[ad_1]

Ethereum’s native token Ether (ETH) has dropped more than half of its value in 2022 in dollar terms, while also losing value against Bitcoin (BTC) and now remains pinned below $2,000 for several reasons.

What’s more, ETH price could face even bigger losses in June due to another slew of factors, which will be discussed below.

Ethereum funds lose capital en masse

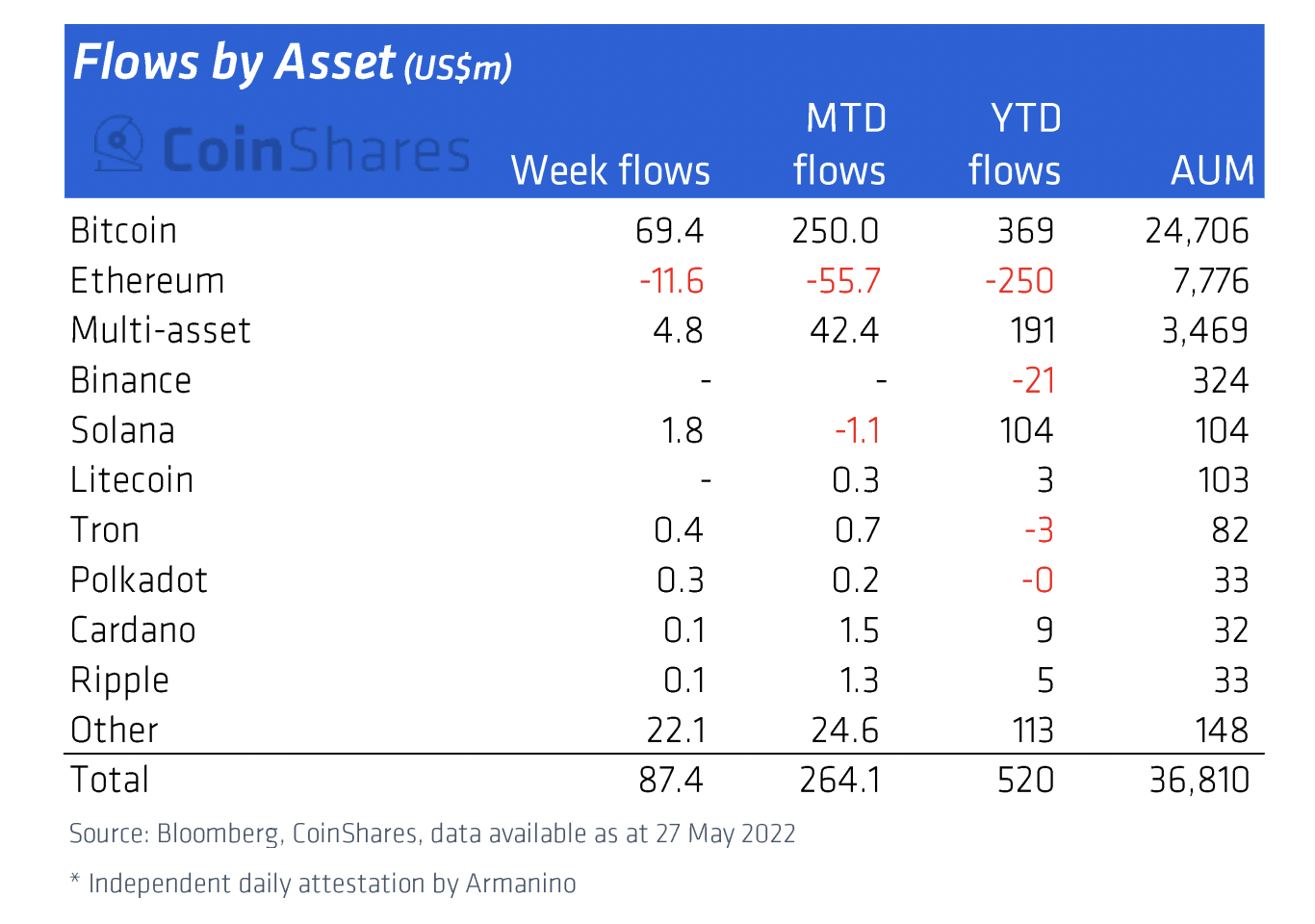

Investors have withdrawn $250 million out of Ethereum-based investment funds in 2022, according to CoinShares’ weekly market report published May 31.

The massive outflow appears in contrast to other coins. For instance, investors have poured $369 million into Bitcoin-based investment funds in 2022.

Meanwhile, Solana and Cardano, layer-one blockchain protocols competing with Ethereum, have attracted $104 million and $9 million, respectively.

The withdrawals from Ethereum funds are a sign of how the recent crash in TerraUSD (UST) and Terra (LUNA) — tokens within Terra’s algorithmic stablecoin ecosystem — has dampened interest in the overall decentralized finance (DeFi) sector.

ETH’s bullish prospects remain glued to anticipations of a boom in the DeFi market, because Ethereum’s blockchain host a majority of financial applications in the sector. As of June 5, the total valued locked (TVL) inside the Ethereum-based apps was $68.71 million, almost 65% of the total DeFi TVL.

But, the TVL still reflects a massive retreat from Ethereum’s DeFi pools, which, before the collapse of Luna Classic (LUNC) and TerraUSD Classic (USTC) on May 9, was hovering around $100 billion.

With macro risks led by the Federal Reserve’s hawkish policies, coupled with a cautious outlook around the DeFi sector, Ether looks poised to continue its decline in June, according to Ilan Solot, a partner at Tagus Capital.

He told the Financial Times:

“If the Federal Reserve is tightening, the world is in recession, and people need to pay $4.5 per gallon of gas, they’ll have less to invest in DeFi or spend on blockchain games.”

Sluggish technicals

Trading behavior witnessed since May also paints a bearish outlook for Ethereum.

In detail, Ether has been fluctuating inside a range defined by a horizontal trendline support and a falling trendline resistance. The pattern looks more or less like a “descending triangle,” a bearish continuation pattern when formed during a downtrend.

Related: Total crypto market cap risks a dip below $1 trillion if these 3 metrics don’t improve

As a rule of technical analysis, descending triangles resolve after the price breaks decisively below their support trendline and then falls by as much as the triangle’s maximum height. Ether risks undergoing a similar downside move in June, as shown in the chart below.

If ETH’s price breaks below the triangle’s lower trendline, it risks falling toward $1,350 in June, down about 25% from today’s price.

ETH reserves on exchanges are increasing

The total number of Ether balances at crypto exchanges globally has increased by 550,459 ETH since May, data from CryptoQuant shows.

That amounts to almost $950 million worth of inflows into the exchanges’ hot wallets since the beginning of the Terra debacle.

Typically, traders send tokens to exchanges when they want to trade them for other assets. Thus, selling pressure would likely increase if the downtrend in ETH reserves on exchanges begins to reverse.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

[ad_2]

Source link