[ad_1]

There’s loads of hypothesis on what the worth motion will appear like for Bitcoin (BTC) if a spot exchange-traded fund (ETF) is accepted in the US by the Securities and Change Fee. There’s presently an extended record of candidates, together with the likes of BlackRock, Fidelity, VanEck and Bitwise. Grayscale, which won a lawsuit against the SEC in August 2023, is in search of to show its present publicly provided Grayscale Bitcoin Belief right into a spot Bitcoin ETF.

This begs the query: Is an ETF higher or worse than a belief for traders who’ve their funds tied up within the conventional finance area?

To complicate issues additional, some corporations hold Bitcoin on their balance sheets and might act as proxies for proudly owning the asset immediately.

These three choices for Bitcoin traders — ETFs, trusts and proxies — every include their very own execs and cons. Whereas nothing beats the sovereignty of self-custodying one’s personal Bitcoin, there are eventualities the place individuals might wish to select one in all these three different choices.

In the US, individuals usually have 401K or Roth IRA retirement accounts, which make investments cash within the conventional inventory market. These funds can typically not be accessed till retirement with out paying hefty charges, however with ETFs, trusts and proxies, individuals can get publicity to Bitcoin within the meantime.

All three choices are passive, “set it and neglect it” devices, the place nobody has to maintain monitor of seed phrases and wallets or fear about phishing scams or potential loss attributable to different human components.

BlackRock CEO Larry Fink said in an interview on Fox Enterprise that Bitcoin and blockchain expertise might help take away the necessity for custodians from the finance business. Nevertheless, “We’re not near there, but it surely’s an development in expertise.” Having a trusted custodian is likely one of the benefits Fink proposed for individuals to look to spend money on a Bitcoin ETF.

Bitcoin ETFs

The crypto media panorama has written extensively on the potential of Bitcoin ETFs, with individuals like MicroStrategy co-founder Michael Saylor saying that spot Bitcoin ETFs are the largest Wall Road growth in 30 years. In the US, 28.2% of the full fairness buying and selling volume in Q3 2023 was from ETFs.

Bitcoin ETFs provide liquidity to a conventional finance (TradFi) funding portfolio, however they’re solely accessible whereas the inventory market is open for buying and selling. This generally is a unfavorable, as spot Bitcoin trades 24 hours a day, seven days per week, stopping ETFs from being traded towards worth fluctuations.

Some ETFs are available 24 hours a day, however they’re nonetheless restricted to weekdays. This may be a difficulty, as decrease volumes on weekends can lead to cost swings that can not be taken benefit of till the TradFi markets open on Monday. After all, this solely impacts short-term shopping for and promoting patterns, and if consumers of Bitcoin ETFs are long-term traders, this worth motion is much less necessary, but it surely ought to nonetheless be famous.

One of many points some within the TradFi area elevate is the shortage of regulatory oversight of the Bitcoin markets. The regulatory scrutiny these ETFs will obtain can doubtlessly present some stage of investor safety and provides the looks of market integrity to TradFi traders.

Buyers might even see an elevated price via increased charges over different types of publicity to Bitcoin. A number of the least expensive gold ETFs have annual charges starting from 0.09% to 0.6%, primarily based on the investor’s holdings. This expense proportion is necessary, because it may eat into earnings and returns for traders.

Bitcoin trusts

Just like a spot ETF, a belief has to personal the underlying asset. Nevertheless, an ETF has to obtain extra of the spot asset (on this case, Bitcoin) relying on demand. A belief holds a specific quantity of an asset and sells shares of that complete quantity that’s fixed on the launch of the belief.

Trusts can have some benefits, together with the periodic disclosure of their Bitcoin holdings, offering some stage of transparency within the funding. Trusts have much less liquidity than ETFs, which makes them tougher to commerce on secondary markets.

The opposite concern with trusts may both be a professional or con, relying on when one enters the place. Trusts can permit traders to commerce at both a reduction or a premium primarily based on the fluctuations within the worth of Bitcoin. The web asset worth of 1 BTC could be decrease than the price of the equal shares of a Bitcoin belief, due to this fact buying and selling at a premium. The alternative can be true: The value of 1 BTC could be increased than the equal shares in a Bitcoin belief, offering a reduction.

