[ad_1]

Bitcoin (BTC) begins the primary week of December trying higher than it has since early 2022 — at over $40,000.

BTC worth motion is delighting bulls already because the month begins, with the weekly shut offering the primary journey above the $40,000 mark since April final yr.

Shorts are getting wiped and liquidity taken because the bull run sees its newest enhance on the again of macroeconomic modifications and anticipation of the USA’ first spot worth exchange-traded fund (ETF).

Regardless of misgivings and a few predicting a serious worth retracement, Bitcoin continues to supply little respite for sellers, who regularly miss out on earnings or are left ready on the sidelines for an entry worth which by no means comes.

The get together temper is not only mirrored on markets — Bitcoin miners are busy getting ready for the halving, and with hash charge already at all-time highs of its personal, the development is ready to proceed this week.

Is there extra upside left or is Bitcoin getting forward of itself?

That is the query that longtime market contributors can be asking within the coming days as legacy markets open and alter to a post-$40,000 BTC worth.

Cointelegraph takes a more in-depth have a look at the state of Bitcoin this week and examines the potential volatility catalysts mendacity in retailer for hodlers.

Bitcoin surges previous $40,000 — however critical correction stays on watchlist

Bitcoin is firmly reminding buyers of “Uptober” because the month will get underway — by liquidating shorts and beating out key resistance ranges.

The enjoyable started into the weekly shut, when $40,000 got here into view for the primary time since April final yr.

Bulls didn’t decelerate there, nevertheless, and BTC/USD continued rising to present native highs of $41,800, information from Cointelegraph Markets Pro and TradingView confirms.

In doing so, Bitcoin has wiped quick positions to the tune of over $50 million on Dec. 4 alone, per statistics from CoinGlass — already the biggest single-day tally since Nov. 15.

Maybe understandably, many merchants are calling for upside continuation towards $50,000, with leveraged quick liquidity slowly disappearing as BTC worth efficiency edges greater.

#bitcoin persevering with to work by means of the 3x, 5x, 10x quick liquidity. pic.twitter.com/aRwvJil3c6

— Decentrader (@decentrader) December 4, 2023

“Somebody nonetheless aggressively chasing worth right here,” fashionable dealer Skew wrote throughout coverage of reside market strikes.

“Extra importantly if mentioned giant market entity truly permits some bids to get stuffed or not. IF stuffed then anticipated for them to push worth greater. Clearly $40K is the value for institutional gamers.”

Nonetheless, not everyone seems to be so positive that the great instances will proceed.

For fashionable dealer Crypto Chase, present ranges symbolize an excellent place to “entice” late longs and take Bitcoin $10,000 decrease.

“Low 40’s then we see low 30’s. Mistaken within the low 50’s, a 1:1 commerce basically,” he initially instructed subscribers on X (previously Twitter) on Nov. 23 in a submit which he repeated on the day.

$BTC ideas

Low 40’s could be the right bull entice IMO.

• Bear stops set off (I initially had my cease right here however opted for guide intervention weeks in the past).

• Contemporary wave of bull FOMO upon “damaged resistance”. Exit liquidity generated.

• Month-to-month resistance *seems to be* as if it is…— Crypto Chase (@Crypto_Chase) November 22, 2023

“To me, this cycle isn’t any totally different than others. At the moment up solely, quickly to be down solely. That is basically how $BTC all the time trades,” he continued in a part of recent evaluation.

“I imagine present costs are overextended. Will add to shorts at 43K.”

Markets longing for Fed pivot in countdown to FOMC

Final week’s assortment of U.S. macroeconomic information experiences did little to shift Bitcoin from what was then a slim buying and selling vary.

That all began to change, nevertheless, when Jerome Powell, Chair of the Federal Reserve, took to the stage to ship what many interpreted as a sign that financial coverage was about to vary considerably.

This might come through the Fed starting to decrease baseline rates of interest — a watershed second for crypto and threat property which might be first in line to learn from growing liquidity deployments by merchants at the moment in money.

As Cointelegraph reported, this Fed “pivot” was beforehand not anticipated or signaled by officers till a minimum of mid-2024, however latest forecasts have introduced the unofficial deadline ahead quickly. Invoice Ackman, CEO and founding father of hedge fund Pershing Sq. Capital Administration, mentioned final week that he expects a pivot in Q1.

“I believe they’re going to chop charges; I believe they’re going to chop charges before folks count on,” he instructed Bloomberg on the time.

Earlier than the brand new yr, the Fed will make another choice on charges, this due in beneath two weeks. Final week’s information prints, which affirmed the narrative of abating inflation, thus constituted essential contributions to that call — these due for launch this week and subsequent fall inside the Fed’s “blackout interval,” the place officers are usually not permitted to touch upon coverage.

