[ad_1]

Crypto change FTX has been burning by means of roughly $53,000 each hour over the three months ending Oct. 31 — simply on chapter legal professionals and advisers, the newest spherical of compensation filings present.

Court docket filings from Dec. 5 to Dec. 16 have proven that the chapter legal professionals have charged an collected complete of no less than $118.1 million between Aug. 1 and Oct. 31. Over the 92 days, this equates to $1.3 million per day or $53,300 per hour.

The most important invoice got here from the administration consulting agency Alvarez and Marshall, which charged $35.8 million for its providers for the three months.

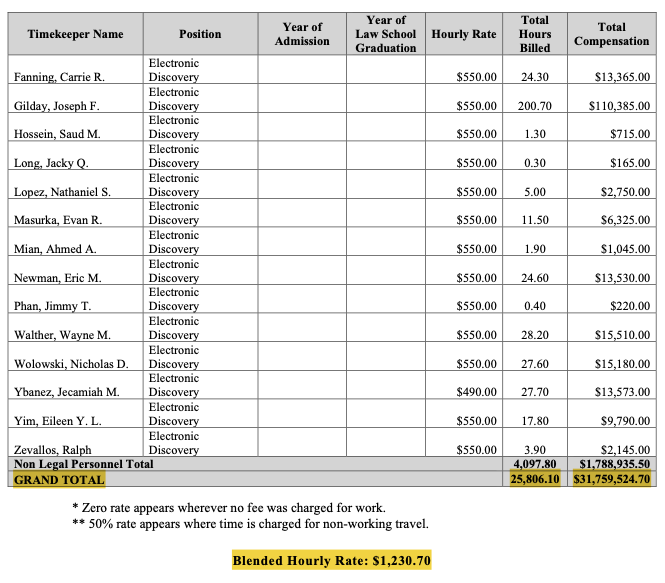

Coming in second place was international legislation agency Sullivan and Cromwell, which charged $31.8 million for its providers. The hourly charge for Sullivan’s and Cromwell’s providers averaged $1,230 per hour.

International consulting agency AlixPartners charged $13.3 million within the interval for skilled providers referring to forensic investigations. Quinn Emanuel Urquhart & Sullivan charged $10.4 million in the identical interval, whereas a number of different billings from smaller advisory corporations added as much as over $26.8 million.

Figures shared by a pseudonymous FTX creditor in a Dec. 17 put up to X (previously Twitter) counsel the full authorized charges which have been absolutely paid since the FTX bankruptcy case began is roughly $350 million.

BTW @lopp this estimates $1.45B of remaining skilled charges for a complete of $1.8B. The Property is at the moment charging $0.5B per yr and bankruptcies are usually not brief endeavors.

Up to now, listed below are the charges which have been petitioned in slightly below 1 yr (~$350mm has been paid): https://t.co/fZhMyTE3B1 pic.twitter.com/5p6at5ZbWy

— Mr. Purple ️ (@MrPurple_DJ) December 17, 2023

Associated: FTX debtors assess value of crypto claims based on petition date market prices

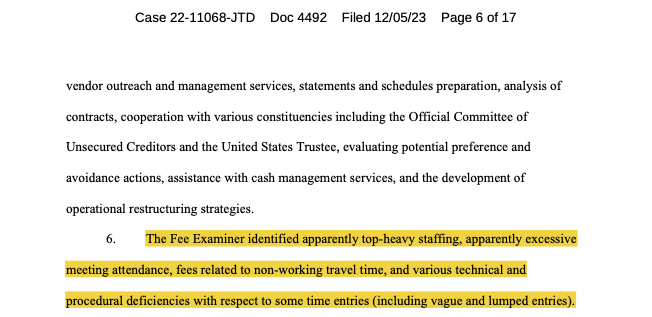

In the meantime, an earlier report filed on Dec. 5 by the court-appointed payment examiner, Katherine Stadler, recognized “vital areas of concern” with the billings submitted by the bigger advisory corporations, together with Sullivan and Cromwell, Alvarez and Marshall, and others between Could 1 and June 31.

“The Charge Examiner recognized apparently top-heavy staffing, apparently extreme assembly attendance, charges associated to non-working journey time, and numerous technical and procedural deficiencies with respect to a while entries (together with imprecise and lumped entries),” wrote the report concerning the billings submitted by Alvarez and Marshall.

Journal: Terrorism and the Israel-Gaza war have been weaponized to destroy crypto

[ad_2]

Source link