Ethereum’s native token Ether (ETH) has declined by more than 35% against Bitcoin (BTC) since December 2021, with a potential to decline further in the coming months.

ETH/BTC dynamics

The ETH/BTC pair’s bullish trends typically suggest an increasing risk appetite among crypto traders, where speculation is more focused on Ether’s future valuations versus keeping their capital long-term in BTC.

Conversely, a bearish ETH/BTC cycle is typically accompanied by a plunge in altcoins and ETH’s decline in market share. As a result, traders seek safety in BTC, showcasing their risk-off sentiment within the crypto industry.

Ethereum TVL wipe-out

Interest in the Ethereum blockchain soared during the pandemic as developers started turning to it to create a wave of so-called decentralized finance (DeFi) projects, including peer-to-peer exchange and lending platforms.

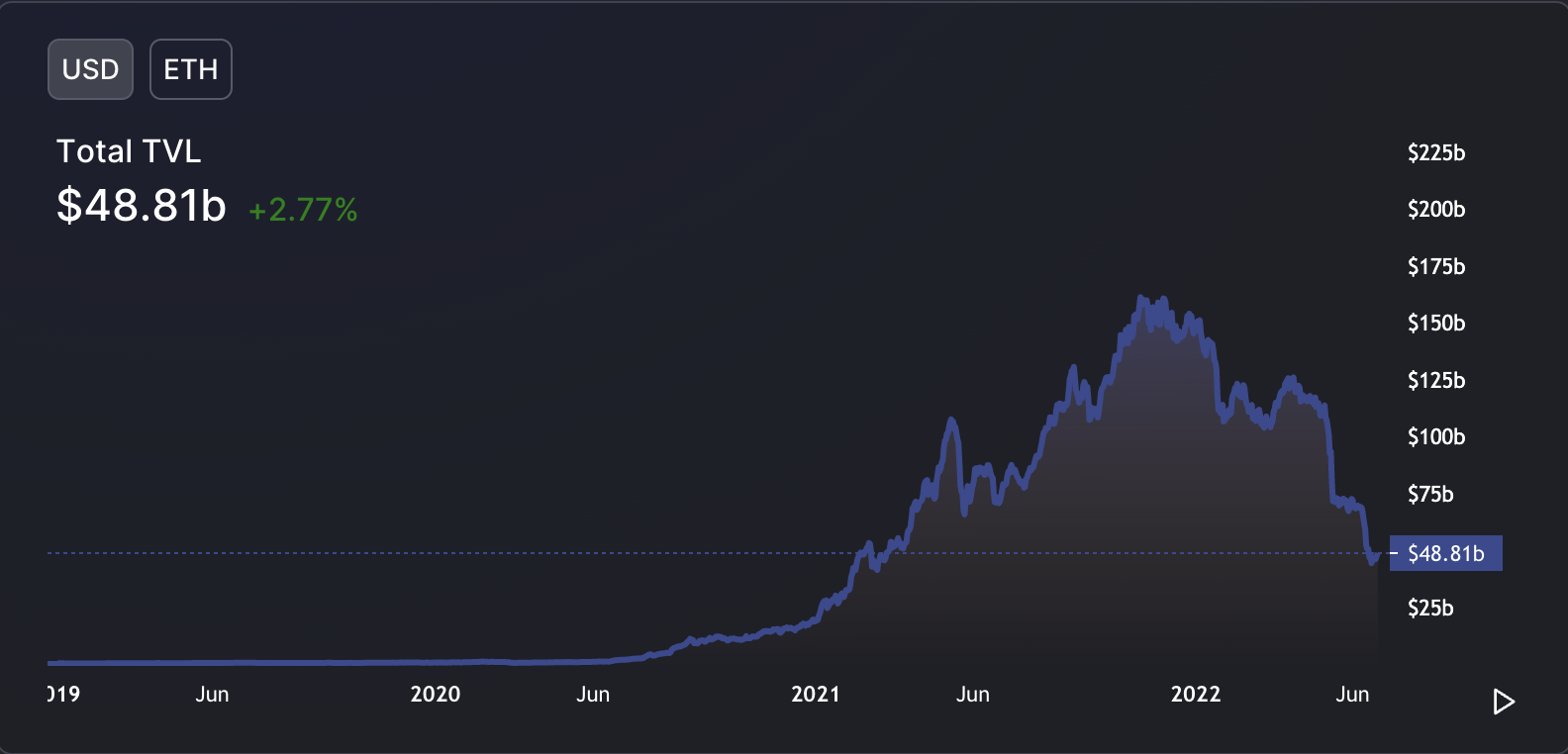

That resulted in a boom in the total value locked (TVL) inside the Ethereum blockchain ecosystem, rising from $465 million in March 2020 to as high as $159 billion in November 2021, up more than 34,000%, according to data from DefiLlama.

Interestingly, ETH/BTC surged 345% to 0.08, a 2021 peak, in the same period, given an increase in demand for transactions on the Ethereum blockchain. However, the pair has since dropped over 35% and was trading for 0.057 BTC on June 26.

ETH/BTC’s drop coincides with a massive plunge in Ethereum TVL, from $159 billion in November 2021 to $48.81 billion in June 2022, led by a contagion fears in the DeFi industry.