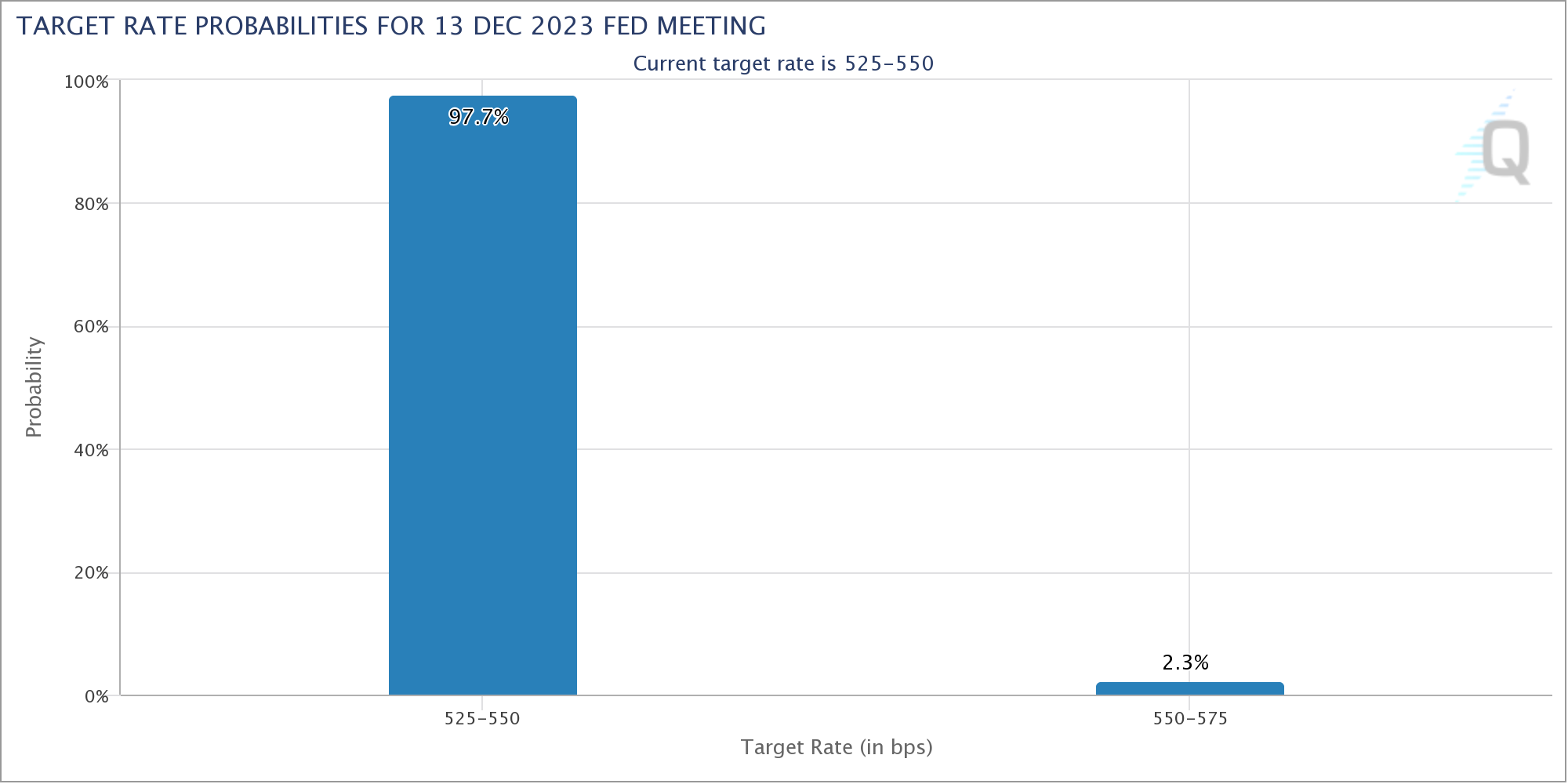

Per information from CME Group’s FedWatch Tool, markets overwhelmingly imagine that charges, whereas not as a consequence of drop simply but, will stay at present ranges after the choice.

This week’s prints embody nonfarm payrolls and different employment information at a time the place U.S. jobless charges are close to historic lows.

“Tons of employment information this week that can closely impression subsequent week’s Fed assembly. Final month of buying and selling for 2023,” monetary commentary useful resource The Kobeissi Letter wrote in a part of its weekly rundown of key macro diary dates.

