[ad_1]

The quantity of “purchase the dip” mentions on social media rose to the best ranges in 22 months, in line with knowledge from Santiment. The blockchain analytics agency mentioned the variety of social media mentions for the phrase rose to 323, the best since March 25, 2022.

A major rise in “purchase the dip” mentions throughout social platforms is a sign of preliminary excessive dealer optimism for a fast market restoration.

This optimism soared significantly after the crypto market flash crash on Jan. 3, signaling rising consciousness amongst merchants concerning the alternatives decrease ranges current.

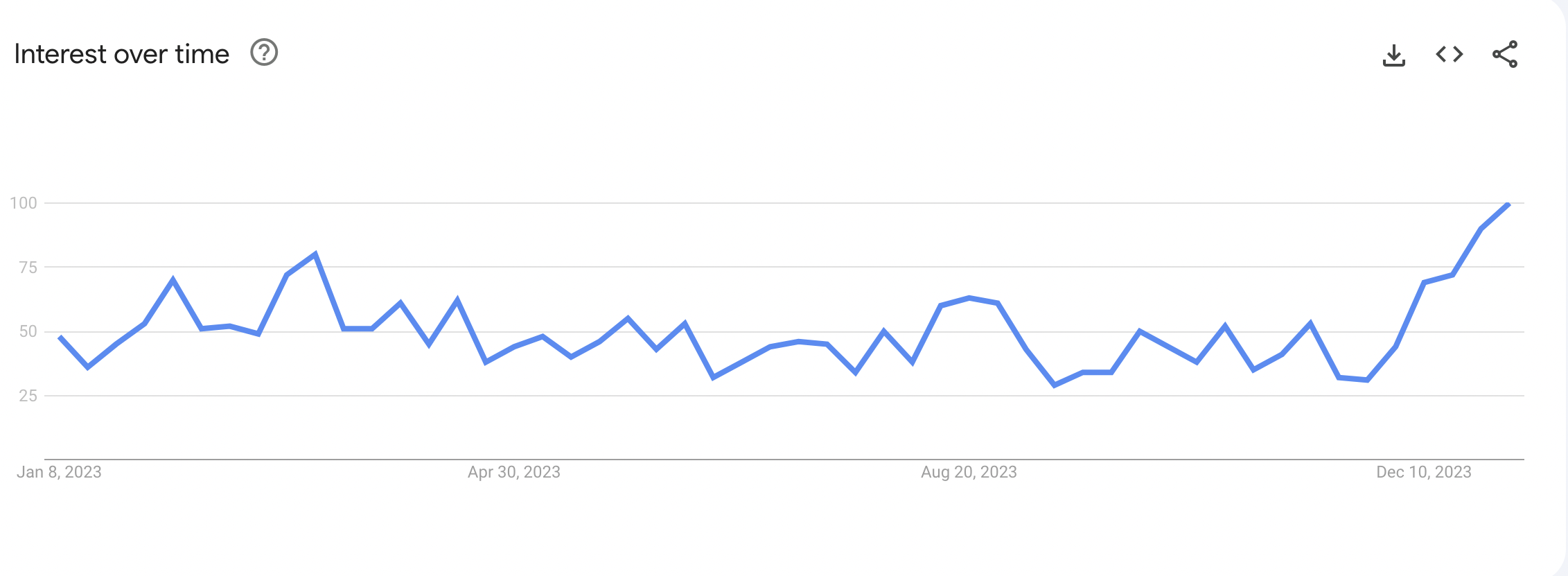

Information from Google Traits reveals consumer curiosity within the time period “purchase the dip” has been on an upward trajectory for the reason that finish of November 2023.

Google Traits is a instrument that analyzes the recognition of Google Search phrases utilizing real-time knowledge.

The above chart exhibits folks have been looking out the time period “purchase the dip” during the last six weeks, impacted by market traits and occasional dips in costs.

Folks on X (previously Twitter) have been among the many most optimistic about costs recovering shortly, with a number of analysts calling on market members to not “search for causes to promote” however “purchase the dip.”

Perma bulls and lengthy solely do not search for causes to promote, solely purchase the dip. https://t.co/S8ctGjXOh6

— David A. Yablon (@day54) January 4, 2024

One other Jan. 3 put up from X consumer Mud identified that “worth motion on the upper timeframe is asking for a a lot bigger run up in worth,” including that it’s a “purchase the dip situation.”

I have been extraordinarily bullish on Bitcoin during the last couple of months extra so than ever, why is that?

As a result of the worth motion on the upper timeframe is asking for a a lot bigger run up in worth.

Little dumps do not matter right here.

It is a purchase the dip situation.

— mud (@DustMacro) January 4, 2024

A spike within the variety of calls to purchase the dip has traditionally offered alternatives for affected person merchants. Nevertheless, it has additionally been identified to mark deeper corrections.

As an illustration, spikes within the buy-the-dip calls in the course of the 2021 bull run have been adopted by deeper pullbacks in costs.

