[ad_1]

Over the past two days, the valuation of the cryptocurrency market has plunged to $201 billion as Bitcoin lost 13 percent, moving closer to its yearly low at $192 billion.

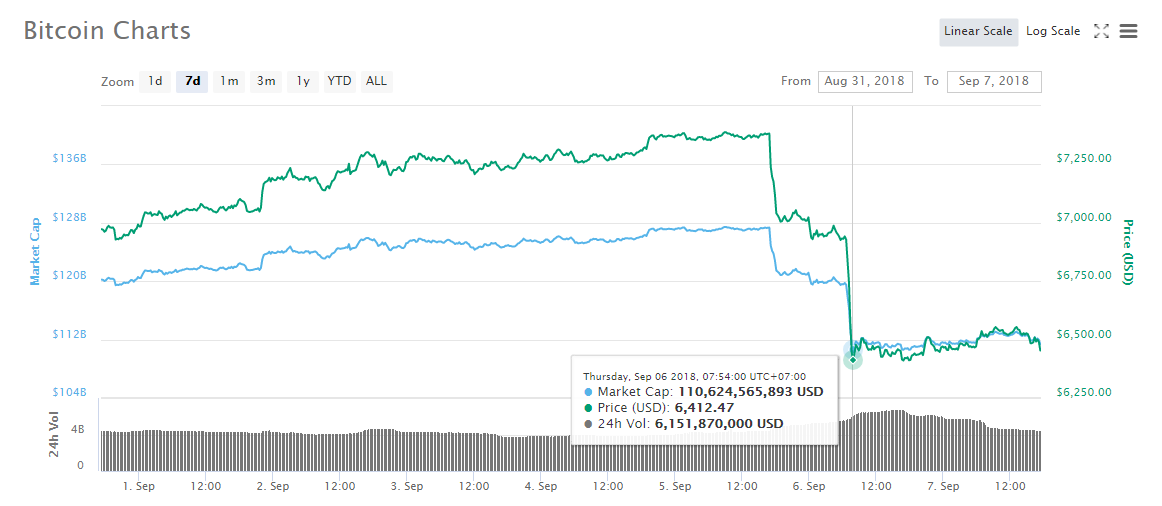

Since Sept. 6 when the price of Bitcoin dropped by more than 10 percent within a one-hour period, the cryptocurrency market has been on a continuous decline. Tokens bled out more intensely than they previously did in April and June, losing out 10 to 30 percent against Bitcoin.

Source: coin360.io

Cointelegraph interviewed ThinkMarkets chief market analyst and former Bank of America trader Naeem Aslam, eToro senior market analyst Mati Greenspan, and well recognized cryptocurrency technical analyst Uzi, delving into the recent drop of Bitcoin and the rest of the cryptocurrency market.

$40 billion drop: One of the biggest daily decline in recent years

On Sept. 6, the cryptocurrency market lost nearly $40 billion from its valuation in less than 24 hours, demonstrating one of the steepest declines in the past three years.

Source: CoinMarketCap.com

In mid August, the cryptocurrency market dropped to its yearly low at $192 billion, but it took seven days from Aug. 7 to Aug. 14 to record such a large drop in valuation.

Prior to Wednesday, throughout the month of August, Bitcoin showed its highest level of stability since June of 2017, as researchers at Diar noted. From Aug. 8 to Aug. 26, the price of Bitcoin remained relatively stable in the $6,000 region, before initiating an overdue corrective rally above the $7,000 resistance level.

Source: CoinMarketCap.com

But, a rushed rally from the $7,000 mark to $7,400 within a four day period led sell pressure to build up, allowing bears in the cryptocurrency exchange market to take over, leading Bitcoin to fall by a large margin.

In late August, ShapeShift CEO Erik Voorhees said that the bear market is not over yet, but the low price range of major cryptocurrencies present a viable opportunity for new investors to come into the market.

The daily chart of Bitcoin demonstrates four similar movements since February. In the past six months, Bitcoin has risen to $10,000, fell to $6,000, recovered to $10,000, and tested the $6,000 resistance level on four occasions.

In February, Bitcoin surged to $11,000 but fell back down to $6,000. In April, Bitcoin rose to $10,000 and dropped to $6,000. In July, Bitcoin rallied to $8,500, only to test the $6,000 resistance level a month later. In September, the same pattern occurs, with each peak on the upside eventually declining $6,000.

Caption: One-day Bitcoin price chart from Cryptowat.ch

If Bitcoin recovers from the $6,000 support level, the next short-term rally could send Bitcoin to $7,000, which may fall back to the $6,000 region. But, if the dominant cryptocurrency can successfully bottom out in the $6,000 region, a possibility for a proper mid-term rally with newly found momentum could emerge.