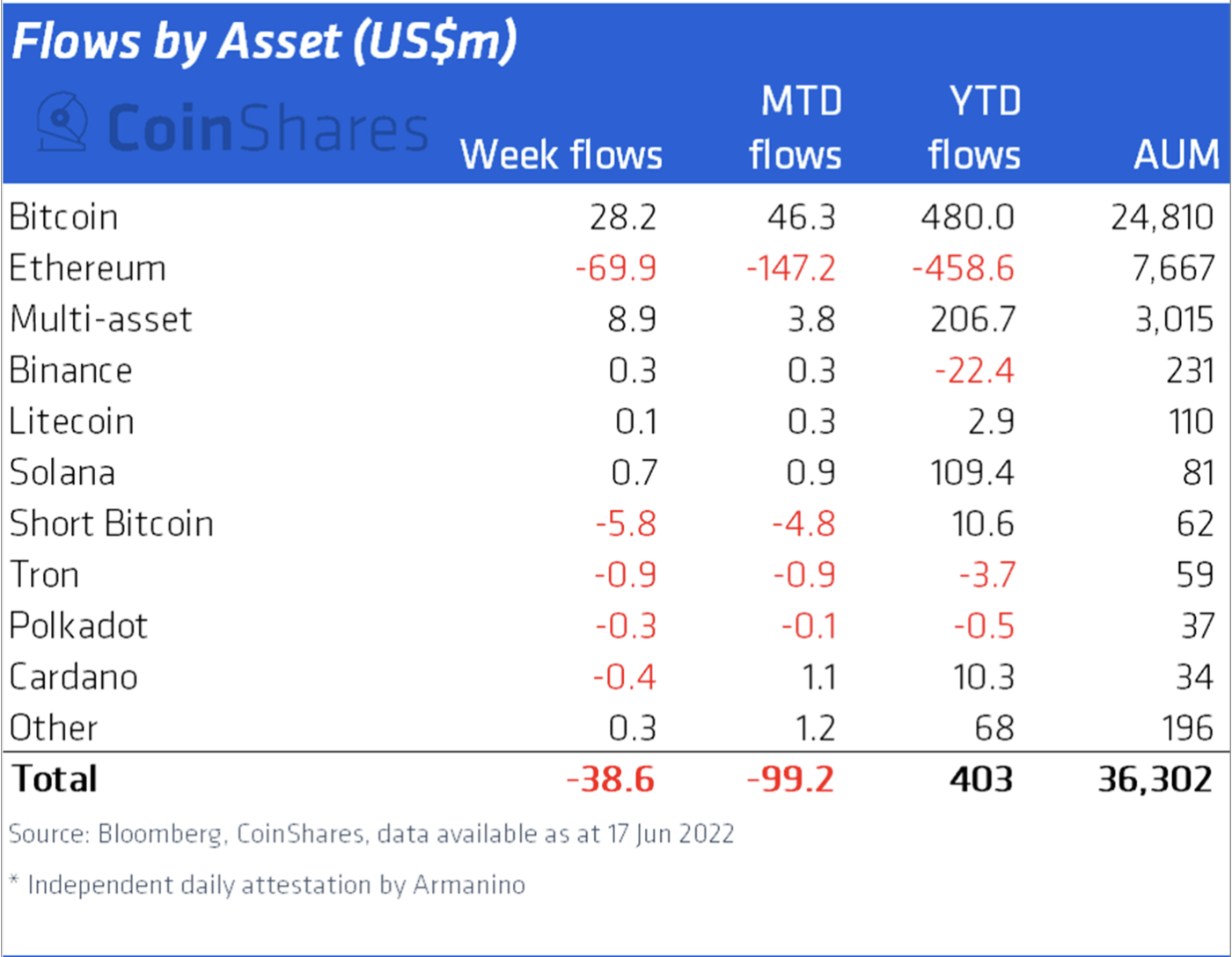

Also, institutions have withdrawn $458 million this year from Ethereum-based investment funds as of June 17, suggesting that interest in Ethereum’s DeFi boom has been waning.

Bitcoin struggling but stronger than Ether

Bitcoin has faced smaller downsides compared to Ether in the ongoing bear market.

BTC’s price has dropped nearly 70% to around $21,500 since November 2021, versus Ether’s 75% drop in the same period.

Also, unlike Ethereum, Bitcoin-focused investment funds have seen inflows of $480 million year-to-date, showing that BTC’s drop has done little to curb its demand among institutional investors.

ETH/BTC downside targets

Capital flows, coupled with an increasing distrust in the DeFi sector, could keep benefiting Bitcoin over Ethereum in 2022, resulting in more downside for ETH/BTC.

Related: Swan Bitcoin CEO against crypto lenders: Users are way under-compensated for the risk

From a technical perspective, the pair has been holding above a support confluence defined by a rising trendline, a Fibonacci retracement level at 0.048 BTC and its 200-week exponential moving average (200-week EMA; the blue wave in the chart below) near 0.049 BTC.

In a rebound, ETH/BTC could test the 0.5 Fib line next near 0.062. Conversely, a decisive break below the support confluence could mean a decline toward the 0.786 Fib line at 0.027 in 2022, down more than 50% from the price on June 26.

The ETH/BTC breakdown might coincide with an extended ETH/USD market decline, primarily due to the Federal Reserve's quantitative tightening that has recently pressured crypto prices lower against the United States dollar.

$ETH historical Bear Markets correction depth:

• -72%

• -94%

• -82% (and counting)

Read more about #ETH Market Cycles here:https://t.co/5hIo7SC1n6#Crypto #Ethereum pic.twitter.com/7Ol0q3xM9G

— Rekt Capital (@rektcapital) June 25, 2022

Conversely, weaker economic data could prompt the Fed to cool down on its tightening spree. This could limit Ether and the other crypto assets’ downside bias in the dollar market, according to Informa Global Markets.

The firm noted:

“Macroeconomic conditions need to improve and the Fed’s aggressive approach to monetary policy has to subside before crypto markets see a bottom.”

But, given that Ether has never reclaimed its all-time high against Bitcoin since June 2017 despite a strong adoption rate, the ETH/BTC pair could remain under pressure with the 0.027-target in sight.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.