[ad_1]

Evidently each time Massachusetts Senator Elizabeth Warren fails to get an anti-crypto invoice handed, she introduces a brand new draft. She has the technique of messaging payments — laws launched for the needs of media consideration and fundraising greater than precise passage — all the way down to a science.

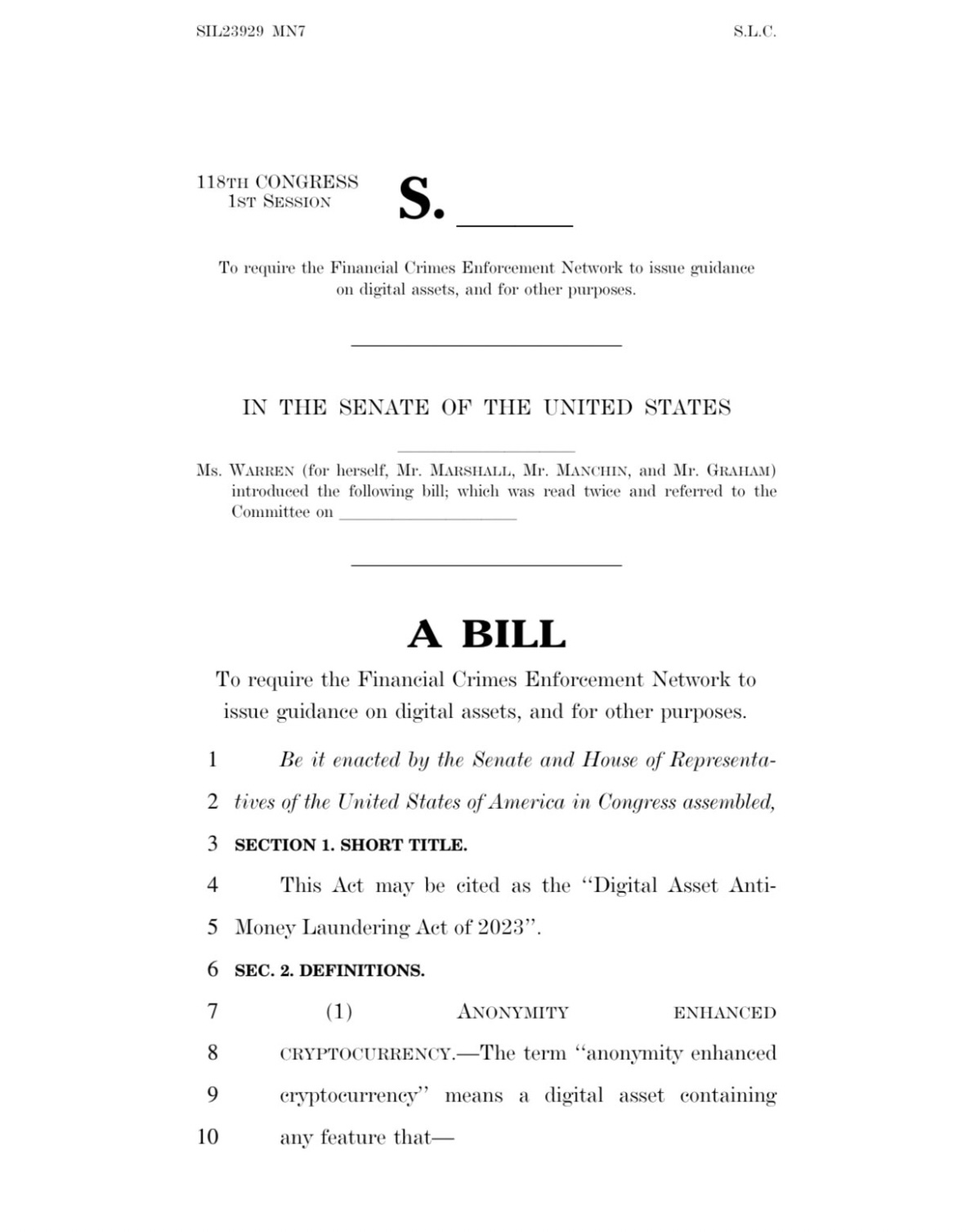

Warren’s newest laws, the Digital Asset Anti-Cash Laundering Act, threatens to undermine crypto’s core rules of freedom and private sovereignty. Whereas Warren argues that her invoice is important to fight illicit actions, a better look reveals its potential to stifle innovation, endanger consumer privateness, and play proper into the palms of huge banks.

The invoice, co-sponsored by Kansas Senator Roger Marshall, is predicated on a premise that digital property are more and more getting used for prison actions equivalent to cash laundering, ransomware assaults, and terrorist financing. Whereas some dangerous actors exploit digital property, the invoice’s method of treating all builders and pockets suppliers as potential criminals shouldn’t be solely impractical but additionally harmful.

