[ad_1]

High Tales This Week

BlackRock revises spot Bitcoin ETF to allow simpler entry for banks

BlackRock has revised its spot Bitcoin exchange-traded fund (ETF) utility to make it simpler for Wall Avenue banks to take part by creating new shares within the fund with money somewhat than simply crypto. The brand new in-kind redemption “prepay” mannequin will permit banking giants corresponding to JPMorgan or Goldman Sachs to behave as approved contributors for the fund, letting them circumvent restrictions that stop them from holding Bitcoin or crypto straight on their steadiness sheets.

El Salvador expects to promote out Bitcoin ‘Freedom Visa’ by finish of yr

El Salvador’s Nationwide Bitcoin Workplace says its $1 million Freedom Visa program has already received hundreds of inquiries since its launch on Dec. 7 and expects it to promote out earlier than the top of 2023. Launched by the native authorities in partnership with stablecoin issuer Tether, the Freedom Visa is a citizenship-by-donation program that grants a residency visa and pathway to citizenship for 1,000 individuals keen to make a $1 million Bitcoin or Tether donation to the nation. This system is restricted to 1,000 slots per calendar yr.

Sam Bankman-Fried’s lawyer says FTX fraud trial was “nearly unimaginable” to win: Report

The lawyer answerable for Sam “SBF” Bankman-Fried’s felony trial protection has admitted that the case was “almost impossible” to win from the outset. Throughout an interview, Stanford Regulation College professor David Mills mentioned he advisable the authorized protection of SBF admit to the allegations of witnesses and state prosecution and persuade the jury that Bankman-Fried meant to save lots of the corporate. Mills additionally disclosed that he had agreed to lend his experience to Bankman-Fried’s protection on the behest of the FTX CEO’s dad and mom, and described Bankman-Fried “because the worst individual I’ve ever seen do a cross-examination.”

Yearn.finance pleads arb merchants to return funds after $1.4M multisig mishap

Yearn.finance is hoping arbitrage traders will return $1.4 million in funds after a multisignature scripting error resulted in a considerable amount of the protocol’s treasury being drained. The error occurred whereas Yearn was changing its yVault LP-yCurve — earned from efficiency charges on vault harvests — into stablecoins on the decentralized alternate CoW Swap. Yearn suffered important slippage when it acquired 779,958 DAI yVault tokens from the commerce, leading to a 63% drop within the liquidity pool worth.

SEC pushes deadline for choice on Invesco Galaxy spot Ethereum ETF to 2024

The US Securities and Change Fee has delayed its decision on whether or not to approve or reject a spot Ether ETF proposed by Invesco and Galaxy Digital. The businesses filed the spot ETH ETF utility in September. The proposed spot crypto funding automobile is one in every of many being thought-about by the fee, which, to this point, has by no means accepted an ETF with direct publicity to Ether, Bitcoin or different cryptocurrencies.

