[ad_1]

As 2023 drew to a detailed and with the beginning of 2024, the crypto market is as soon as once more experiencing a resurgence, one that’s harking back to the bull run witnessed again in December 2020.

The continuing revival has introduced with it a renewed sense of optimism and potential, with traders hoping for a serious turnaround.

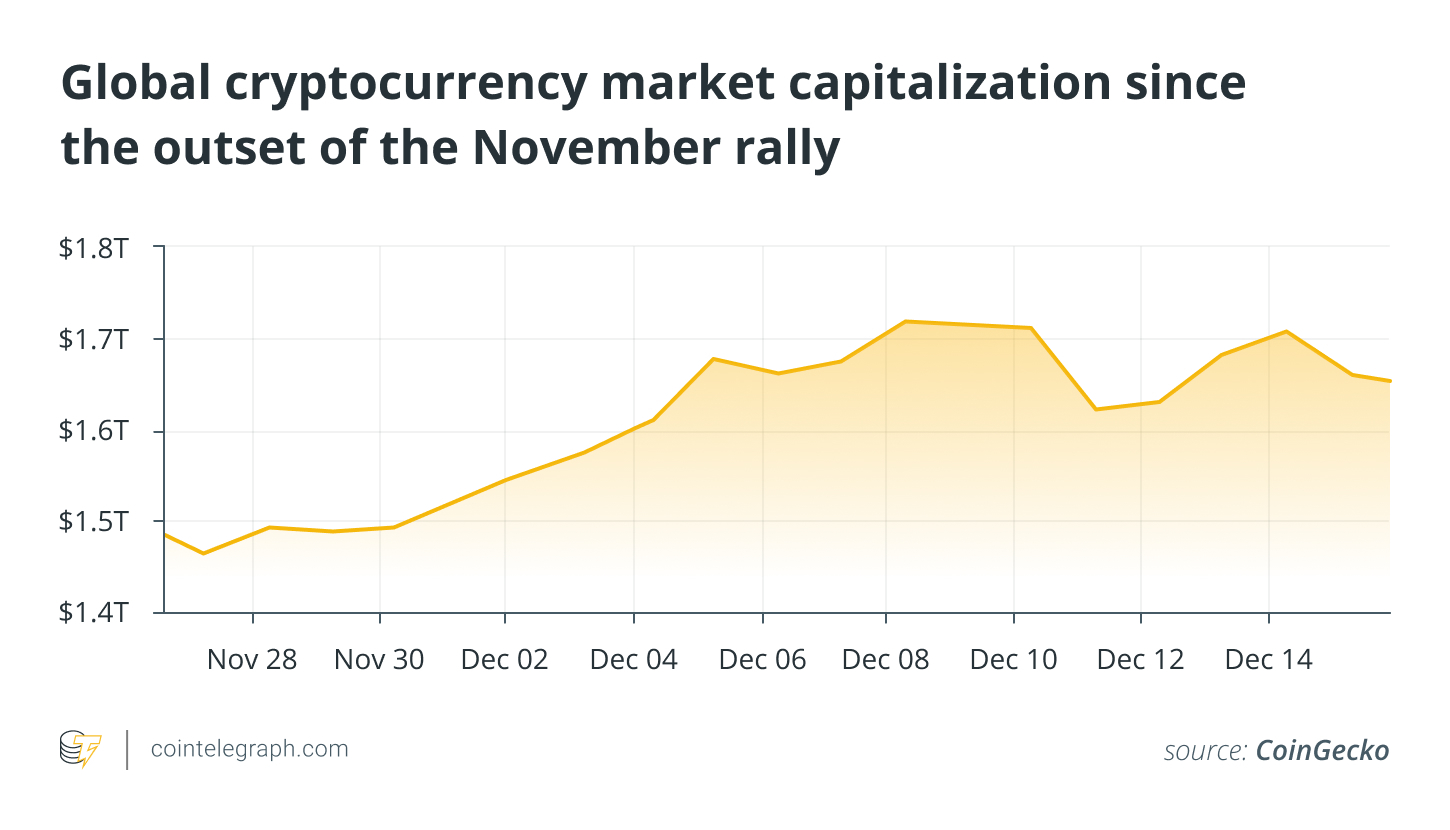

So far, for the reason that begin of 2023, the market capitalization of the digital asset sector has boomed from $831 billion to over $1.8 trillion, thereby showcasing a progress of almost 100%.

Due to this latest uptrend, it’s however pure that individuals have began drawing parallels between the vacation worth motion of the final bull run and the present market. Nonetheless, is that this resemblance merely coincidental, or are we witnessing the cyclical nature of the crypto market at play?

Antoni Trenchev, co-founder and managing companion at cryptocurrency lending firm Nexo, believes that the continuing worth motion displays the 2020–2021 vacation interval, which he marked as a prescient second, heralding the final main bull run earlier than cryptocurrency entered the mainstream. He added:

“Again then, the market’s upturn proved to be way over merely seasonally uplifted costs. Arriving mere months earlier than the April 2020 Bitcoin halving and driving the wave of enthusiasm round crypto ETFs [exchange-traded funds], this rally was a harbinger of an unprecedented surge in crypto valuations.”