Associated: The SEC is facing another defeat in its recycled lawsuit against Kraken

Probably the most harmful a part of the invoice is the requirement that digital asset builders adjust to Financial institution Secrecy Act (BSA) tasks and Know-Your-Customer (KYC) requirements. This successfully locations the burden of regulation enforcement on the shoulders of software program builders. It is akin to requiring automotive producers to be liable for how their automobiles are used on the highway.

The invoice additional seeks to eradicate privateness instruments that defend crypto customers from malicious actors. By cracking down on digital asset mixers and anonymity-enhancing applied sciences, Warren’s proposal threatens the privateness rights of law-abiding residents. It is important to keep in mind that privateness is a basic proper, not a privilege that may be discarded at will. A lot of early Bitcoin (BTC) millionaires have been kidnapped and tortured as a direct results of the transparency of the Bitcoin blockchain, Warren would depart future Bitcoiners defenseless in opposition to such threats.

Whereas she claims to be performing within the title of nationwide safety, it is value noting that the large banks would profit significantly from limiting the competitors posed by cryptocurrencies. By imposing onerous laws, the invoice would make it troublesome for crypto to compete on a stage taking part in subject.

However what in regards to the argument that digital property are being utilized by rogue nations and prison organizations? Whereas it is a legitimate concern, it is essential to differentiate between the know-how itself and the actions of some. The identical argument might be utilized to money, which has been used for unlawful actions for hundreds of years. Banning money could be an overreaction, simply as overly restrictive crypto laws are.

Breaking: Elizabeth Warren’s newest proposed anti-crypto laws

Sen. Warren has co-sponsored the Digital Asset Anti-Cash Laundering Act of 2023.

Says the laws goals to:

-combat the “rising” misuse of digital property.

-close regulatory “gaps.”

-extends Financial institution… pic.twitter.com/cl0L95Fyaj— Carlo⚖️.eth (@DeFiDefenseLaw) December 11, 2023

One main concern is the invoice’s method to “unhosted” digital wallets, which permit people to bypass AML and sanctions checks. Whereas stopping illicit transactions is essential, the invoice’s proposed rule to require banks and cash service companies to confirm buyer identities and file studies on sure transactions involving unhosted wallets might have unintended penalties.

Forcing people to offer private data for each transaction goes in opposition to the very rules which have drawn individuals to cryptocurrencies — privateness and pseudonymity. It is vital to strike a steadiness between safety and particular person rights. Overregulation may drive customers away from regulated platforms, pushing them into unregulated, extra challenging-to-track environments.

Moreover, the invoice’s concentrate on directing FinCEN to concern steering on mitigating the dangers of dealing with anonymized digital property appears to misconceive the core tenets of blockchain know-how. Cryptocurrencies like Bitcoin are designed to be clear but pseudonymous. Making an attempt to eradicate this pseudonymity jeopardizes one of many key options that make blockchain safe and interesting to customers.

Associated: BRC-20 tokens are presenting new opportunities for Bitcoin buyers

One other vital concern is the potential overreach in extending BSA guidelines to incorporate digital property. Requiring people engaged in transactions over $10,000 in digital property by means of offshore accounts to file a Report of International Financial institution and Monetary Accounts (FBAR) could also be extreme. It may lead to pointless burdens on people who use digital property for reliable functions, equivalent to cross-border remittances or investments.

Warren’s invoice is a sledgehammer method to a nuanced downside. Quite than stifling innovation and privateness, a extra balanced method could be to focus on particular prison actions and people. The present AML system, which massive crypto exchanges adjust to, has been efficient at interdicting illicit crypto utilization, which is why remoted cases have been reported.

The Digital Asset Anti-Cash Laundering Act is a deeply flawed piece of laws. Warren’s invoice poses an actual menace to the crypto neighborhood and dangers taking part in proper into the palms of huge banks. It is important that we discover a extra balanced and efficient resolution that addresses the issues with out stifling the potential of this transformative know-how.

J.W. Verret is an affiliate professor at George Mason College’s Antonin Scalia Regulation Faculty. He’s a training crypto forensic accountant and in addition practices securities regulation at Lawrence Regulation LLC. He’s a member of the Monetary Accounting Requirements Board’s Advisory Council and a former member of the SEC Investor Advisory Committee. He additionally leads the Crypto Freedom Lab, a assume tank preventing for coverage change to protect freedom and privateness for crypto builders and customers.

This text is for normal data functions and isn’t supposed to be and shouldn’t be taken as authorized or funding recommendation. The views, ideas and opinions expressed listed here are the creator’s alone and don’t essentially mirror or signify the views and opinions of Cointelegraph.

[ad_2]

Source link