[ad_1]

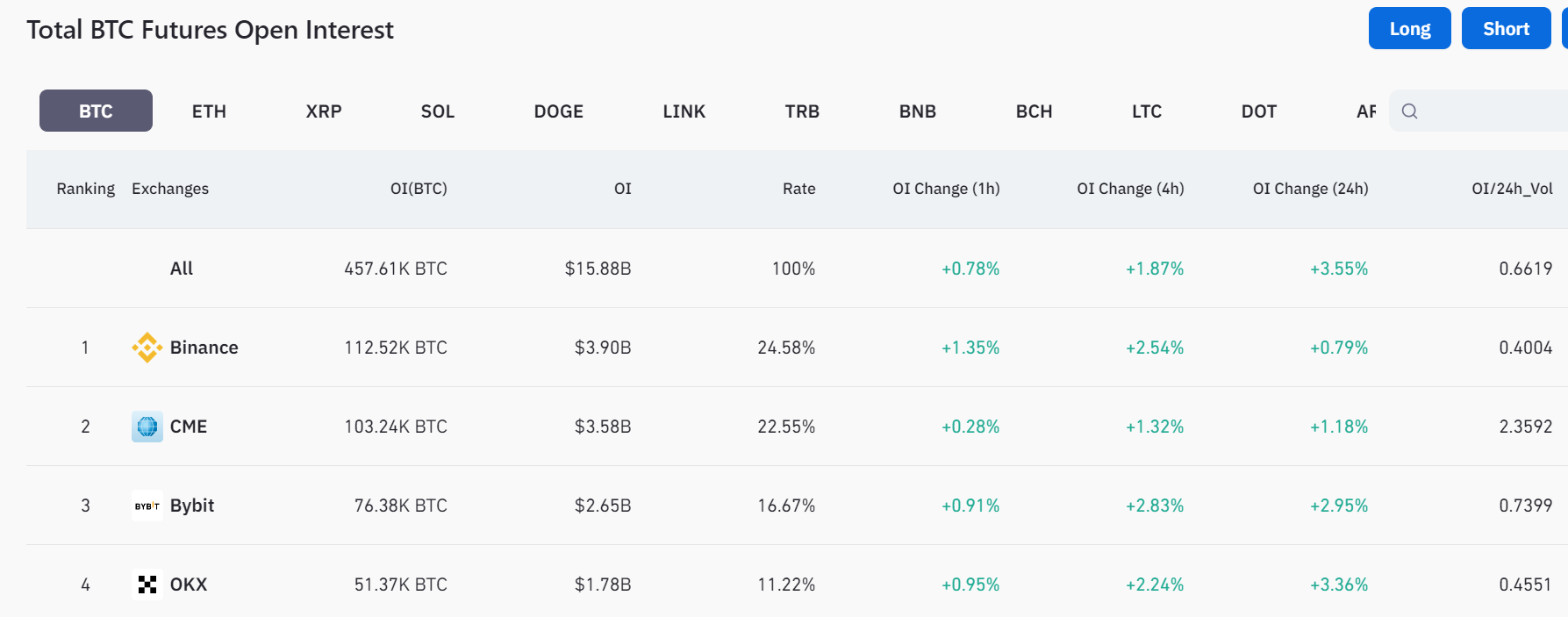

The Chicago Mercantile Trade (CME), a regulated Bitcoin (BTC) Futures alternate, now stands simply behind Binance when it comes to notional open curiosity (OI) to rank second within the record of BTC futures exchanges.

CME’s OI hit $3.58 billion earlier on Oct. 30, pushing the regulated derivatives alternate platform to leap two positions from the final week. CME overtook Bybit and OKX with $2.6 billion and $1.78 billion in OI, respectively, and is just some million away from Binance’s OI of $3.9 billion.

The usual Bitcoin futures contract provided by CME is valued at 5 BTC, while the micro contract is value a tenth of a Bitcoin. Perpetual futures, versus unusual futures contracts, are the primary focus of open curiosity in offshore exchanges as they arrive with out an expiration date and use the funding fee methodology to take care of their value parity with the market value.

Bitcoin open curiosity refers back to the complete variety of excellent Bitcoin futures or choices contracts out there. It’s a measure of the sum of money invested in Bitcoin derivatives at any given time. The OI measures the capital flowing out and in of the market. If extra capital flows to Bitcoin futures, the open curiosity will improve. Nonetheless, if the capital flows out, the open curiosity will decline. Therefore, rising open curiosity displays a bullish sentiment, whereas a declining OI signifies a rising bearish sentiment.

Associated: Blockchain congestion and transaction queues actually deter ‘nefarious actors’: Study

CME’s rising OI not solely helped the regulated futures alternate to climb to the second spot amongst futures crypto exchanges but in addition noticed its cash-settled futures contracts exceed 100,000 BTC in quantity. The rising curiosity of merchants within the Bitcoin futures market has additionally propelled CME to realize 25% of the Bitcoin futures market share.

A majority chunk of funding into CME futures has come by way of customary futures contracts indicating an inflow of institutional curiosity as Bitcoin registered a large double-digit surge in October, serving to it attain a brand new one-year excessive above $35,0000.

Journal: Deposit risk: What do crypto exchanges really do with your money?

[ad_2]

Source link