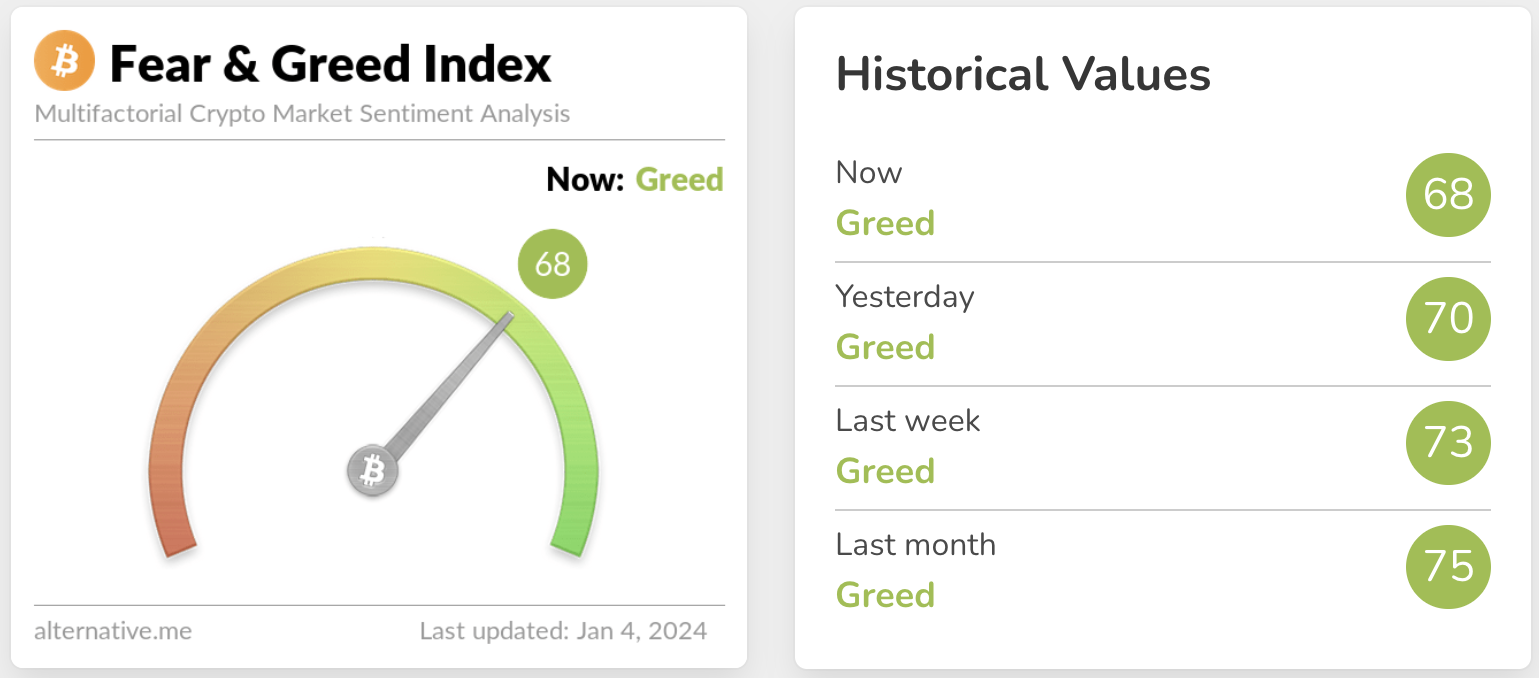

Nevertheless, the Crypto Concern and Greed Index stays within the “greed” territory, in line with Different.me. Although the measure dropped from 73 final week to 68 on Jan. 4, it is a sign that merchants are nonetheless optimistic concerning the market persevering with the uptrend.

Associated: Bitcoin bull market metrics ‘almost reset’ as BTC price hovers at $43K

BTC worth drop sparks “purchase the dip” sentiment

The surge within the calls to purchase the dip adopted a pointy drop within the worth of Bitcoin (BTC) on Jan. 3, which nosedived as a lot as 9% from $45,510 to $41,000, ranges final seen in December 2023, virtually wiping out all the gains made since Jan. 1.

The drop flushed out many leveraged positions, with over $700 million in lengthy liquidations in 24 hours.

The marketwide correction was attributed to a report by digital monetary providers platform Matrixport retracting its recent forecast that the US Securities and Alternate Fee would probably approve the primary spot Bitcoin exchange-traded funds (ETFs) in January 2024.

Matrixport claimed that the SEC will reject all spot Bitcoin ETFs in January and that such approvals gained’t come earlier than Q2 of this yr.

On the time of writing, Bitcoin is tradin at $44,417, up 3.8% during the last 24 hours, in line with knowledge from CoinMarketCap.

The lengthy decrease wick on the Jan. 3 candlestick instructed that the bulls have been shopping for aggressively on the disadvantage to $41,000.

All the foremost transferring averages have been dealing with upward, suggesting that the upside was not over. The bulls at the moment are targeted on returning to $45,000 and flipping it into help. In the event that they succeed, they’d set their eyes on the subsequent main resistance at $50,000.

On the draw back, bears may proceed profit-taking with the ensuing promoting strain pulling Bitcoin towards $42,000 and later $40,000.

In the meantime, market members await with bated breath the SEC’s decision on spot Bitcoin ETFs and the way the massive crypto and, by extension, the broader market will react.

This text doesn’t include funding recommendation or suggestions. Each funding and buying and selling transfer entails threat, and readers ought to conduct their very own analysis when making a choice.

[ad_2]

Source link