[ad_1]

Strategically navigating the cryptocurrency market when it surges isn’t only a skil. It’s an artwork. Volatility is fixed. Volatility measures the value actions of belongings and calls for a complicated strategy from gamers out there. Just like the ebb and stream of tides, it may be navigated strategically.

Decoding the dynamics of market surges

Bitcoin (BTC) peaked at $69,000 in the course of the 2021 bull run, whereas Ether (ETH) did the identical at $4,800. Regardless of the market hitting an all-time excessive of $3 trillion in market capitalization, that determine sits somewhat beneath $1.7 trillion as of Dec. 15 — a distinction of simply greater than 30 p.c. Whereas important, the comparability clearly doesn’t do justice to what a rollercoaster the market has been.

Understanding the driving forces behind that volatility is vital to navigate it. Market sentiment, technological breakthroughs, and regulatory developments play essential roles. It’s essential to grasp the prevailing temper and adapt to market dynamics, leveraging insights analyzing social sentiment, information sentiment, and technical evaluation indicators.

Associated: With Bitcoin’s halving months away, it may be time to go risk-on

Past the surface-level hype, dynamics that contribute to the complexities of crypto surges embrace international financial situations, investor hypothesis, partnerships, market liquidity, and halving occasions (for sure cryptocurrencies).

Basic evaluation

The bedrock of any profitable buying and selling technique is the standard of basic evaluation backing it. Cryptocurrencies with sturdy fundamentals persistently outperform these missing a robust basis, a precept supported by the efficient-market hypothesis (EMH).

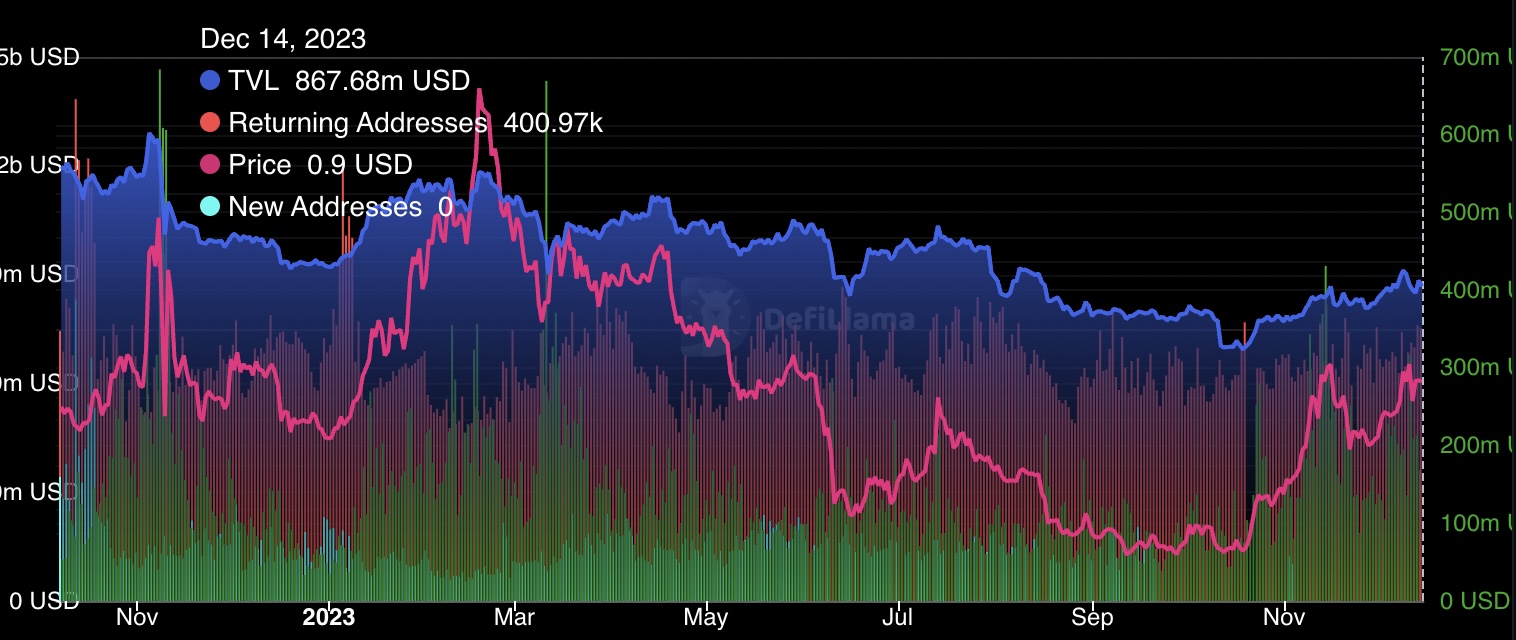

This speculation, examined throughout numerous markets, underlines the importance of basic evaluation in navigating crypto surges, providing traders a compass to determine initiatives with nice potential. Staying knowledgeable on developments and narratives in crypto requires leveraging analysis and evaluation instruments like DefiLlama (one in every of my go-tos). Actual-time knowledge and in-depth evaluation are serving to for monitoring developments and making knowledgeable selections.