Now, on the tail finish of the 2023–2024 festive season, Trenchev believes that we discover ourselves on the cusp of one other thrilling chapter.

“With an early ‘Santa Rally’ already glimmering on the charts and the Bitcoin halving slated for April 2024, we’re optimistically poised for what may very well be one other surge, and the bulls are solely simply warming up,” he mentioned.

Circumstances round crypto bull runs

Jupiter Zheng, companion at institutional asset supervisor HashKey Capital, instructed Cointelegraph that, whereas there are undoubtedly a number of vacation elements influencing the continuing market progress — akin to what was witnessed a few years in the past — there are different peripheral drivers to think about this time round, including:

“At present, now we have the looming introduction of spot BTC exchange-traded funds (ETFs) and the upcoming halving occasion in 2024, together with the fast enlargement of the Bitcoin ecosystem, which incorporates the introduction of latest layer-2 options and inscriptions. Moreover, the change within the Federal Reserve’s stance from hawkish to dovish additionally has had a constructive impression on dangerous belongings.”

Increasing on Zheng’s narrative, Ryan Lee, chief analyst at Bitget Analysis, believes that, whereas drawing parallels between the 2020–2021 bull run and the present crypto market situation is definitely useful, this time round, the market is being closely influenced by completely different macro circumstances, together with regulatory updates, technological developments and shifting investor sentiment.

He famous that, whereas the final bull run was formed by particular circumstances, just like the COVID-19 pandemic, which spurred quantitative easing and institutional investments, this run is being pushed by fluctuating inflation charges, rate of interest adjustments and geopolitical tensions.

Moreover, monetary indicators just like the drop within the U.S. 10-year Treasury yield and a decrease within the U.S. Greenback Index (a measure of the U.S. greenback’s worth relative to nearly all of its most vital buying and selling companions) have created a positive setting for Bitcoin (BTC).

Recent: Bitcoin ETFs are coming, but what about BTC stocks and trusts?

Additional bolstering this pattern is a few optimistic financial knowledge that has emerged, with Lee noting that the U.S. gross home product has outperformed expectations, whereas the Private Consumption Expenditures (PCE) worth index (a measure of shopper spending on items and companies amongst households within the U.S.) has additionally shown moderation, staying comparatively steady all by means of 2023. He additional added:

“The chance of the Federal Reserve sustaining its present coverage stance into December has risen above 80%, offering reduction to market pressures which have been intensified by this 12 months’s difficult macroeconomic setting.”

May we witness a crypto rally within the coming weeks?

Whereas the continuing worth motion is definitely promising, the market nonetheless appears to haven’t been in a position to break previous the $1.7-trillion threshold cleanly.

Zak Taher, CEO of MultiBank.io — the digital asset wing of the MultiBank Group — instructed Cointelegraph that his group didn’t anticipate costs to start out skyrocketing anytime quickly, however given the present market circumstances, it does appear as if a serious rally could also be within the offing: “Whereas short-term market actions could be influenced by varied elements, together with the greed index, sentiment and market hypothesis, predicting with certainty whether or not this rally will evolve right into a full-blown bull market within the close to to mid-term is difficult.”

Regardless of the uncertainty, Taher believes that the growing institutional curiosity and adoption will proceed to play a pivotal position in shaping the following run and offering legitimacy and stability to the market, significantly throughout Europe and the Center East.

Denis Petrovcic, co-founder and CEO of Blocksquare — a tokenization infrastructure supplier for real-estate belongings — shared a considerably comparable sentiment, telling Cointelegraph that, whereas Bitcoin’s latest surge previous the $44,000 mark mixed with a rising curiosity in Bitcoin ETFs may be greater than only a seasonal rally, historic traits recommend such surges might not maintain within the long-term.

“The market’s optimism may face challenges with the shifting international financial panorama, together with potential coverage shifts in 2024,” he mentioned.

Nonetheless, Lee stays optimistic concerning the business’s near-term future, stating that ongoing coverage shifts, inflation charge changes and geopolitical occasions will probably play a crucially constructive position in influencing Bitcoin’s worth.

“Notably, a forecasted shift in U.S. financial coverage, which can decrease the 10-year yield, seems promising for danger belongings like cryptocurrencies,” he concluded.