Factors behind the drop

Speaking to Cointelegraph, ThinkMarkets chief market analyst Naeem Aslam said that speculators have unnecessarily intensified the downtrend of Bitcoin by overselling Bitcoin in the global exchange market.

Aslam emphasized that the downward trend of Bitcoin has not changed since December of 2017, when the cryptocurrency market achieved a $900 billion valuation and initiated a rapid decline:

“Speculators have gone crazy and they are trying to squeeze as much blood out of this trade as they can. Bitcoin hasn’t changed what it was since last December, so what is the panic?”

Aslam added that it is difficult to pinpoint specific factors that have led the price of Bitcoin to drop substantially in recent months.

Analysts and investors in the cryptocurrency market and the broader financial market often attempt to find correlation in cryptocurrency price movements to developments in the cryptocurrency and blockchain sector.

However, correlation is not equivalent to causation, and because an event occurs at a certain time in which cryptocurrency prices fall or surge by a large margin, it does not necessarily mean that the event triggered a big movement in the cryptocurrency market.

TABB Group, an international research company, reported in July that the over-the-counter (OTC) Bitcoin is at least two to three times larger than the cryptocurrency exchange market.

Under the assumption that the OTC market is in fact two to three times bigger than the exchange market of crypto, developments in the cryptocurrency sector should have minimal impact on the price movements of cryptocurrencies — at least in the short-term — as the exchange market depends on the larger OTC market.

Reports have suggested that the correction of Bitcoin initiated on Wednesday was mainly caused by the delay in the decision of Goldman Sachs to launch a Bitcoin trading desk.

It is far-fetching to claim that the decision of a major investment bank to pivot from offering Bitcoin trading services — which may not appeal to its consumer base of institutions and large-scale corporations — to cryptocurrency custodian services led the price of Bitcoin to plunge within an hour.

Rather, it is more likely that the continuous build up of sell pressure on Bitcoin and other major cryptocurrencies since December of 2017 created instability and volatility in the market, causing the valuation of the market to drop.

Because the volume of Bitcoin remains relatively low in comparison to traditional assets and stores of value like gold, it is easier to trigger a domino effect across leading cryptocurrency exchanges.

Goldman Sachs delaying Bitcoin trading desk not relevant

On Sept. 6, Cointelegraph reported that Goldman Sachs has delayed the formal launch of its Bitcoin trading desk that is structured to facilitate rising demand from retail traders and individual investors.

Goldman Sachs spokesperson Michael DuVally told Reuters that the bank has not been able to reach consensus on the roadmap of its digital asset venture, citing various regulatory issues that currently exist in United States markets.

Hours after the statement of DuVally was released, Martin Chavez, the chief financial officer at Goldman Sachs, personally refuted reports that the institution is pivoting away from forming a Bitcoin trading desk operation, characterizing reports around it as “fake news.”

Aslam stated that it is premature to attribute the market’s struggle throughout this week to the delay in the launch of the Bitcoin trading desk operation by Goldman Sachs, as the bank has not closed its operation but merely delayed it to focus on a more urgent initiative that is cryptocurrency custodianship:

“Goldman has only delayed the process, they still have invested a lot of money and talent in this area. Investors must know it is very normal for banks to delay the IPO process if the market conditions are not favorable and over here we are talking about starting something completely new. Goldman has its fingers in many of the areas when it comes to Bitcoin, so stop thinking about it and focus on the price.”

Currently, the cryptocurrency market has a wide range of regulated exchanges in the likes of Coinbase, Gemini, and UPbit that can be used by retail traders to invest in the cryptocurrency market. However, it lacks trusted custodianship and solutions that can break the barrier between cryptocurrencies and institutions.

It can be argued that Goldman Sachs is working on a more urgent issue that needs to be addressed in order to convince the broader financial market and governments to acknowledge cryptocurrencies as an emerging asset class.

As such, while the Goldman Sachs announcement contributed to the fall of the market, as cryptocurrency technical analyst Uzi told Cointelegraph, it is difficult to acknowledge Goldman Sachs as the sole cause for the correction. Bitcoin was already facing resistance around $7,400, the peak it achieved last week before sliding downwards:

“I feel the Goldman Sachs news about them rolling back plans on their crypto trading desk definitely helped trigger the Bitcoin drop, we were facing some tough resistance around $7,400 as well, but it’s not the biggest secret in the world that a massive amount of BTC shorts was added on Bitfinex days before this drop. 10K BTC in shorts, I believe — follow the money, as they say.”

