document of $34 that was set in November 2021. Then again, the iShares Blockchain and Tech ETF has been breaking all-time highs, with the inventory crossing its earlier excessive of $8.4 in November 2023.

Associated: SEC pushes deadline for decision on Invesco Galaxy spot Ethereum ETF to 2024

Many firms which have seen success with their blockchain industry-themed ETFs in 2023 — together with VanEck, Bitwise and International X — are additionally searching for to launch a spot Bitcoin ETF.

Not like blockchain industry-themed ETFs equivalent to DAPP and BKCH, a spot Bitcoin ETF aims to offer direct exposure to the price of Bitcoin, as it might maintain the precise cryptocurrency.

In one other effort to get its spot Bitcoin ETF submitting permitted by the U.S. Securities and Alternate Fee (SEC), VanEck filed a fifth amended application for a spot Bitcoin ETF on Dec. 8. In line with Bitwise, a spot Bitcoin ETF will be approved in 2024 and can grow to be the “most profitable ETF launch of all time.”

Journal: Lawmakers’ fear and doubt drives proposed crypto regulations in US

[ad_2]

Source link