Components that can probably drive the following bull market

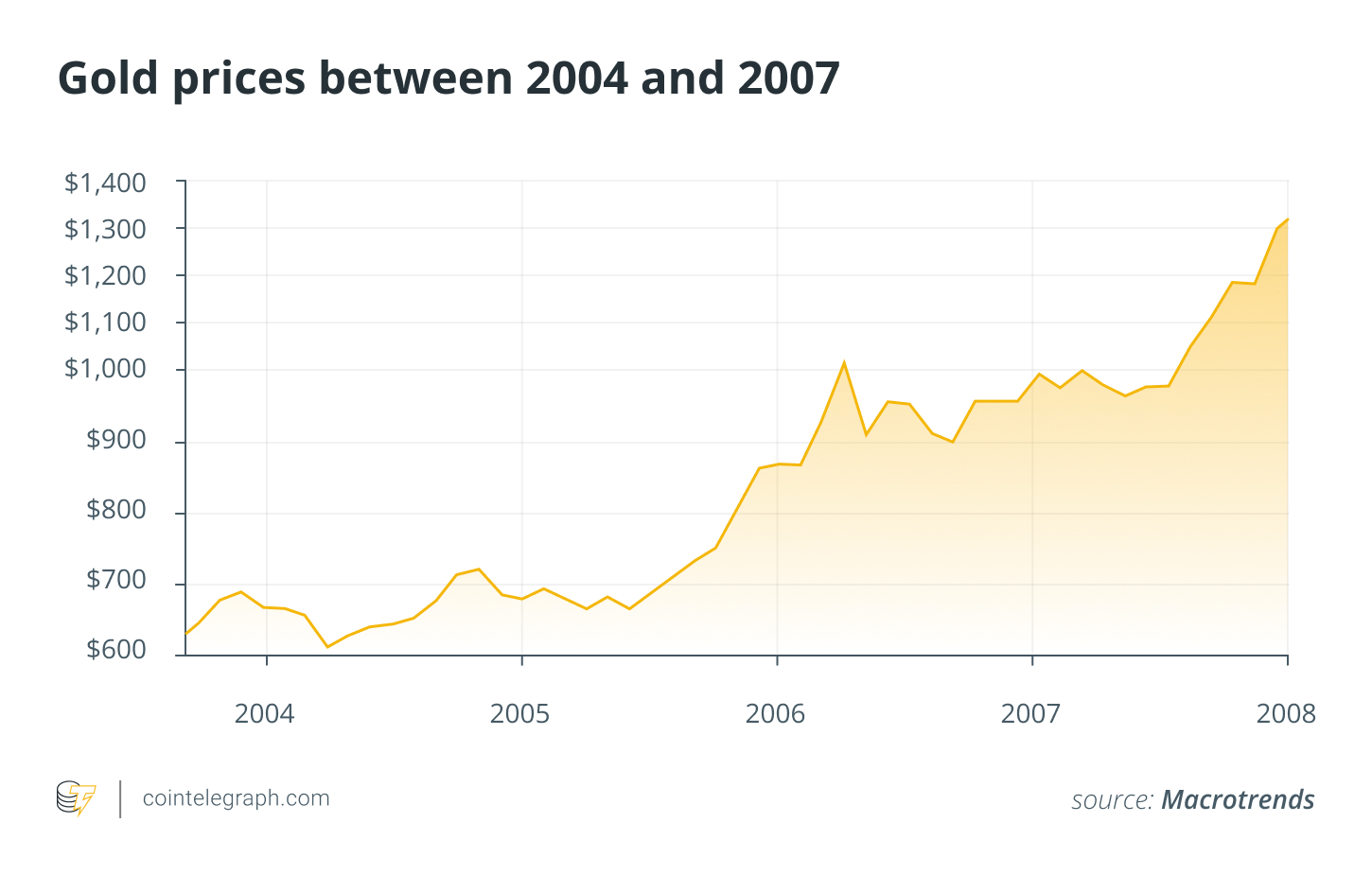

Between Jan. 5 and Jan. 10, 2024, the crypto market is anticipating a decision on the approval of a U.S. spot BTC ETF. If authorised, there may very well be a serious inflow of funds into the crypto market akin to what was witnessed after the approval of the primary gold ETFs again in 2004. Moreover, the increasing likelihood of a Federal Reserve charge minimize in 2024 is one other crucial issue to control, because it might have important implications for the market.

With the following Bitcoin halving scheduled for Could 9, 2024, it’s price noting that the digital asset’s worth has proven a sample of peaking between 368 and 550 days after the occasion after which bottoming out between 779 and 914 days later. This cyclical habits is a crucial pattern to watch because it stands to play a serious position in driving investor sentiment.

Recent: GameFi opportunities and challenges in 2024

Moreover, China’s initiative to internationalize the renminbi represents a big shift in international monetary dynamics, probably affecting each conventional and digital currencies. Concurrently, the cryptocurrency market is showcasing its variety, as evident from altcoins like Ether (ETH) and Solana’s SOL (SOL) reaching 19-month highs, whilst Bitcoin’s rally reveals indicators of pausing.

Lastly, in a much wider context, Brazil’s growing consideration of digital currencies for monetary transactions throughout the G20 displays an growing international curiosity within the potential of digital currencies.

This text doesn’t comprise funding recommendation or suggestions. Each funding and buying and selling transfer entails danger, and readers ought to conduct their very own analysis when making a choice.

[ad_2]

Source link