Winners and Losers

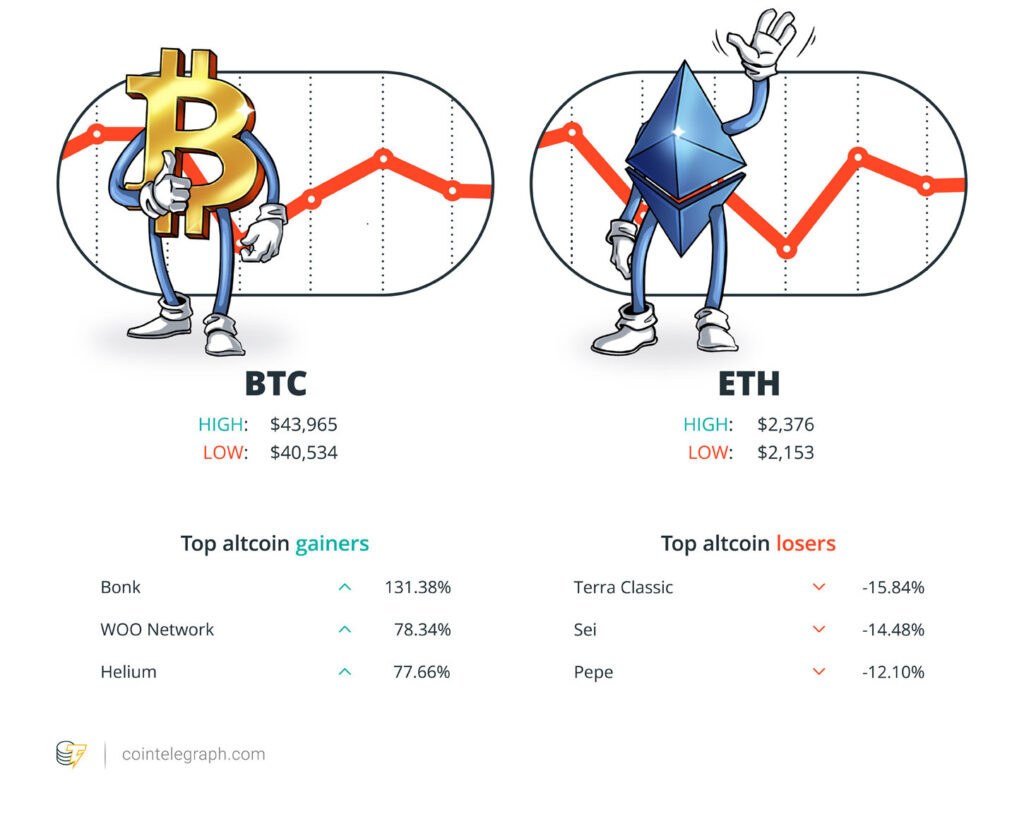

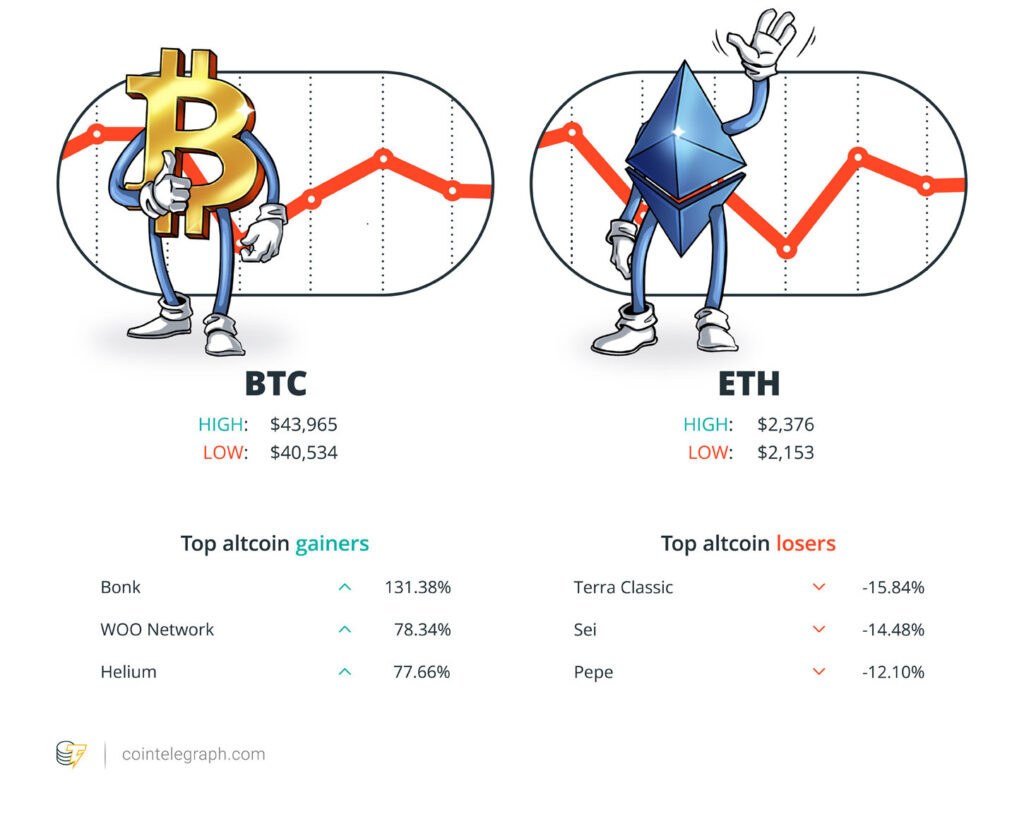

On the finish of the week, Bitcoin (BTC) is at $42,222, Ether (ETH) at $2,250 and XRP at $0.62. The entire market cap is at $1.6 trillion, according to CoinMarketCap.

Among the many greatest 100 cryptocurrencies, the highest three altcoin gainers of the week are Bonk (BONK) at 131.38%, WOO Community (WOO) at 78.34% and Helium (HNT) at 77.66%.

The highest three altcoin losers of the week are Terra Traditional (LUNC) at -15.84%, Sei (SEI) at -14.48% and Pepe (PEPE) at -12.10%.

For more information on crypto costs, ensure that to learn Cointelegraph’s market analysis.

