[ad_1]

Bitcoin (BTC) tapped $40,000 after the Dec. 8 Wall Road open as United States employment information shrunk market bets on rate of interest cuts.

Bitcoin holds agency as jobs information unsettles U.S. greenback

Information from Cointelegraph Markets Pro and TradingView coated the newest BTC value motion as danger property reacted to the newest U.S. inflation cues.

Nonfarm payrolls got here in above expectations at 199,000 versus 190,000, whereas unemployment was decrease than forecast at 3.7% versus 3.9%, per an official release from the U.S. Bureau of Labor Statistics.

Each steered that the complete affect of Federal Reserve financial tightening had but to indicate itself, and whereas different information had already captured declining inflation, markets handled the labor figures nervously.

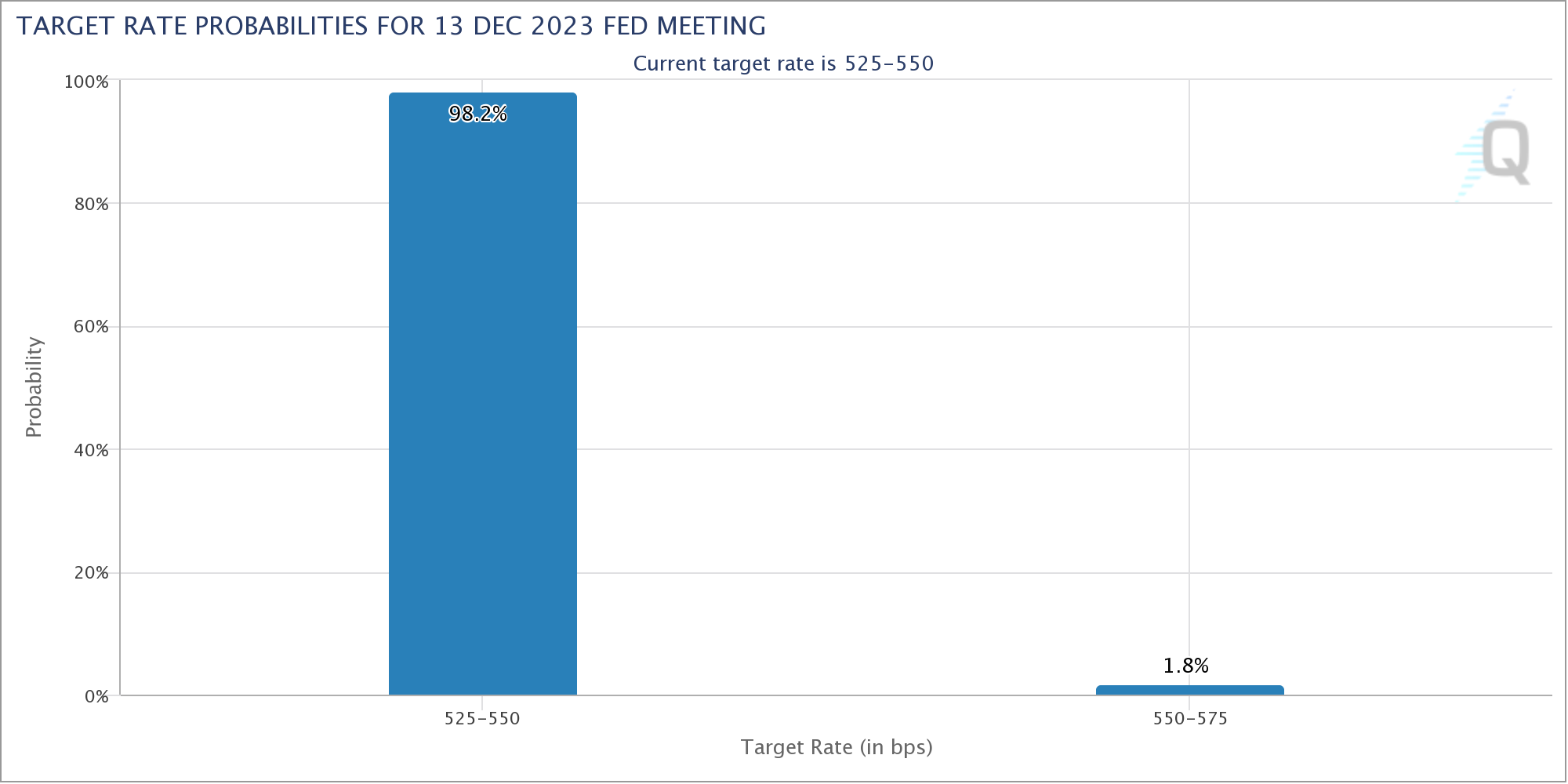

JUST IN: Rate of interest futures shift from displaying fee cuts starting in March 2024 to Might 2024 after jobs report.

Previous to the November jobs report, markets noticed a 60% likelihood of fee cuts starting in March 2024.

Odds of fee cuts starting in January 2024 fell from 16% to six%.… pic.twitter.com/hFYFLVP5xv

— The Kobeissi Letter (@KobeissiLetter) December 8, 2023

Information from CME Group’s FedWatch Tool nonetheless put the percentages of something aside from a fee change freeze persevering with at subsequent week’s Fed assembly at virtually zero.

The U.S. greenback index (DXY) noticed notably pronounced volatility across the information, briefly hitting its highest ranges since Nov. 20 earlier than erasing its positive factors to commerce at 103.8 on the time of writing.

Liquidity crowds BTC value amid consolidation

Whereas gold was down 0.8%, Bitcoin managed to keep away from a straight comedown regardless of the decreased perception in decrease rates of interest coming sooner.

Associated: ‘Early bull market’ — Bitcoin price preps 1st ever weekly golden cross

The biggest cryptocurrency stayed locked in a multi-day buying and selling vary as merchants seemed for indicators of development continuation.

“Bitcoin nonetheless consolidating in an uptrend and holding robust after the latest transfer,” in style analyst Matthew Hyland wrote in a part of evaluation on X (previously Twitter).

“Clear help round $43k now.”

Fellow dealer and analyst Daan Crypto Trades in the meantime famous important areas of liquidity instantly round spot value.

#Bitcoin Liquidation Map

Has been constructing some thick clusters on either side as a consequence of ranging on this similar space for a while now.

Most notably: $42.9K & $43.8K

Maintain a watch out for these ranges. pic.twitter.com/Vz6eYVVwy5

— Daan Crypto Trades (@DaanCrypto) December 8, 2023

Ongoing consideration centered on altcoins versus Bitcoin, with Ether (ETH) and Solana (SOL) taking the lead overnight amid renewed anticipation of a type of “alt season” returning.

“Bitcoin nonetheless consolidating round $43K, whereas Ethereum is taking extra momentum,” Michaël van de Poppe, founder and CEO of MN Buying and selling, told X subscribers.

“The underside for ETH/BTC is shut or possibly in. Coming two months are going to be electrical for altcoins additional.”

This text doesn’t comprise funding recommendation or suggestions. Each funding and buying and selling transfer entails danger, and readers ought to conduct their very own analysis when making a choice.

[ad_2]

Source link