The artwork of mastering technical evaluation

Whereas fundamentals set the stage, technical evaluation is the script. Indicators like shifting averages, the relative strength index (RSI), and Bollinger Bands decipher market developments. Technical evaluation has turn out to be an artwork type amongst merchants, considerably influencing buying and selling selections and boosting annual returns for these versed in its intricacies. Past chart patterns, it’s about understanding market psychology, enabling merchants to make knowledgeable selections that strategically influence the crypto market. All exchanges provide these instruments. TradingView is a best choice for extra in-depth evaluation.

Throughout short-term swing buying and selling within the 15-minute timeframe, the RSI indicator is my north star. Its simplicity, versatility, and performance as a momentum oscillator assist to determine overbought and oversold situations, signaling potential reversals or shopping for alternatives. My very own buying and selling selections are a mix of technical and basic evaluation, evaluating pattern patterns, assist, and resistance ranges, market sentiment, broader market situations, token/project-specific developments, and related information occasions.

Know when to promote

“The yr after bitcoin halving is normally the bull yr,” former Binance CEO Changpeng Zhao famous on Twitter Areas in July.

— Binance (@binance) July 5, 2023

Scheduled to happen in April, Bitcoin’s halving will see the variety of new Bitcoin issued to miners minimize by half from a present block reward of 6.25 Bitcoin to three.125 Bitcoin. JPMorgan analysts additionally anticipate the 2024 halving to double Bitcoin’s mining price, probably establishing a brand new value ground. As a savvy dealer, capitalize on these predictions by strategically buying belongings that might run on the coattails of Bitcoin and know when to divest.

The method you’re taking to conclude when to promote your crypto is a nuanced one which calls for a strategic mix of market evaluation, danger evaluation, and a deep understanding of your monetary targets. I sometimes get into initiatives that I see fixing very important issues at very early phases. I do that to contribute to constructive change that impacts the world and make it somewhat higher. That is my success. In my expertise, whenever you remedy an actual downside, you finally flip a revenue. I take revenue when getting some monetary reward from the venture is sensible.

This technique does not work for everybody. A main indicator to contemplate is reaching predefined revenue targets. It might be prudent to safe revenue in your funding if it has met or exceeded your anticipated returns. Eschew greed and you will be simply positive.

Associated: BONK, PEPE and SHIB are a menace to crypto

As well as, entry to the general valuation of the cryptocurrency is crucial. A speedy and unsustainable surge in worth largely alerts potential overvaluation, and it is perhaps an opportune second to promote, particularly if it deviates considerably from basic components. These fundamentals embrace alterations in venture improvement, the underlying know-how, or regulatory framework that may undermine the cryptocurrency’s long-term potential.

Embrace exterior components like important information occasions, financial situations, and adjustments in market sentiment when making selections. Finally, the holistic strategy to managing your cryptocurrency could be aligning your promote selections along with your danger tolerance, monetary objectives, and the necessity for portfolio diversification. Reassessing your funding technique commonly with these components in thoughts can contribute to a proactive and knowledgeable stance out there.

The very best trades I’ve made have come from paying consideration to what’s being stated within the trade after which appearing on it. My most profitable trades come from discovering info (“alpha”) by being lively and alert and appearing on it earlier than it turns into mainstream information. To that finish, it helps to affix “alpha teams” and dealer channels. You hear about updates on these platforms earlier than they get to the market. These updates provide you with a short window to take place earlier than a big proportion of the market does.

That is the way you win. In sharp distinction, the worst trades I’ve made have been appearing in haste. Calmness is an effective high quality to have as a dealer, and as Warren Buffet says, “Timing the market is much more vital than time out there.”

Navigating the market calls for greater than surface-level methods. They require a complete understanding of the nuances that outline the blockchain house. Past analytics and statistics, the trade calls for the knowledge of seasoned professionals who acknowledge that, within the delicate dance that’s buying and selling and investing within the blockchain, technique isn’t just a software; it’s what we use to chase down success within the crypto market.

Evan Luthra is a crypto entrepreneur who bought his first firm, StudySocial, for $1.7 million on the age of 17 and had developed greater than 30 cellular apps earlier than he was 18. He turned concerned with cryptocurrency in 2014 and is at present constructing CasaNFT. He has invested in additional than 400 crypto initiatives.

This text is for basic info functions and isn’t meant to be and shouldn’t be taken as authorized or funding recommendation. The views, ideas and opinions expressed listed below are the creator’s alone and don’t essentially mirror or characterize the views and opinions of Cointelegraph.

[ad_2]

Source link