Learn additionally

Most Memorable Quotations

“I’m a giant fan of this stablecoin referred to as Tether…I maintain their treasuries. So I hold their treasuries, they usually have lots of treasuries.”

Howard Lutnick, CEO of Cantor Fitzgerald

“This [blockchain] may be leveraged to make sure correct recycling and dealing with of waste supplies by monitoring them from origin to vacation spot.”

Dominic Williams, founder and chief scientist at Dfinity

“Digital currencies are the pure evolution of the world’s cost system, and Europe […] is paving the way in which for this inevitable shift.”

Michael Novogratz, CEO of Galaxy Digital

“I believed it was nearly unimaginable to win a case when three or 4 founders are all saying you probably did it.”

David Mills, felony trial legal professional of Sam Bankman-Fried

“Our bipartisan invoice is the hardest proposal on the desk cracking down on crypto’s illicit use and giving regulators extra instruments of their toolbox.”

Elizabeth Warren, U.S. senator

“We’ve to know that the Central Financial institution is a rip-off. What Bitcoin represents is the return of cash to its authentic creation, the non-public sector.”

Javier Milei, president of Argentina

Prediction of the week

‘No excuse’ to not lengthy crypto: Arthur Hayes repeats $1M BTC worth guess

Bitcoin and altcoins are a no-brainer bet in the current macro climate, Arthur Hayes says. In a put up on X (previously Twitter) on Dec. 14, the previous CEO of alternate BitMEX mentioned that traders have “no excuse” to brief crypto.

Going lengthy on crypto is the important thing to success as markets guess on the US Federal Reserve reducing rates of interest subsequent yr, Hayes argues. “At this level, there is no such thing as a excuse to not be lengthy crypto,” a part of his put up said.

“What number of extra occasions should they let you know that the fiat in your pocket is a grimy piece of trash,” he wrote. Hayes additional reiterated a longstanding $1 million BTC worth prediction because of macro tides eroding the worth of nationwide currencies.

FUD of the Week

Ledger patches vulnerability after a number of DApps utilizing connector library had been compromised

The entrance finish of a number of decentralized functions utilizing Ledger’s connector were compromised on Dec. 14. Ledger introduced that it had mounted the issue three hours after the preliminary studies in regards to the assault. Protocols affected embrace Zapper, SushiSwap, Phantom, Balancer and Revoke.money, stealing not less than $484,000 in digital belongings. The attacker utilized a phishing exploit to realize entry to the pc of a former Ledger worker. The hack sparked criticism about Ledger’s safety method.

Bitcoin inscriptions added to US Nationwide Vulnerability Database

The Nationwide Vulnerability Database flagged Bitcoin’s inscriptions as a cybersecurity risk on Dec. 9, calling consideration to the safety flaw that enabled the event of the Ordinals Protocol in 2022. In response to the database data, a datacarrier restrict may be bypassed by masking knowledge as code in some Bitcoin Core and Bitcoin Knots variations. As one in every of its potential impacts, the vulnerability may end in massive quantities of non-transactional knowledge spamming the blockchain, doubtlessly rising community dimension and adversely affecting efficiency and costs.

SafeMoon falls 31% in 5 hours after submitting for Chapter 7 chapter

The token of decentralized finance protocol SafeMoon has fallen 31% in five hours after the corporate behind it filed for chapter. SafeMoon formally utilized for Chapter 7 chapter, also called “liquidation chapter,” on Dec. 14. The newest blow comes solely a month after the U.S. Securities and Change Fee charged SafeMoon and its executives with violating securities legal guidelines in what the regulator described as “a large fraudulent scheme.” A number of former SafeMoon supporters expressed frustration on Reddit relating to the chapter, alleging they had been rug-pulled by the SafeMoon builders.

Learn additionally

High Journal Items of the Week

Terrorism & Israel-Gaza struggle weaponized to destroy crypto

Draconian anti-crypto legislation may quickly be handed to unravel a terrorism funding “disaster” that many argue is vastly overstated.

Korean crypto agency raises $140M, China’s $1.4T AI sector, Huobi battle: Asia Specific

Line Next raises $140M, China’s AI market surpasses $1.4T, Sinohope stagnates because of caught FTX deposit, and extra!

J1mmy.eth as soon as minted 420 Bored Apes… and had NFTs price $150M: NFT Creator

NFT collector J1mmy.eth trades like Warren Buffett, his assortment peaked at $150 million, and he as soon as minted 420 Bored Apes with Pranksy.

Subscribe

Probably the most partaking reads in blockchain. Delivered as soon as a

week.

Editorial Employees

Cointelegraph Journal writers and reporters contributed to this text.

[ad_2]

Source link