Key Occasions This Week:

1. JOLTs Jobs Knowledge – Tuesday

2. ISM Non-Manufacturing PMI – Tuesday

3. ADP Nonfarm Employment Knowledge – Wednesday

4. Preliminary Jobless Claims Knowledge – Thursday

5. Client Sentiment Knowledge – Friday

6. November Jobs Report – Friday

We’re one week out from the…

— The Kobeissi Letter (@KobeissiLetter) December 3, 2023

Gold worth spike sparks issues as U.S. liquidity rushes again

Others famous that Bitcoin and crypto gaining is probably going as a consequence of extra than simply information.

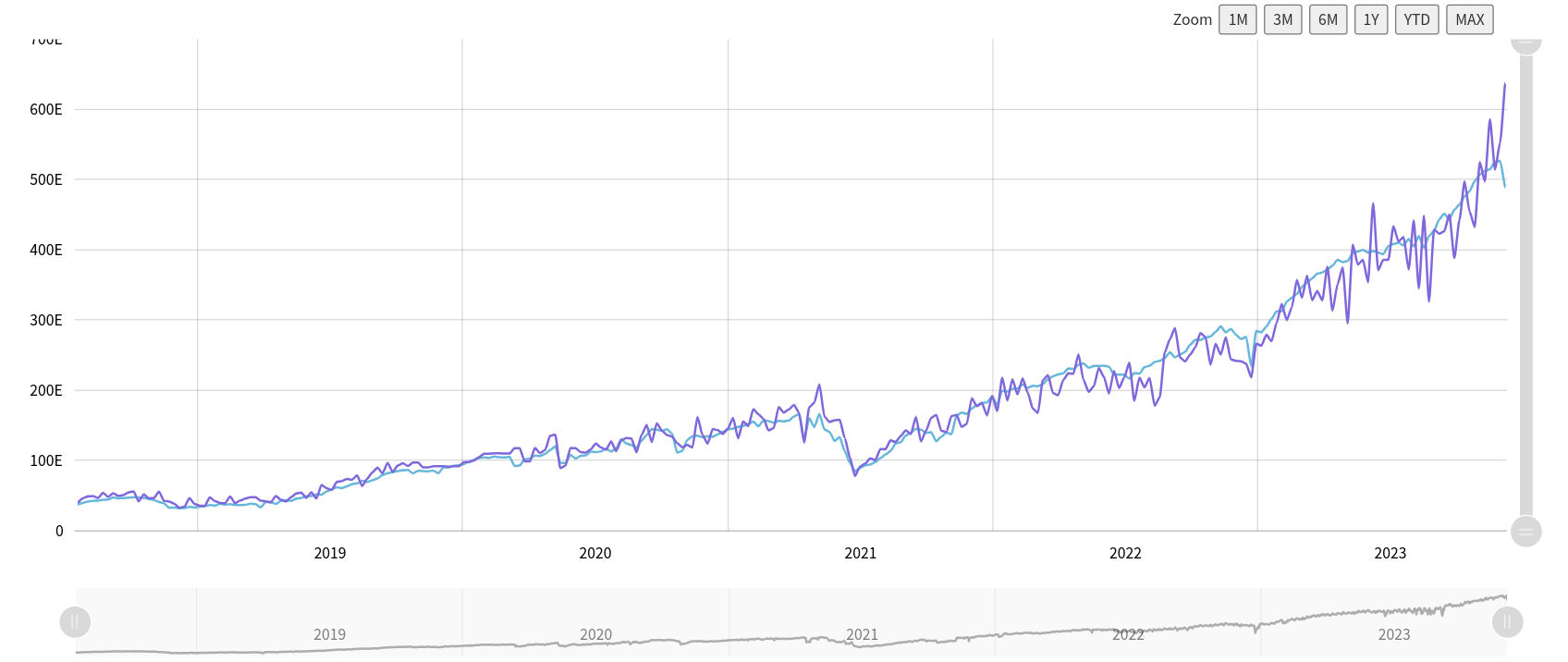

They’re all a perform of International Liquidity.

International Liquidity goes up, they usually all observe. pic.twitter.com/Zekzclup6g

— Philip Swift (@PositiveCrypto) December 4, 2023

The Fed’s reverse repo facility is declining quickly, injecting extra liquidity into the financial system — arguably the important thing variable for threat asset efficiency worldwide.

“That is cash that is in any other case stashed with the Fed in a single day which is coming into the financial system/markets. This tends to assist out threat property and produce $DXY down,” Daan Crypto Trades wrote in commentary on an accompanying chart.