There are, nevertheless, increased fund expense charges as a result of trusts are actively managed. The Grayscale Bitcoin Belief, for instance, has an annual administration fee of two%. In contrast with the decrease charges possible on potential ETFs, this can be an necessary issue to think about.

Bitcoin proxies

An investor might wish to be uncovered to the worth motion of Bitcoin however not have direct publicity to the asset itself. That is the place a Bitcoin proxy comes into play.

These could be corporations or equities that function within the blockchain area or maintain Bitcoin on their stability sheet. Bitcoin proxies within the U.S. embody public Bitcoin miners similar to Marathon, Hut8 and CleanSpark, for instance.

Additionally included are corporations similar to MicroStrategy, which holds 189,150 BTC, price roughly $8.1 billion, on the time of writing.

Recent: Key industry figures predict the future of DeFi in 2024

Conventional monetary evaluation of equities consists of wanting on the outcomes of U.S. Typically Accepted Accounting Rules. Underneath the present guidelines, Bitcoin’s fall to the $16,000 vary was what MicroStrategy needed to report on its stability sheet, displaying a internet lack of $193.7 million in Q4 2022.

This impacted how conventional Wall Road analysts considered the inventory. Nevertheless, this conventional metric will change in December 2024 when accounting practices will begin reflecting the honest worth of Bitcoin held by an organization. Which means monetary numbers for the likes of companies similar to MicroStrategy will look very completely different, particularly if Bitcoin’s spot worth begins to really feel upward strain from the upcoming halving event around April 2024.

MicroStrategy has acquired an extra 14,620 BTC for ~$615.7 million at a median worth of $42,110 per #bitcoin. As of 12/26/23, @MicroStrategy now hodls 189,150 $BTC acquired for ~$5.9 billion at a median worth of $31,168 per bitcoin. $MSTR https://t.co/PKfYY59sTW

— Michael Saylor⚡️ (@saylor) December 27, 2023

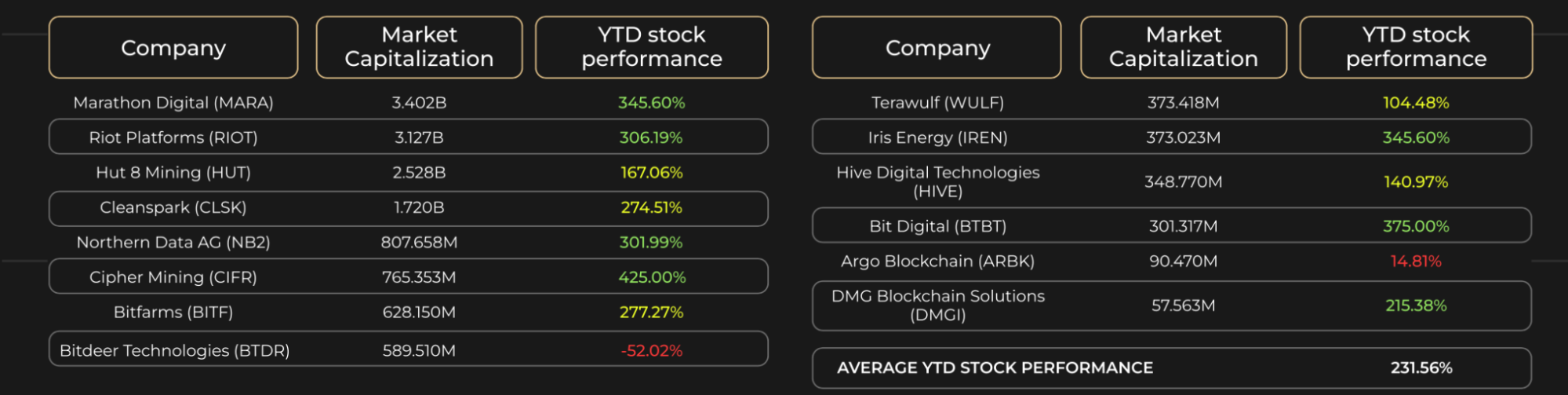

Bitcoin miner shares (listed within the desk under) largely carried out properly in 2023, with the vast majority of them up by the triple digits. These miners not solely stand to realize better earnings from the potential future rise within the worth of Bitcoin they promote but in addition from the Bitcoin they maintain. One of many key components when analyzing Bitcoin mining shares is how a lot debt is held on their stability sheets. Whereas this debt might permit some corporations to buy new and quicker mining tools to remain forward of their competitors, the decreased provide of Bitcoin quickly to be in the marketplace might put some miners in a precarious place in the event that they fail to win mining rewards attributable to a string of unhealthy luck.

