[ad_1]

The 9.6% intraday Bitcoin (BTC) value correction on Jan. 3 dropped the value to $40,940 and created turmoil and substantial losses for by-product merchants. That is evident from the $137 million in leverage long futures liquidations, marking the best in over 4 months.

Fortuitously, for bulls, Bitcoin value rebounded considerably shortly and at present trades above $44,000. This has raised the query of whether or not BTC value can attain $46,000 earlier than the upcoming SEC choice on the various pending spot Bitcoin exchange-traded fund (ETF) purposes.

U.S authorities debt development favors risk-on property, together with Bitcoin

The surging United States authorities debt and expectations of rate of interest cuts by the U.S. Federal Reserve present a constructive situation for risk-on markets, together with cryptocurrencies. Minutes from the current Federal Open Market Committee assembly, launched on Jan. 4, strengthened expectations of si quarter-point cuts this 12 months. Notably, U.S. authorities debt curiosity has exceeded $1 trillion per 12 months, as reported by Bloomberg.

Mounting debt and political discord within the U.S. have led to credit standing downgrades for the nation. Fitch downgraded its sovereign debt rating from AAA to AA+ in August 2023, and Moody’s warned of a possible downgrade from the remaining AAA score. Home Republicans intention to chop spending under the degrees agreed upon within the June debt ceiling deal, whereas Senate Democrats oppose such cuts, leaving the specter of a authorities shutdown looming.

Buyers are pricing in additional U.S. authorities debt issuance and the next lack of the greenback’s buying energy. This development tends to have an effect on different fiat currencies as central banks comply with the Fed’s lead, holding excessive rates of interest to restrain financial progress. Nonetheless, the U.S. deficit may turn into unsustainable if the financial authority insists on reaching the two% inflation goal earlier than reducing rates of interest.

Bitcoin futures show resilience after the Jan. 3 value crash

To find out whether or not Bitcoin’s value features after the Jan. 3 crash can proceed and doubtlessly break above the $46,000 resistance, one should analyze BTC derivatives markets.

It’s essential to notice that the $137 million liquidation on Jan. 3 didn’t decimate the bulls. For starters, BTC futures open curiosity stays at $18.5 billion, that means lower than 1% of contracts have been affected by the current value crash. Moreover, knowledge stays according to the earlier month, downplaying the importance of current value swings.

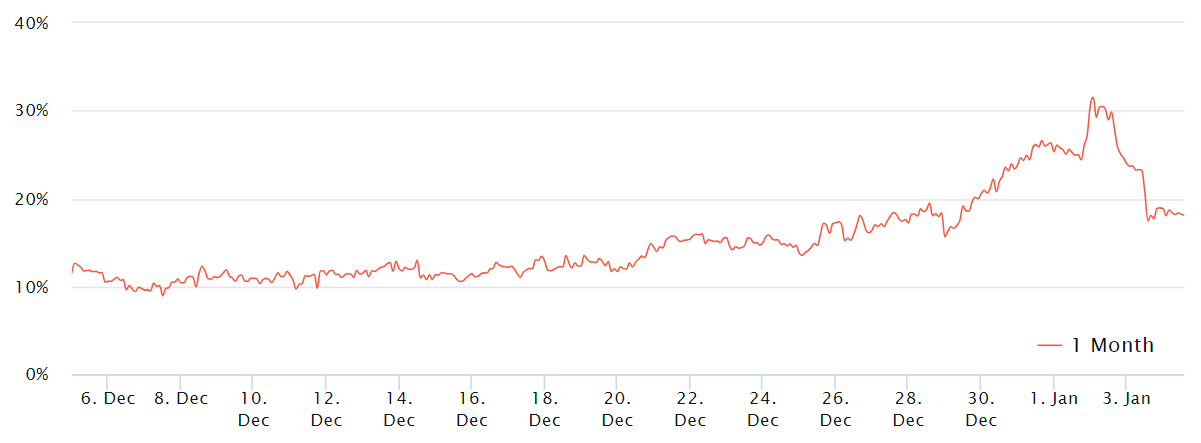

To grasp skilled merchants’ positions after the shock rally, one ought to analyze BTC derivatives metrics. Bitcoin month-to-month futures usually commerce at a 5%–10% annualized premium in contrast with spot markets, indicating that sellers demand further cash to postpone settlement.

The present Bitcoin futures premium stands at 18%, remaining unchanged from the earlier week. The weird facet was the exaggerated 31% peak on Jan. 2. Merchants displayed extreme confidence in ETF approval odds before Jan. 10, counting on extreme leverage, which finally uncovered them to liquidations throughout value volatility.

Bitcoin choices depart room for upside shock within the case of a spot ETF approval

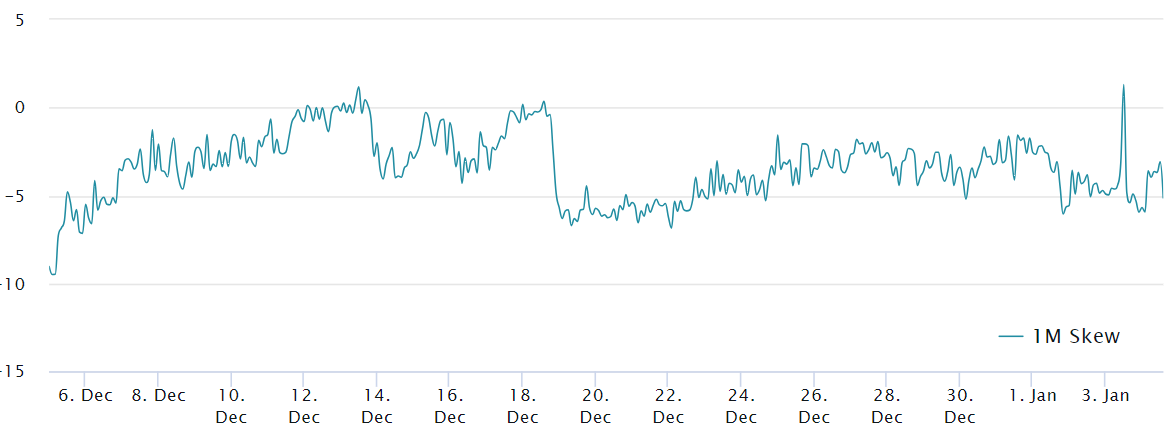

To evaluate whether or not the dip under $41,000 dashed bullish hopes, one ought to look at the Bitcoin choices markets. Throughout anticipation of a Bitcoin value drop, the delta 25% skew tends to rise above 7%. In distinction, intervals of pleasure usually see a delta skew under unfavourable 7%.

Associated: No crystal ball – Crypto price predictions that didn’t pan out in 2023

Discover how the Bitcoin choices skew barely modified in the course of the current value drop on Jan. 3, indicating that professional merchants weren’t affected and didn’t rush for protecting put choices. If these merchants had feared a unfavourable or postponed ETF choice, the 25% skew indicator would have shifted accordingly.

Skilled merchants seem unaffected by the value swing and are accustomed to the FOMO (concern of lacking out) and FUD (concern, uncertainty and doubt) that encompass vital occasions like a possible ETF approval. Nonetheless, this doesn’t assure a bull run above $46,000 forward of the SEC choice, particularly on condition that traders had ample time to build up and strategize because of the regulator’s publicized deadlines.

This text doesn’t comprise funding recommendation or suggestions. Each funding and buying and selling transfer entails threat, and readers ought to conduct their very own analysis when making a choice.

[ad_2]

Source link