The U.S. greenback index (DXY), a measure of USD energy towards a basket of main buying and selling accomplice currencies, is at the moment within the midst of a modest rebound after hitting four-month lows final week.

Liquidity is on the radar of institutional names inside the crypto area, amongst them Dan Tapiero, founder and CEO of 10T Holdings.

The latest U.S. bond rout supplies a uncommon shopping for alternative on par with the 2008 International Monetary Disaster and 2020 COVID-19 crash, he argued final week, once more concluding that liquidity ought to “rush” into shares and Bitcoin.

NOTHING goes down eternally.

H/T @APompliano for the chart.

Rates of interest peaked/ yields happening loads subsequent yr.

2 biggest shopping for alternatives of the final 40 years in fairness equal now in bonds.

2yrs headed again to three%.

Liquidity rushes into #NASDAQ #Bitcoin #gold pic.twitter.com/uTwBErJt2I

— Dan Tapiero (@DTAPCAP) December 1, 2023

Charles Edwards, founding father of quantitative Bitcoin and digital asset fund Capriole Investments, was one determine noting liquidity traits preempting Fed motion already — with the biggest U.S. monetary easing in forty years occurring in November.

November noticed the biggest easing in over 40 years! https://t.co/cRRVIpgDFj

— Charles Edwards (@caprioleio) December 4, 2023

As Cointelegraph reported, gold is already reacting, hitting new greenback all-time highs and spiking almost 4% on the day earlier than correcting.

Such habits is uncommon, others argue, anticipating “one thing huge” occurring this week.

One thing VERY BIG is coming tomorrow. Gold simply BLASTED previous all time highs on a Sunday evening.

Somebody is aware of one thing.— Tom Crown (@TomCrownCrypto) December 3, 2023

“Except somebody is getting carried out proper now after shorting Gold, that is saying one thing vital,” the favored social media commentator and dealer referred to as Horse suggested.

“Gold would not simply arbitrarily rip on a Sunday like this except it means one thing.”

Responding, fashionable dealer Bluntz likewise expressed concern in regards to the ongoing cross-asset surge, including that this principally targeted on worldwide inflation traits.

Bitcoin miners take hash charge relentlessly greater

There may be little standing in the way in which of Bitcoin miners and their want to cowl themselves going into April’s block subsidy halving.

My quick thought when #Bitcoin pumps, is how onerous miners are gonna pump straight after.

— James V. Straten (@jimmyvs24) December 2, 2023

Final month, estimated hash rate hit new document highs and passed 500 exahashes per second (EH/s) for the primary time in Bitcoin’s historical past.

The development goes nowhere as December begins — the following problem readjustment will add an estimated 1.6% to the already document excessive tally, reflecting the depth of competitors for block rewards.

Per information from statistics useful resource BTC.com, this can mark Bitcoin’s seventh consecutive upward adjustment.

“The Bitcoin hashrate will enter the enjoyable stage of its parabolic superior this cycle because the fourth and ultimate section of mining is upon us,” Nick Cote, founder and CEO of digital asset market SecondLane, predicted in a part of latest X commentary.

“Refined contributors who’ve ∞ assets & authorities alignment will put the boot to the necks of inefficient miners as the speed of deployment accelerates.”

Alex Thorn, head of firmwide analysis at crypto training useful resource Galaxy, in the meantime made reference to the agency’s “bull case” for hash charge turning into actuality.

“This is without doubt one of the most fascinating charts on this planet proper now,” he told X subscribers in regards to the hash charge numbers.

“An image price a thousand phrases.”

Greed matches $69,000 Bitcoin all-time excessive

The most recent journey to 19-month highs has doubtless delivered a good bigger enhance to crypto market greed.

Associated: Bitcoin ETF will drive 165% BTC price gain in 2024 — Standard Chartered

Knowledge from the Crypto Fear & Greed Index — the benchmark sentiment indicator — already places greed ranges at highs not seen since November 2021, when Bitcoin set its newest all-time excessive.

A lagging indicator, Worry & Greed had not taken the journey past $40,000 into consideration on the time of writing, however nonetheless stood at 74/100 — verging on “excessive greed.”

The Index makes use of a basket of things to find out the general temper amongst crypto buyers. Its implications serve to foretell marketwide development reversals when both worry or greed reaches unsustainably excessive ranges.

To that extent, the $69,000 peak marked an anomaly — historic precedent calls for {that a} correction enter when the Index passes 90/100. The present bull market might thus have room left to run earlier than irrational exuberance takes maintain, commentators have previously argued.

This text doesn’t include funding recommendation or suggestions. Each funding and buying and selling transfer includes threat, and readers ought to conduct their very own analysis when making a choice.

[ad_2]

Source link