Whereas proxies present the normal market with oblique publicity to Bitcoin, additionally they include the normal market issues that every one public corporations face — specifically, potential scandals involving management misconduct, unhealthy enterprise practices, lawsuits or altering jurisdictional crimson tape, all of which might impression the worth of the inventory.

The advantage of proudly owning a Bitcoin proxy inventory is the shortage of charges in trusts or ETFs. Proxies even have a functioning enterprise that brings in income and revenue. Which means moreover holding Bitcoin on their stability sheet, they’ll fall again on a sort of cushion, decreasing the chance of possession. Whereas the worth of Bitcoin can impression the inventory worth of proxies, the operational enterprise can assist some stage of market worth above zero. Proxies even have an necessary capacity that different choices don’t, according to Michael Saylor:

“The ETFs are unleveled and so they cost a payment. We offer you leverage, however we don’t cost a payment. We provide a high-performance car for those who are Bitcoin lengthy traders. […] We will benefit from clever leverage. We will borrow cash at zero % curiosity for a lot of a few years, and we did that with the convert, and we are able to use that to purchase Bitcoin.”

The power to tackle debt with Bitcoin as collateral can’t be duplicated by ETFs or trusts, and should permit corporations like MicroStrategy to take out loans in bull markets and purchase extra Bitcoin in bear markets.

One concern that must be stored in thoughts in regard to corporations taking up debt and discovering finance for Bitcoin procurement is the potential of share dilution.

As of December 2023, MicroStrategy had 15.64 million shares excellent, a 25.76% improve in contrast with 2022. With MicroStrategy holding 189,150 BTC, every share represents 0.012094 BTC. On the time of writing, it might take 83 shares (82.69) of MicroStrategy inventory to approximate 1 BTC.

The TradFi Bitcoin trilemma: ETF, belief or proxy?

Not all people, establishments, companies, household workplaces and sovereign wealth funds are prepared or capable of immediately personal and management their very own Bitcoin. Many are in search of publicity to Bitcoin — however within the palms of these they deem reliable from the normal “Web2” worldview.

For merchants taking note of the worth swings in Bitcoin, there is a chance to make the most of the present immaturity of the normal market in understanding Bitcoin with ETFs, trusts, and proxies. The value of every might swing increased throughout instances of exuberance and dump decrease in instances of FUD (worry, uncertainty and doubt), as TradFi nonetheless doesn’t absolutely perceive this asset class. This offers the power to purchase alternatives at a reduction and promote at premiums, with out buying and selling Bitcoin itself. With retirement accounts like 401Ks or Roth IRAs in the US and comparable schemes in different nations, this generally is a option to commerce with no tax burdens throughout Bitcoin’s cycles.

Recent: GameFi opportunities and challenges in 2024

Declaring the winner of this TradFi Bitcoin trilemma isn’t so simple. For some, there are benefits to proudly owning a part of a belief, notably if the shares are buying and selling at a reduction in contrast with the asset itself. For others, an ETF might take away a few of the excessive charges related to the administration of the belief, however the fluctuation within the quantity of Bitcoin held must be intently monitored to make sure rehypothecation doesn’t happen.

Others might look to proxies as a option to achieve publicity with zero charges, however might must cope with shock scandals, mismanagement and solvency points if company money owed can’t be paid.

In any occasion, having extra choices for participation within the Bitcoin revolution isn’t a foul factor and can assist pave the way in which for additional adoption as we transfer into future cycles.

This text doesn’t comprise funding recommendation or suggestions. Each funding and buying and selling transfer entails danger, and readers ought to conduct their very own analysis when making a call.

[ad_2]

Source link