Same bear trend since February

Mati Greenspan, a senior analyst at eToro, one of the largest multi-asset trading platforms in the global finance sector, with eight million active users, echoed the sentiment of Aslam by stating that the cryptocurrency market has been in a similar trend over the last few months, unable to break out of the $8,000 resistance level with solid volume and momentum:

“Volatility in the crypto markets has picked up over the last few days but is still pretty normal for this market. As far as Bitcoin’s price is concerned, the price has been in a rather stable range between $5,000 and $8,000 for the last few months and this hasn’t changed.”

Greenspan added that the volatility in the market can be attributed to the lack of demand from traders in the cryptocurrency sector, rather than specific events which analysts have pinpointed as the primary cause of the recent correction.

“Several possible reasons for the drop could be a few bad rumors that are circulating in the press, along with a stronger dollar and weakness in tech stocks. Ultimately though, it’s simply a matter of more supply and less demand in short-term trading.”

Technical analyst says Bitcoin market is illiquid, fake volumes

Bitcoin is not considered a sufficiently liquid market, especially considering the fact that its exchange market is open to any individual investor and retail trader in the global market. While cryptocurrency market data providers estimate the daily volume of Bitcoin to be around $5 billion, studies have shown that most major cryptocurrency exchanges inflate their volumes through wash trading.

Alex Kruger, an economist and a cryptocurrency trader, stated earlier this week that Bithumb, South Korea’s second largest cryptocurrency exchange behind Kakao-run UPbit, said that more than $250 million worth of fake volume was created since Aug. 25.

He explained that one group of traders has been taking advantage of Bithumb’s 120 percent trading fee payback, which can generate about $90,000 in net income, with a $250 million daily trading volume.

“There currently are $250 million [in] fake volume traded at [the] Korean crypto exchange Bithumb, every day at 11 a.m. Korean Time, since Aug. 25. Bithumb offers 120 percent payback of trading fees as an airdrop. Trading fees are 0.15 percent taker. To collect the full KRW 1 billion rebate, a wash trader must thus trade KRW 278 billion. That is $250 million in daily fake volume. Notice how 31K Bitcoin are traded at exactly 11 a.m.”

Directly or indirectly, the method utilized by Bithumb has incentivized wash trading that bumps up the daily trading volume of the cryptocurrency exchange. The end outcome is a daily net income of $90,000 for a group of traders and a significant increase in the daily trading volume of Bithumb.

However, while the method leads to a win-win situation for both parties, it affects the global cryptocurrency exchange market in a negative way — as it reduces the authenticity of the international trading volume of cryptocurrencies.

Uzi stated that liquidity and fake volumes are two problems that cryptocurrency exchanges will have to address urgently, to ensure that investors in the market are protected and governments can recognize the sector as a legitimate industry:

“Solving the liquidity issue is one that needs to be tackled, and the issue of fake volume is something that needs to be addressed on a larger scale, because there are definitely questionable volumes on major exchanges.”

Uzi also noted that the Bitcoin market is still generally illiquid, given the lack of activity from institutions and large-scale hedge funds in the sector. He stated that the market is still not ready to support big demand from institutional investors, and most short or long contracts around Bitcoin filed through the U.S. futures market or cryptocurrency exchanges are done by individual investors.

“I have always felt the market for Bitcoin is still illiquid, and especially if you look at the altcoins market. I don’t feel any professional institution would take up a short position at that time on Bitcoin just out of the sheer volatility and the momentum it had testing a decent resistance, as well as the massive short being opened that was noticeable to most, it would be terrible risk management.”

Where the market goes next with Coinbase ETF variable

As Cointelegraph reported on Sept. 7, the world’s largest asset manager BlackRock, which oversees $6.317 trillion in assets, and Coinbase, the cryptocurrency sector’s biggest exchange and brokerage, are in talks to develop a cryptocurrency-based exchange-traded fund (ETF) to bolster market activity and facilitate growing demand from institutions for cryptocurrencies.

The entrance of VanEck and the Chicago Board Options Exchange (CBOE) has already increased the probability of the approval of the first Bitcoin ETF by the U.S. Securities and Exchange Commission (SEC). The involvement of BlackRock will create more competition in the Bitcoin ETF space among U.S.-based regulated financial institutions, which may lead to more contenders filing with the SEC to improve the liquidity of the dominant cryptocurrency.

Variables like Bakkt, the Coinbase-BlackRock ETF and positive regulation-related developments in Japan and South Korea could contribute to the recovery of the cryptocurrency in the short-term, which previous corrections in 2012, 2014, and 2016 did not have.

Experts generally agree that the correction of the cryptocurrency market on Sept. 6 was caused by increasing sell pressure and a culmination of various developments, rather than a single event like the Goldman Sachs Bitcoin trading desk announcement having an immense impact on a global market.

[ad_2]

Source link